“Everyone knows that feeling when they were stolen from. It's a dark sinking feeling as you instantly start thinking of the opportunity costs and better things you could have did with that value. It's very personal and it hurts. And in peer-to-peer Bitcoin finance, that pain is very present and observable by the wrongdoer.”

Foreclosure, Bankruptcy, Eviction, Loan forgiveness, Bad Credit, Bailout…

These words mean distinctive things to various individuals. For some they are the words used to depict an oppressive system that exploits people. People on the less desirable end of these words are usually seen as the victims, who require help. These people/companies were urged into something they couldn't manage or afford and the people now have people in positions of power projecting these words at them. And keeping in mind that these words hurt and are disparaging, they are also a getaway course from unpayable debt.

Then again, when I hear these words I am nauseated and irritated. There is just one single unfortunate casualty behind these words and that is the lender. Maybe it’s my time spent as a landlord, or just my ideology, yet the general societal view on these words are just plain incorrect. Not paying debt is theft, and those that don't pay are liars and thieves up until they do. Every action has an equal and opposite reaction, and that is the same in the world of debt.

How Young people view debt

While I am certain there are special cases or exceptions, I would bet that if you took a bunch of millennials randomly and ask them what their credit score was, a high percentage of them would proudly and gladly broadcast that their credit is bad. The reason behind their bad credit varies. For some, it is a result of large student loans and small financial record. For other people, it will be for unpaid phone or TV bills or something different that they overlooked or didn't bother paying. There might be light hints of disappointment from the low credit score group with unpaid bills, but it’s mostly just regret they now have a low credit score. There is little to no remorse for the money they still owe and almost no shame.

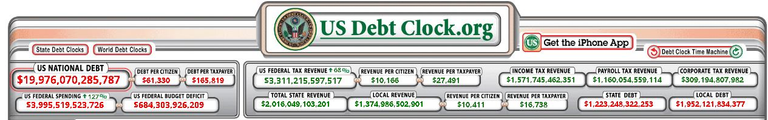

Can we even blame the millennials? I mean, if you were in there their shoes and living in their world a little unpaid phone bill is not that big of a deal in the big picture. Looking out into the large scale one just has to look at the government though there are many examples to choose from. Local, state, and federal. All of these institutions are mired in debt and they feel no shame. There is even a fun website (http://www.usdebtclock.org/) where you can watch the debt go up and there is little worry of where the top is or what even happens at the top.

In the average household the image is a bit more grim but still similar. Households usually live in a home with a mortgage, drive cars with a car payment, drink beer from a fridge that is paid for payments, and probably even sleep in a bed and sit on furniture that have payments as well. And for all the younger individuals there is more than likely a great heaping handful of student debt they still have from when they were fresh out of highschool and convinced to go to college for a degree they likely don’t use. Debt is everywhere and it's cheap!

Debt + No Savings = Delinquencies

So with debt everywhere for everything in society, there is obviously going to be situations where it doesn’t get paid back. With one of the main reasons being that people have no savings and because of the low to no interest on deposits they really have no reason to save. “An estimated 38 million households in the U.S. live paycheck to paycheck and almost half of all Americans would not be able to pay for an unexpected expense of $500 or less.”

So obviously when disaster strikes a household , which it will because we live on earth, payments are not able to be made and lenders don’t receive their money.

Impersonal Debt: Shifting Blame off of the debtor.

Image of lender

When people think of lenders the first thing they think of is banks. Banks are after all the people with all the money and the primary borrowers in the economy. The image of the bank for most people is probably that of a nice expensive looking well decorated lobby with a bank vault full of money in the back. This is intentional and good business, as what depositors want security for their funds and if a bank has this nice of lobby, they obviously have enough funds to secure their deposit.

As for other types of lending like mortgages and cars, people think of skyscrapers and giant corporations which making billions of dollars and have executives flying around in jets.

Image of a Borrower

The image of a borrower in most cases is of a normal person down on their luck. A family member died and took them from work and left them with expenses. The economy changed and they lost their job and couldn’t afford the payments. A divorce happened and without 2 incomes they could no longer afford the house or cars.

So with this imagery, it's pretty easy to guess who is blamed as the bad guy.

Who is actually the bad guy?

There are always 2 sides to the story. On the side of the poor debtor who is losing their house or car as a result of some sort of calamity, it is often overlooked that they should have had savings or been prepared to deal with that sort of thing. It is also overlooked that the person probably has all sorts of luxuries that we consider normal like name brand clothes, an Iphone, large flatscreen TV, and of course a pet.

The Debtor is the Bad Guy

So my point is that yes, the debtor and the person defaulting on any loan is the bad guy. They took a commitment they shouldn’t have, and they didn’t fulfill their end of the bargain. And if they don’t pay it back using one of the words of Foreclosure, Bankruptcy, Eviction, Loan forgiveness, Bad Credit or whatever, the end result is that it is theft from the lender.

But

The Lender is a base bad guy as well

The lender is not faultless either. Big banks in one way or another are at the base of this evil tree. They are in the market to make profit on money and grow, and in order to make money and grow more loans need to go out. They also know that bad credit risks borrowers (who are likely the defaulter on the loans) are more profitable. They pay higher interest rates, fees, and basically anything else so they are very lucrative to work with. And if they default once, they will likely come back and lend more or rollover their debt creating even more profit. And, if this lending to risky borrowers and rolling over credit is coordinated and all the defaults happen at the same time, it’s now an economic problem or recession and these companies will need a bailout to survive.

Fiat money is the root of the Bad Guy tree

There are many sources out there with great information on how fiat money works and the scame it is. A book could be added here and it wouldn’t even quite do justice to the scope and evilness of the scam. But, to be short fiat money is backed by nothing and can be created out of thin air. The people that create the money out of thin air are the large banks through fractional reserve banking. And they are enabled by an even higher more mythical entity called the federal reserve, which is basically just the head of a cartel that has a monopoly on creating money out of thin air and bestows its banks with that power as well. So nobody saves money, and banks lend money at ridiculously low cost to borrowers because they can make it out of thin air and still make profits which large defaults.

Peer to Peer default with Bitcoin is theft, and there is no one else to blame this time.

Because of how fiat money works and the malicious system that supports it, people are not entirely wrong shifting some blame away from the defaulting debtor. But, a default is still theft regardless of the situation. The defaulting borrower is wrong and a thief. But, the fiat money system is even more wrong and a bigger thief.

Bitcoin is real, sound, money. There is nothing dishonest about Bitcoin and everything about it is completely transparent. So when you take out a Bitcoin loan or debt, it comes from someone else and there is no trickery on how that Bitcoin was created. Every Satoshi borrowed comes from someone else, and every satoshi not repaid is theft pure and simple.

Peer to Peer finance is the only lender of Bitcoin

Banks as we think of them don’t work for Bitcoin. The reason for this is that nobody is going to deposit their Bitcoin into a bank. Bitcoin is already digital and easy to spend, so a bank adds no value there. Bitcoin is also extremely secure, so banks don’t add any value here either. Banks are then whittled down to their primary function which is lending out money to borrowers for interest. But, without depositors, who is going to do the lending. Depositors are not going to part with their currency easily or cheaply and then not see who it is lent out to or know that it is secure. So, the obvious solution then is to cut out the bank, and let the depositors be lenders themselves directly through Peer to Peer Lending.

Peer to Peer lending with Bitcoin is Personal

Finally we come to how personal Peer to Peer lending with Bitcoin is personal. Borrowers can see and communicate with their lenders directly. Lenders themselves are only thinly hidden behind a username. So when a borrower doesn’t repay, they are then faced with the issue of dealing with real people and suffer the moral consequence of being a real thief. This is likely extremely personal, and much harder to deal with then stealing from a faceless corporation.

For the lender the process is painful and equally as personal. They put their trust in a person with their funds, and that person stole them. While not the same as someone breaking into your house and stealing from you, it is still very personal and hurts. One cannot help but feel betrayed and directly wronged.

Why personal lending is is a good thing

I believe this new era of real money and real debt is a good thing. It brings everything back to reality. Credit available to borrowers becomes realistic amounts to suit their needs. And depositors receive the full benefits and profits of their lent capital. Risks of course didn’t go away and default potential is always there. However with cryptocurrency the power of the free market is unleashed to account for this risk, and it is quickly balanced by a free market interest rate for borrowers. This rate based on real money, is the real time cost of money for borrowers without any middleman, regulations, or fiat money madness in the middle. It's a pure rate, and it continuously changes based on millions of unseen but real variables.

The End of Debt Bubbles

Business and finance will always move in cycles. The process is just cyclical in nature. So while these cycles will remain, I think real money and real interest rates will make bubbles a thing of the past. A bubble by definition is “is trade in an asset at a price or price range that strongly exceeds the asset's intrinsic value.” With Bitcoin and free market peer to peer finance, their is no hiding of the intrinsic value from anybody. So as such, destructive bubbles are a thing of the past.

New finance Proceed with caution

So while I am super excited for real economic borrowing and lending to be done peer to peer, I do suggest both borrowers and lenders proceed with caution. Bitcoin economics are not the same was what we are used to. And the risks for both sides are especially high this early in cryptocurrency. So proceed with caution as the industry forms and the new market determines useable solutions for users. But, even though I encourage caution, I strongly encourage everyone to get involved. If done intelligently on both sides, a win-win transaction is created on the time value of money. And because cryptocurrency is global, a win-win for a set of individuals, is a win-win for mankind itself.

Thank you so much for sharing this amazing post with us!

Have you heard about Partiko? It’s a really convenient mobile app for Steem! With Partiko, you can easily see what’s going on in the Steem community, make posts and comments (no beneficiary cut forever!), and always stayed connected with your followers via push notification!

Partiko also rewards you with Partiko Points (3000 Partiko Point bonus when you first use it!), and Partiko Points can be converted into Steem tokens. You can earn Partiko Points easily by making posts and comments using Partiko.

We also noticed that your Steem Power is low. We will be very happy to delegate 15 Steem Power to you once you have made a post using Partiko! With more Steem Power, you can make more posts and comments, and earn more rewards!

If that all sounds interesting, you can:

Thank you so much for reading this message!