Time Value Of Money and Bitcoins Intrinsic value

With Bitcoin wining the race in, “The World Of Cryptocurrencies”, Cryto Communities around the world an onlookers are attempting to calculate the intrinsic value of Bitcoin (a new form of digital currency).

In just a few years Bitcoin has skyrocketed from $1,000 dollars a coin the current high of $6,000 dollars a coin. This massive price increase defy’s logic and leaves all contrarian individuals perplexed.

There is a fundamental financial principal which which if examined would provide some explanation into Bitcoins aggressive climb to the top of the food chain. But in order to understand the “why”, we must understand a financial concept called the time value of money.

Below is a hypothesis as to what is a driver in the current price driver for Bitcoin.

Time Value Of Money (TVM):

Simply stated $100 USD acquired today is more valuable TODAY than the same $100 USD in the future. Each Dollar invested into a fund TODAY there is an expected yield of return something above the Treasury Bill Rate or Risk Free Rate. This is financial fundamental. Thus folks who have invested in earlier periods are intrinsically able to gain more and more return as more capital flows into the currency. Increasing Bitcoin’s value.

Diving deeper into Bitcoin:

Lets look at Bitcoin in terms of 3 month quarterly periods and look at its earnings across this cross-section; this will better assist in our analysis.

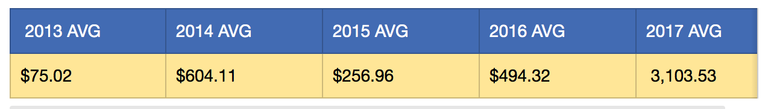

Table 1: Average Price 2013-Current

Average Yearly Price

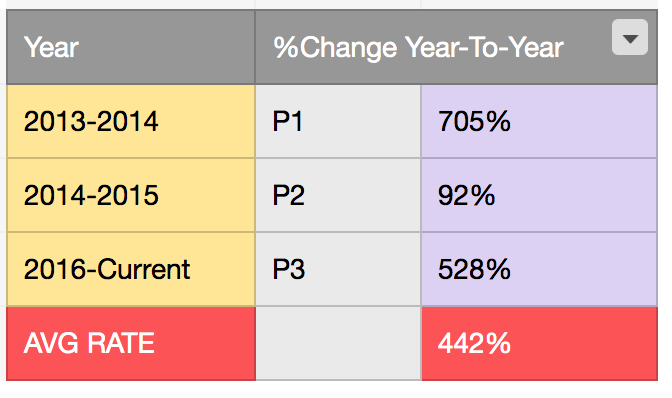

Table 2: Percent Increase/Decrease with Average Rate of Return

Average Yearly Rate with average overall

Analysis:

Period One (2013–2014), annual closing price remained at an average below 100 dollars despite the percent change being above 700%. Period Two (2014–2015), Bitcoin’s average value closes well above $600 dollars despite a correction due to Mt. Gox crash in February 2014, with the scandal occurring in that year Bitcoin still posted a 92% annual return. Period Three (2015–2016), a clear recovery in price from high returns from P1 at 528% yet all amounts still remain below a return year-to-year of 705% suggesting a normalization in the rate of return that continues to correct.

Comparable Bitcoin vs. USD:

