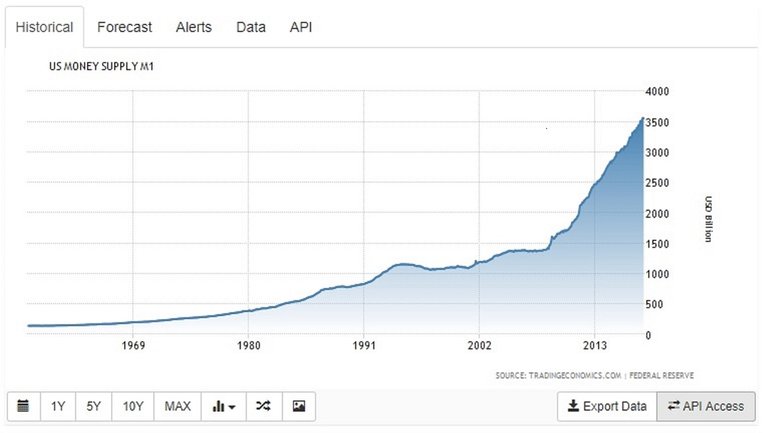

Have you ever wondered why with every year that passes your money buys less and less? It is not really because the cost of the products you buy is increasing. Think about it, with technical advances through the years it cost much less to produce products today than it did many years ago and yet prices have gone up. As an example, take the cost of a loaf of bread. In 1950 the cost of a loaf of bread was 12 cents. A gallon of gas was 18 cents, toilet paper was 5 cents a roll, and a can of soup was ten cents. Do you really believe that it costs more today to produce these products to justify them costing more today? The real reason is that your money is worth less every year. So what's the reason for this? One reason is that the nation's money supply is expanding, as the money supply expands through the printing of more dollars, the value of every dollar you hold is diluted. The chart below shows the expansion of the money supply over the years.

On the other hand, it is also true that on average we earn more money today than we did years ago (this is also due to the dilution of the money supply), wages and incomes have increased so the loss in value may not be as apparent. This issue is not just limited to the U.S., I would say that the value of most fiat currencies around the world are declining year after year.

Because of this, in my opinion, the biggest threat to your wealth is holding your wealth in U.S. dollars or any other fiat currency. If you simply put money into a savings account year after year the value of that money is steadily evaporating. In my opinion, you would be much better off to not keep a huge portion of your wealth in fiat just sitting in a bank, or on the bank's balance sheet, because actually, banks keep very little cash on hand in relation to the deposits they hold.

To be clear I am not a financial advisor and this is not financial advice, I am just pointing out what I see as an issue with anyone trying to save for their future. However having said that if I was giving advice, I believe you would be better off to keep a majority of your wealth invested in a variety of assets, such as real estate, stocks/bonds, precious metals, and cryptocurrencies. Yes, I know cryptocurrencies are very speculative and just in their infancy but in my opinion, if you stick with the major coins and tokens the risk is minimized somewhat. Besides, I strongly believe if you get into cryptocurrencies, now especially Bitcoin and hold them for several years you will see massive gains. The real point of this blog is not to pump cryptocurrencies but to make you aware of the penalty you pay by holding your wealth in fiat currencies.

The link below is a great visualization of how the U.S. dollar has been devalued over time. Pay close attention to the increase in the money supply, 1907 - 7 billion to over 13 trillion in 2010. This only goes through 2010, just imagine what it is today! Again this is not limited to just the U.S. dollar, this is happening to fiat currencies all over the world, they are all being manipulated and diluted.

http://www.visualcapitalist.com/buying-power-us-dollar-century/

Here is another link, this one goes into some history of the dollar.

http://jpatton.bellevue.edu/bottomline/dollar.html

Until the next post,

Take Care!

BigskyCrypto