Selling MSTR

While Michael Saylor has been buying immense amounts of Bitcoin, he has been furiously selling MSTR stock in 2024. Per openinsider.com, he has been divesting roughly $410 million in stock between 03.01.2024 and 26.04.2024. The last time he sold shares before that date was in Q3 of 2012.

Buying BTC

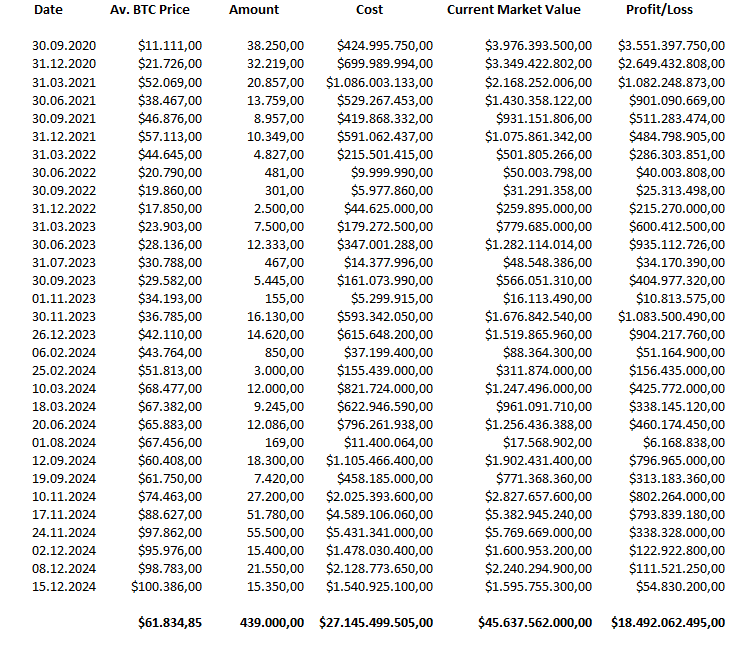

Since August 2020, the company has accumulated a staggering 439'000 BTC, investing approximately $27,1 billion at an average price of $61,8k per Bitcoin.

Acquisition Breakdown

MicroStrategy’s CEO, Michael Saylor, has aggressively pursued Bitcoin acquisitions, with a significant portion of purchases occurring in 2024:

| Year | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Funds Deployed (%) | 9,7% | 1,0% | 7,1% | 78,1% |

| BTC Acquired (%) | 12,3% | 1,9% | 12,9% | 56,9% |

In 2024 alone, MicroStrategy deployed $21,2 billion on Bitcoin. This immense expenditure was made possible by the premium at which MSTR shares trade above the market value of the BTC owned.

Market Value of Holdings

As of today, with Bitcoin trading at $103'958, the market value of MicroStrategy’s holdings has surged to $45,6 billion. This reflects an unrealized gain of $18,5 billion, with the company’s total Bitcoin position being 68% in profit.

Microstrategy owns 2,09% of all BTC (or 2,4%*).

Sources:

Michael Saylor on X.com

Microstrategy financials: MicroStrategy investor relations page for 8-K, 10-K and 10-Q reports.

MicroStrategy stock market data: finance.yahoo.com

MSTR shares outstanding: ycharts.com

MSTR insider transactions: openinsider.com

BTC price: coingecko.com

Notes:

- Funds deployed: funds allocated during a certain period in comparison with overall investments in a particular asset

- Nr. BTC acquired: amount Bitcoin acquired during a certain period in comparison with the total amount on the books

Vote for my witness: @blue-witness

Posted Using InLeo Alpha