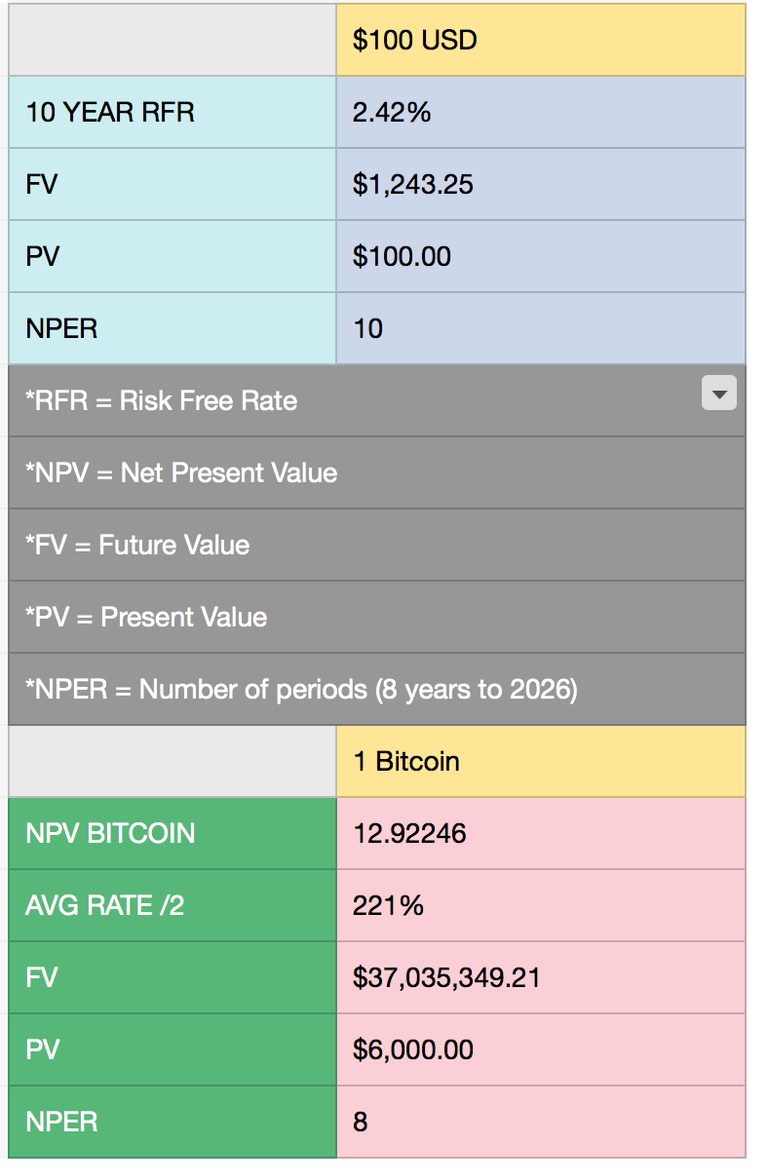

Table 3: USD vs Bitcoin Present and Future Value.

Present Value and Future Value Charted USD vs Bitcoin

As pointed out the importance TVM:

Simply stated $100 USD acquired today is more valuable TODAY than the same $100 USD in the future.

This is described more easily by looking at a quick snapshot comparison between Bitcoin and the United States Dollar. Present Value (PV), Future Value (FV), and Number of Periods (NPER). Its the combination of these factors based on the original amounts and current amounts invested into Bitcoin which give its intrinsic value.This propels the PV, FV to return levels never seen before in the investing community lending doubt to Bitcoins sustainability.

$100 dollars USD invested today with a Risk-Free-Rate of return will yield only $1,243.25 with minimal to NO volatility. As many in finance understand with increased volatility comes an increased rate of return. Bitcoin devours the rate of return of 2.42% with a Net Present Value 12 times above 1, which is the normal level for expectance of any monetary project. 442% average rate of return is sustainable? I will conclude on this question at the end,

In the above example I divided in half the 442% rate of return giving me 221% as the rate of return for my PV and FV calculations. With the PV of $6,000 my FV 37 Million in 8 years is obtainable. 37 million is abstract value due to a devalued USD currency that continues to be suppressed despite increasing global production levels and real rates of return. Now understand that this is not a projection rather than it is a reflection of how undervalued and suppressed the United State Dollar is. Suppressed meaning debt and serious macro economical factors. The Risk-Free-Rate set by government to reduce volatility has suppressed value in fact to the point that rising debt has now increased volatility making a major correction in the United States Dollar a new market fear. This is partially related to the massive returns seen in the world of Crypto Currencies.

Conclusion: Bitcoin is the first of its kind; a new digitized decentralized currency. An unregulated digital coin free from a central banking system. In other words this currency is not limited by government debt but also has the freedom to flourish for the user. Bitcoin is the first successful global currency with a incorruptible ledger providing transparency in transactions, making this transparency a first priority for all users.

It is these ideals in implementation, which propel the new Crypto World to new highs. In fact highlighting the imperfection of the current centralized banking system that can no longer escape the debt and scandal that has turned off its modern day users. Welcome to decentralization of currency where 442% real-rate-of-return is common practice.!

Hey,

I just upvoted you,

Please follow me and upvote my posts...

Congratulations @blacksteemit4u! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @blacksteemit4u! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

Congratulations @blacksteemit4u! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness and get one more award and increased upvotes!

Congratulations @blacksteemit4u! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!