An economic bubble is basically a trade in an asset which is currently at a price that exceeds is actual value. For example take your house. You would have customized the entire place based on your likes and dislikes over many years. You may think it may be worth $1 million whereas realistically, its value on the market is $600 k or even lesser.

I am a 25 YO Business Analyst typing this from my tiny cubicle in Ewing, NJ. I got into trading stocks around a year back. Incurred major losses and some profits. But i learnt a lot from it. Every day I make sure that I read something new at least for an hour. Most of the articles for the past couple of days has been about Bitcoin. It took me three days to read one article. All the analysis made my head hurt. So, thought i'll write my first article which is easy for normal bloke like me to understand.

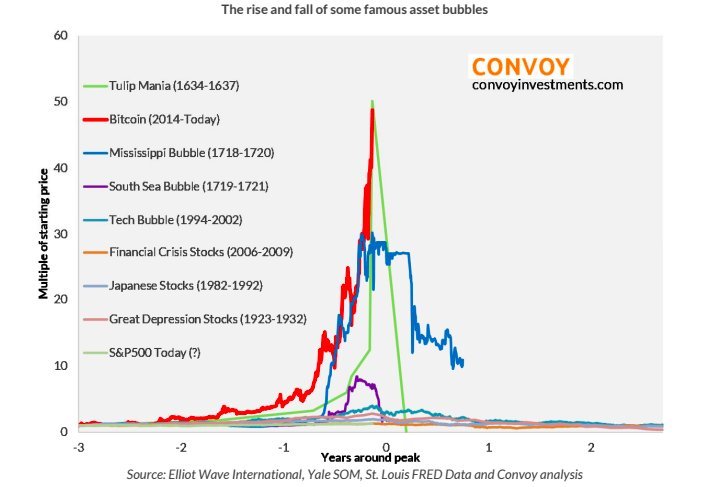

Bitcoin’s recent wobbles makes you ask the questions which most observers had in their mind from past few years: Will this crypto go down as one of history’s most infamous bubbles, alongside tulip mania and the dot-com bubble?

When does the bubble actually start? It’s not very clear but one thing is for sure, you won’t know if it’s a bubble or not until the entire party is over. They say that it usually begins by disrupting the market, which the crypto has done over and over again [I’m talking about other crypto currencies like Ripple, Ethereum etc] and it has sustained for all these years. People who had invested even a couple of hundred bucks back in the day are millionaires now. Don’t trust me? Go check out Youtube for people buying luxo barges and exotic supercars with bitcoin money.

Bitcoin just lost as much as 50% when compared with its numbers from Dec Last year. Bitcoin’s boom in the last few years was like a drag racer which deployed shots of nitrous in the middle of a drag run. But looking at numbers now, do you think that the car has run out of fuel?

Bulls say that Bitcoin’s boom is far from over, and that there’s more to analyzing a market than just measuring price gains. Bitcoin stormed back up from below $10k to $10,780 within two days.

Check out the views from some hotshot crypto analysts - Howard Wang of New York-based Convoy Investments LLC and Jeremy Grantham of GMO LLC have analyzed Bitcoin’s fluctuations and concluded that it’s unsustainable.

“Having no clear fundamental value and largely unregulated markets, coupled with a storyline conducive to delusions of grandeur, makes this more than anything we can find in the history books the very essence of a bubble,” Jeremy wrote.

Bitcoin’s “price has now gone up over 17 times this year, 64 times over the last three years and superseded that of the Dutch Tulip’s climb over the same time frame,” Wang wrote in a research report.

Check out the graph below for reference. If i can see and read correctly, it says that bitcoin maybe the biggest bubble ever -

Wang also noted that if bitcoin were to continue appreciating at its current pace for a couple more years, it would have a greater value than the U.S. economy.

Like other analysts, Wang said he was “highly bullish” on blockchain, the decentralized ledger technology that is the underpinning to bitcoin and other digital currencies, though he was skeptical on bitcoin’s long-term price prospects. Investment giant UBS wrote “While we are doubtful cryptocurrencies will ever become a mainstream means of exchange, the underlying technology, blockchain, is likely to have a significant impact in industries ranging from finance to manufacturing, health care, and utilities”

Some of the things which Wand said made some logical sense to me like - “In our world, it is always the people that generate long-term value, not things. If I’m bullish Apple, I buy equity in the company, I don’t go and convert my retirement portfolio to iPhones,”

He added that “while investors in stocks, bonds and real estate can always come back to dividends, interest and rent payments as anchor points around valuation, bitcoins have no income and no intrinsic basis of value.” The “only source of value” that bitcoin has “is other people’s perception of its value.”

Recent interest in bitcoin is also being fueled by the news of Bitcoin Interest and bitcoin futures on some major exchanges.

I have to clarify that I have not invested in bitcoin. Few years back I would’ve but I did not have the moolah. Now I have some vitamin D, but what if the frikking bubble actually burst? For all you know bitcoin may be legitimized in the coming days which might help institutions funnel money into the crypto and it might soar high again. Or maybe none of this might happen. What do you folks think? Comment away :)

Thank you for posting

You're welcome.

Congratulations @axle4! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP