Bitcoin is the currency of the Internet: a worldwide, time-stamped, persistent, decentralized digital money.

Understanding Bitcoin

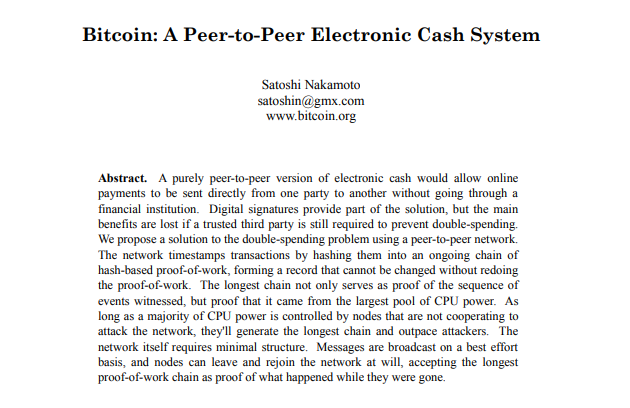

Bitcoin is both cryptocurrency and reference to the technology, it is the first fully transparent, math-based currency that cannot be controlled by a central entity. The Protocol was invented by an anonymous cypherpunk who went by the alias Satoshi Nakamoto. Satoshi was the first to create a white paper that outlined the need for a trustless payment system that could operate in a decentralized peer-to-peer network. The invention was remarkable because it provided a solution to a problem called “double-spending” meaning it is designed to use cryptography to prevent counterfeiting. And not only Bitcoin’s advanced cryptography keep your funds secure, but it also provides you with more financial control and privacy.

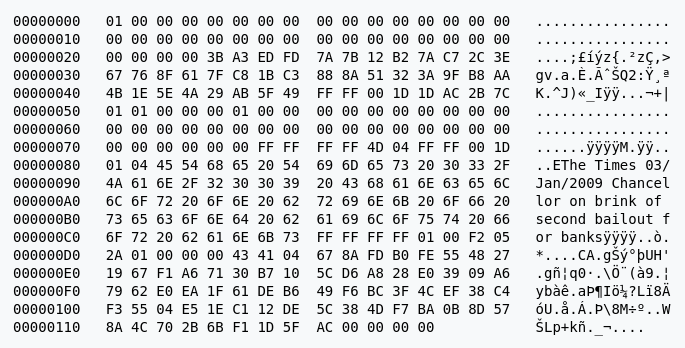

Cryptocurrencies such as Bitcoin allow an exchange of digital information and to buy or sell goods and services across the internet without being linked to a real identity. On 3 January 2009, the bitcoin network was born with Satoshi Nakamoto mining the genesis block, which contained a reward of 50 bitcoins. Embedded in the coinbase of this block along with the normal data, had the following text:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.

What is the purpose of Bitcoin?

Bitcoin was Born Out of the Ashes of centralization.

“Give me control of a nation’s money and I care not who makes the laws.”

“I care not what puppet is placed on the throne of England to rule the Empire, …The man that controls Britain’s money supply controls the British Empire. And I control the money supply.”

-Mayer Amschel Rothschild, founder of the Rothschild banking dynasty.

The purpose of Bitcoin lays in its decentralized structure, which means that it puts the power back into people’s hands. Normally with a centralized system, all our money and data are stored, updated, and managed through centralized servers which require us to trust the third party. This means that when the core system is hacked, it acts as a single point of failure, which makes our data extremely vulnerable. For example, if a country’s database is hacked into, it might have a troubling effect on the economy at large including banks, businesses, and individual consumers. And since you don’t actually even own this data, banks and institutions can do whatever they want, such as restricting you from transacting and so on.

The decentralized networks work differently, data can be broken into pieces and encrypted. The more nodes the network has, the more decentralized and secure it becomes. This creates multiple points that need to be attacked in order to take down the network. Unlike banks and institutions, the Bitcoin Source code is completely open, which means anyone who understands coding language can review it and participate. Nothing is hidden. When you own Bitcoins, your money is locked on the public ledger and can be accessed anytime with the right private keys. For this reason, there is no third party such as a bank or institution to limit how many coins you can send or receive, and there is no way they can restrict your transactions.

With Bitcoin, we can settle international deals without messing around with exchange rates and extra charges. Bitcoin is free from government interference and manipulation, so there’s no Federal Reserve System to hike interest rates. It is also transparent, so you know what is happening with your money. Not a single institution can counterfeit or arbitrarily create more Bitcoins because of the core rules of the Bitcoin protocol. The inflation rate is also programmed into its code, and the supply is fixed. This is how we know the rate at which Bitcoins are created when they’re created, how they’re created, and how many will ever exist. And anyone can look exactly the total supply of Bitcoin at any given moment, no centralized entity can influence the core protocol without the community’s consensus.

Bitcoin is a truly revolutionary technology that is changing the rules of society. You can start accepting bitcoins instantly, without investing money and energy into details, such as setting up a merchant account or buying credit card processing hardware. And third parties cannot confiscate your wealth without first gaining access to your private keys. Meaning essentially you become your own Bank. 🙂

Have you ever wondered why the bank has a daily spending limit on you? That’s because they don’t actually have all your money. This is called “Fractional-Reserve Banking”. Here are some more useful information for anyone just starting out with cryptocurrencies.

