Game Over For Cryptos?

...

I know many of you woke up today with the sight of RED. Blood on the charts and Coinmarketcap. You're thinking: "OMG what's going on, this is the end of Bitcoin and cryptos." Well my friend, welcome to the world of cryptos. This is the place where you find the craziest swings and mood changes.

Now I'm not here to put salt into your wounds. Or maybe I am cause ironically putting salt into a wound might sting and hurt even more for the moment, but it will make the wound heal faster and better. So to make this situation even worse I'm gonna present 2 different probable price path scenarios for Bitcoin that will confuse you even more, but in the same time make you prepared for what can come.

The Bullish scenario (also my primary)

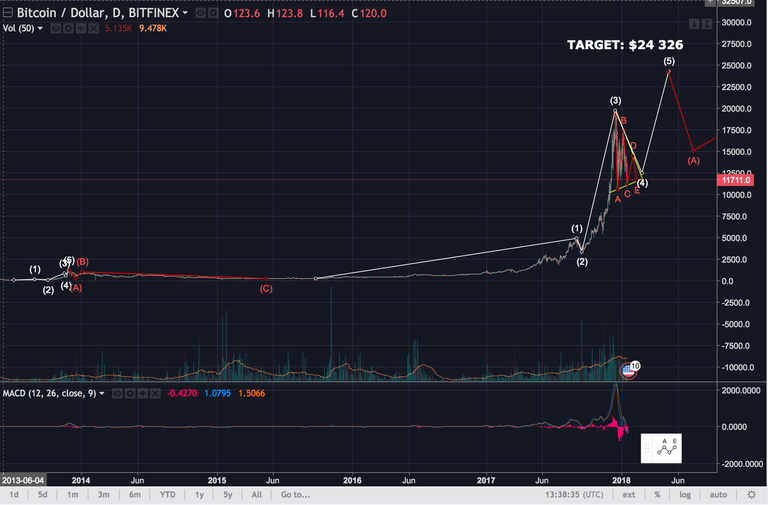

We could be forming a new triangle with lower lows, so let's see if we can manage to impulse up to Wave D which is around $14 000. Now, when we look at bitcoin from a broader perspective, we can see that we're in the end of a 4th correction wave. This type of triangle pattern is very common for the 2nd and 4th correction wave. And if we really are in the end of the 4th wave we might soon be looking to impulse and enter the last 5th Elliott Wave. Now that the 3rd has been a little extended, the 5th won't probably go that high. Usually 0.38 or 0.618 of wave 1 to wave 3 combined. Which leaves us at a target at $24 326.

And everyone that are familiar with Elliott Waves, should know that after the 5th wave, a big correction will come. Depending on how extended the 5th wave is the correction goes deeper. Much like the saying: "The higher the rise, deeper the fall". A common correction is the golden fibonacci level which is 0.618, also meaning around 62% down fall. If the 5th wave is extended we can expect a correction up to 62-90% which would be a complete blood bath. The media coverage on that would make people never want to look at cryptos again, and whales would take the opportunity to scoop up heaps of cheap coins.

New triangle forming:

The bigger picture:

Probable future price path:

The Bearish Scenario (my secondary count)

Now here's where I pour a ton of salt into your wound. You think we saw a correction? It's about to get a lottttt worse.

The thesis that's backing this scenario is that we're not in the 4th correction wave, instead, we've just completed the 5th Elliot Wave which, like I explained before, is the last of the impulse waves. This means we've already started a mean and vicious ABC correction that will shake out a lot of weak hands that bought the top. And if this theory is correct, it would mean that the 5th wave was a little extended which leads to a deeper correction, from 62% down to 90%. Now given how high the demand is in the world right, where exchanges even close registration doors , I would be very surprised to see a deep and long correction. The only news that would justify a longer and extended correction would be if Bitcoin/cryptos gets completely banned in one of the leading markets or something similar.

SUMMARY:

So you're thinking, what should I do? Well, I'm not your financial advisor, I'm just here to present my thoughts on how I view things. And if I were to give advice, I would simply say. If you believe in cryptos in the long run, then always have cash at hand so you can buy these dips. Don't try to outsmart the market and time the dips, focus instead of adding coins at the right spots. Timing dips is a skill that requires experience and knowledge about the market. I've been burned and I've learned by my mistakes.

If you've invested money that you can afford to lose? Well, learn by your mistake and make the best out of the situation. If you believe in my first scenario, then set sell orders from $14 000 down to $11 000.

If you have sold the top and sitting on fiat? Good for you. You have the opportunity to buy low. Set buy orders at different support levels and never put everything at one single level.

I hope this has been a good read for you, amateur or professional. If you like this post and want to see more content like this, please support by a simple up vote or comment.

Follow me on Twitter and turn on notifications to get instant updates at http://www.twitter.com/benkalashnikov

Disclaimer:

I'm not a financial advisor and these are only my opinions. I don't take any responsibility for any investments that you make based on my analysis.

You have shown good understanding of both fibonacci targeting and EW counting in this post. How long have you been trading based on EW?

Thank you! Around 3 months. Still have a lot to learn, reading books and your blog as well :)

I always wonder when I see goals with this accuracy: 8097, 5629)))

Don't put too much emphasis on the exact numbers. I just base them on different support levels or in this case Fibonacci levels

I understood)) Usually I allocate some zones for buying and selling, and I execute the orders in parts.

While we are on a bearish scenario, I hope we will not fail below $8000 ...

Technical analysis is a practical method that weighs past prices of certain coins and their trading volume. When considering entering a trade, it is not recommended that you only rely on technical analysis. Especially in the field of crypto, a field that often generates news, there are fundamental factors that have a significant impact on the market (such as regulations, ETF certificates, mining hash, etc.). Technical analysis only ignores and can’t predict these factors, so the recommendation is to mix together the technical analysis and the fundamentals analysis to make wise investment decisions.

Well spoken my friend. The crypto world is not for weak hands. (Most of us learned it the hard way in the beggining.)

Thanks, let's hope for the first scenario :)

Like the old saying goes, hodl

Yeah :D

This post has received a 0.99 % upvote from @booster thanks to: @benkalashnikov.

I liked your analysis, this Elliot Wave theory is very interesting to me. I'll be watching how it plays out and I'll check back for more info so keep posting.

Thank you sir!

Very informative post, thanks for your insight!

Wish Granted!

0.2 SBD transformed $0.66 upvote

Always check profile location for current rates.

I LOVE YOU, Lila-Wish-Genie Gratitude for @earthnation alliance