- Federal Reserve

- Fractional-Reserve Banking

- Quantitative Easing

- Inflation

- Deflation

- Metcalfe’s Law

- History of the Internet

- The Original Whitepaper

Properties of Bitcoin:

There are many distinct properties of Bitcoin.

Decentralized – Unlike traditional fiat currencies such as dollars, bitcoins are issued and managed without any central authority. There are no banks in charge of Bitcoin.

Digital – Unlike cash, Bitcoin exists only online, there is no physical coins or paper.

Deflationary – The total supply of Bitcoin is limited to 21 million coins by the protocol. As more people get interested, the price rises to meet the demand.

Highly Divisible – Bitcoin can be divided down to 8 decimal places, the smallest unit of a Bitcoin is called a satoshi: ₿0.00000001

Irreversible– Bitcoin is designed to be irreversible, once a transaction is sent it can‘t be reversed unless the new owner agrees to return the coin to you. Knowing this, it’s extremely important to be sure your transaction details are correct.

Persistent – Each Bitcoin transaction is recorded, permanently, on the blockchain, and can’t be changed or tampered with. The unhackable ledger has never been compromised since its inception in 2009

Pseudonymous– In Bitcoin, neither transactions or accounts are connected to real-world identities. You receive Bitcoins on so-called addresses. Every transaction is stored forever in the blockchain. Therefore if your address is ever linked to your identity, every transaction will be linked to you.

Borderless – All that’s needed to send or receive Bitcoin is a Bitcoin wallet. Once the transaction is sent, the recipient receives the bitcoins in a matter of seconds. Since this happens in an open network of computers it doesn’t matter where these two people are located. Bitcoin is borderless and works anywhere in the world.

Permissionless – Much like the internet today, anyone in the world can participate. You don‘t have to ask permission to use Bitcoin. It‘s just a software that anyone can download for free.

Trustless – You can transact Bitcoin with strangers because the system was designed so that nobody has to trust anybody else in order for the system to function.

Durable – Bitcoin is a peer-to-peer, decentralized form of money and since Bitcoin is not centrally controlled, it acts as durable as the Internet itself, or near-infinite.

Secure – Bitcoin uses a public key cryptography system. Only the owner of the private key can spend Bitcoin.

How does Bitcoin work?

The fundamental core that makes bitcoin so amazing is a shared public ledger that records all transactions on the network, and on which the whole Bitcoin network relies. This ledger is called a Blockchain. Without getting too technical, all confirmed transactions are settled in batches called blocks. As each block enters the system, it is broadcast to the network of nodes for validation. In this way, all users can keep track of each transaction, you can think of this like the physical ledger that is maintained by banks. The only difference is, it’s maintained by the public & anyone can use the ledger to match a transaction.

Because of bitcoin’s open-source nature, anyone can become a fully validating node and start keeping a record of blockchain by downloading Bitcoin’s original software, called Bitcoin Core. This program is free to use, review and modify by the public. The Bitcoin core software has all the core rules of the Bitcoin protocol and it also keeps a record of the entire history of the blockchain. By downloading the entire blockchain on your computer you can become a fully validating node on the network. Nodes contain the rules and broadcast transactions to communicate with each other. The more nodes the network has, the more distributed and secure it becomes.

The Bitcoin network contains tens of thousands of nodes each containing a full record of the ledger, for this reason, there is no single target that can be attacked, which is why no institution, bank or government has the power to censor Bitcoin.

“Unlike traditional fiat currencies such as dollars, bitcoins are issued and managed without any central authority. There is no institution, or banks in charge of Bitcoin. Instead it exists only online. It is also distributed, decentralized and not managed by a single entity, but rather a group of people who process and secure transactions, called miners.”

What is Bitcoin mining?

Mining is the backbone of the Bitcoin network, Miners provide security and confirm Bitcoin transactions. Mining is done by specialized hardware. The role of miners is to secure new transactions (or blocks) to the chain and keeping them in the queue. Miners achieve this by solving a computational math problem which gets increasingly harder to solve. The more computers there are mining on the network, the more difficult, secure and decentralized the network becomes. This service rewards miners with newly-created Bitcoins and transaction fees. It also provides a way to distribute the currency without a central authority and also gives people an incentive to mine.

The Bitcoin block reward supply is controlled by design and is agreed by everyone in the network. The protocol is designed to create new Bitcoins every ten minutes and to reduce the mining reward in half every four years. To prevent inflation the total supply to ever be created is capped at 21 million bitcoins. The last Bitcoin will be mined in 2140.

When Bitcoin first came out it was possible to mine blocks with a simple home computer, as more computers joined the network, the difficulty for solving blocks increased, and miners had to find more efficient ways to participate. Soon miners discovered that they could use graphic cards on the computer and eventually companies invented specialized mining machines.

These machines are designed for a single purpose, and they are called application-specific integrated circuits or simply (ASICS). These machines are extremely powerful at what they are designed to do, which is to generate random hashes as quickly as possible. Since the creation of ASICS, Bitcoin mining has become highly industrialized and is no longer an available business for the average joe.

What is a Bitcoin wallet?

A bitcoin wallet is basically the equivalent of a bank account, It allows users to send, store and receive bitcoins, manage private keys; codes that allow you to spend your coins. In reality, it’s not bitcoins that need to be stored, but the private keys that give you access to them.

Bitcoin addresses and private keys look like a long string of numbers and letters and they can also be represented by QR codes. Here is an example of what these keys look like:

Public Key / Address: 13mvq8wD6VxoHrXTVaHPrSwjMwFkYUZxYU

Private Key: 5KMpGa6X1212AmqUd7kdbhevh63Lbt96LU82eQVSSotgFzCGvQ2

If you don’t have the private keys, you don’t control the bitcoins.

You can use any of the following websites to easily search any public key online.

These block explorers allow you to watch all Bitcoin transactions happening live on the network. Searching a Bitcoin address will show how many coins are stored and all of its previous transaction history.

Bitcoin is pseudonymous because there is no personal information attached to the address, yet all transactions are public. Imagine how implementing this type of technology could change the way we operate institutions and banks. No longer could governments build bombs or fund wars without everyone knowing about it. With Bitcoin, it’s possible to make the world more transparent while giving individuals their right to privacy.

You’ll find wallets that come in four main types: web, software, hardware, and paper. Each of these has its advantages and disadvantages.

- Online web wallets – Web wallets such as exchanges have the lowest level of security, although wallets have the advantage of being accessible from any internet-connected device.

- Software wallets – Software wallets are a great choice for both new and advanced users. they can be downloaded and installed on your computers, mobile phones or tablets.

- Hardware wallets – A hardware wallet is a physical device that is designed for securing crypto coins. The three most popular hardware wallets are: Trezor, Ledger and KeepKey

- Paper wallets – A paper wallet is a piece of paper containing private keys printed on them from an offline computer that has never been connected to the internet.

How do you get a Bitcoin?

The easiest way to acquire some Bitcoin is to just buy them, but Bitcoins can be obtained in numerous ways, here are some examples.

Buy on an Exchange

You can buy Bitcoins directly from other people or you can also use a cryptocurrency exchange such as CEX.IO, Binance, and Changelly. For a beginner, it’s probably easiest to start using some of these exchanges.

Buy bitcoin in person

Marketplaces such as HodlHodl, Paxful, and LocalBitcoins hook up local buyers and sellers and lets you use cash to buy bitcoin from someone else either directly, or via bank deposit.

Bitcoin ATM

ATMs work like a regular one, they allow a person to exchange bitcoins and cash. Find the closest ATM easily, using Coin ATM Radar, a Bitcoin ATM map.

Earn Free Bitcoins or Sell a product or service for bitcoins

Lolli makes it easy for you to earn up to 30% in Bitcoin rewards when shopping at your favorite stores. Bitify lets you sell your products online for bitcoins. Purse gives discounts on Amazon if you pay with Bitcoin.

To learn more read our article on How to get started with Bitcoin.

You may also like reading this How to Trade Cryptocurrencies.

How to secure your Bitcoins?

A Bitcoin wallet is like a regular wallet with cash and credit cards, it is a good practice to keep only small amounts of bitcoins on your mobile for everyday uses and keep the rest of your funds in a safer environment. Best Ways To Protect Your Bitcoins

- Guard your private keys with your life

- Learn how to protect your privacy

- Never reuse your bitcoin addresses

- Separate wallets for different purposes

- Create regularly multiple secure backups

Spending some serious time on these steps can save your money. We recommend you read our article: How To Make Your Computer Ultra SecureYou may also wanna obtain Hardware Wallets such as Ledger Nano S

If you lose your private key, you can no longer access or spend funds from your wallet!

What else should I know?

Taxes and regulations of Bitcoin: Regulations differ widely from country to country, most jurisdictions still require you to pay income, sales, payroll, and capital gains taxes on anything that is valuable, including bitcoins.

Final thoughts

Bitcoin is the first of it’s kind, and it paints a future that is drastically different from the fiat-based world today. This is either exciting or unsettling for the vast majority of people.

Because Bitcoin and other cryptocurrencies have the potential to disrupt virtually every market that exists in the world today. That being said this is just a short summary of Bitcoin. If you want to learn more, here is a list of various types of resources that contain all levels of information: the original white paper, developer documentation, wiki or watch Andreas Antonopoulos explain it all in his “Bitcoin for Beginners” video playlist.

Andreas is easily one of the most knowledgable speakers on Bitcoin and Blockchain technology.

Bitcoin for Beginners

https://www.youtube.com/watch?list=PLPQwGV1aLnTuN6kdNWlElfr2tzigB9Nnj&v=l1si5ZWLgy0

Continue learning, read our article on How to get started with Bitcoin.