We will start our journey on August 2nd, 2016.

Bitfinex, the largest exchange by volume in the world, just got hacked. The perpetrator managed to steal 119,756 bitcoin, valued at almost $70 million, remaining unidentified to the present day. In response to the theft, Bitfinex distributed the loss among it's user base, reducing the available funds by 36% in order to compensate for the stolen bitcoin. Naturally, this was received poorly by the users who did not have their wallets emptied.

The management of the exchange decided not to declare bankruptcy, instead issuing tokens they would one day buy back, effectively reimbursing the stolen bitcoin, together with the 36% that was distributed among those who were unaffected by the hack.

Thus the BFX token was born, and started trading on the exchange. By the very creation of BFX tokens, Bitfinex transferred the liability of their debt onto their customers. It was valued at 1$ at the release time, but quickly lost value, as users didn't believe Bitfinex would be able to repay the debt.

Following this chart, we can see the value of the token, during time it was in use. How convenient was it to have your debt almost halved weeks after it came into existence. This basically enabled them to buy off their debt at a discount, which they promised not to do. Promises, promises.

At those times, people looking into the exchange's revenue, calculated it would take 7 to 8 years to fully repay all the customers. They did it in 8 months, reclaiming the lost reputation, and becoming stronger than ever. Now, logic dictates that in order to repay a debt, you must repay it with something of value. This is where things get interesting and a bit complex.

2. Introducing TETHER (USDT)

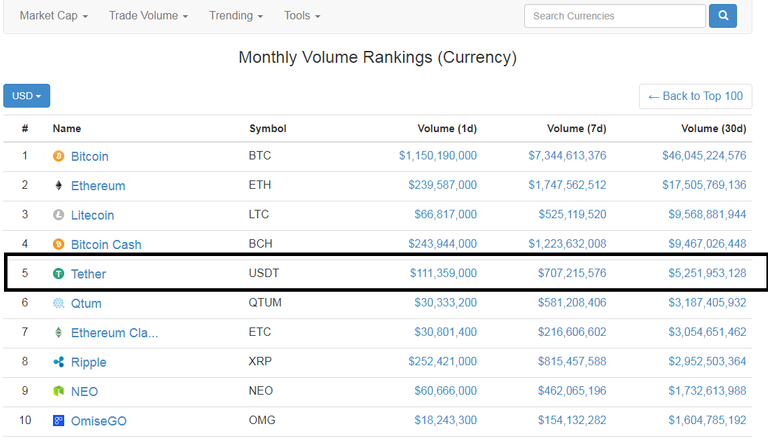

For those of you who might not be familiar with it, Tether is a cryptocurrency linked to the US dollar. Basically, for every Tether in existence, there should be a US dollar on a bank account somewhere backing it. It currently has the fifth largest cap on www.coinmarketcap.com

Back in April, Wells Fargo reversed US dollar cash deposits designated for Bitfinex, who filed a lawsuit only to withdraw it a week later. You can read about it here.

In turn, Bitfinex started accepting payments through its sister company Tether. By depositing a dollar to their bank account, you recieve one USDT (TETHER), which can then be traded on numerous exchanges. At the time of writing, the total supply of Tether is 437,061,572 USDT. But remember - for every tether, a dollar must be deposited as coverage.

What really made me dig into this topic was an article on Medium by Bitcrypto'ed. Before you continue reading this blogpost, I recommend you read THIS ARTICLE, and after that, I strongly urge you to read the rest of his posts there. You can also follow him on twitter.

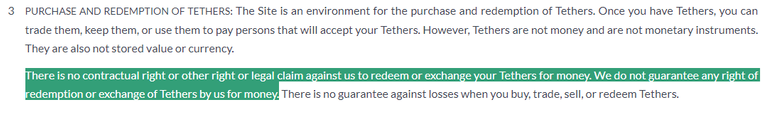

If you for some reason did not read Bitcrypto'ed aricle you are missing gems like :TETHER T&C

In layman's terms:

By buying tether from us, you consider them store of value, and can trade them on exchanges with like-minded individuals. We, the creators of it, reserve the right to declare it worthless, and if we decide to do so, we have no legal obligations to anyone.

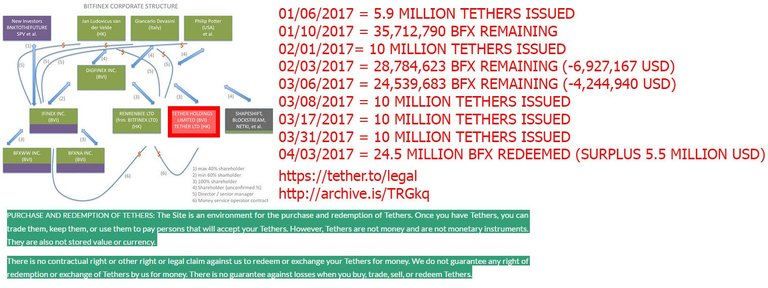

So from Crypto'eds articles, we can see that tether is being issued without proof there is a backing to it. The parent company is controlled by Bitfinex through shareholding, and can introduce new Tether into the system at will, avoiding an audit to make sure there are enough funds to cover the newly minted coin, all while declaring publicly that audits are regular and transparent. Have they done it already, and if so, why?

3. The Big Picture

Remember the BFX token, used to transfer the debt to the entire user pool of Bitfinex? Remember how it was estimated it would take 7 years at least to break even and return the debt. And remember how it was done within a single year. Why is the tether story so important? Again we have to thank Bitcrypto'ed for providing the answer.

The debt was repaid using Tether, and creating it out of nothing made Wells Fargo reverse US dollar cash deposits, while this ban provided legitimacy for minting so much new coin, because after all, the cash was now flowing in through it.

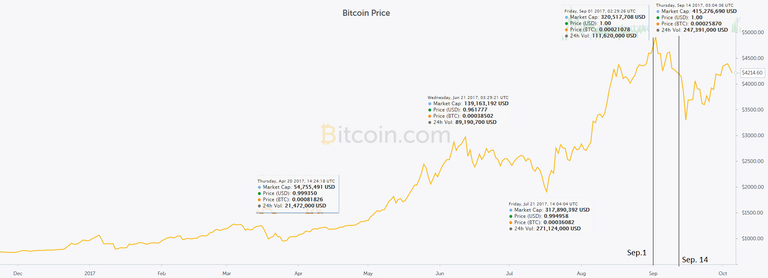

If all this wasn't enough, I have one last thing to share. It only took about 55 million tether to repay the debt, but as I stated previously, the total number in circulation as of today is 437,061,572 USDT. You can see the rate it was issued from the following chart, and I believe it was issued strategically, to slow down, and eventually reverse the downtrend in Bitcoin price. The largest sums were added over a period of a few days, numerous times, just as the price of bitcoin started reversing.

(open image in new tab)

Why, would you pump up the price of Bitcoin, and try as hard as you can to keep it up. Well the answer is simple. If the prices start dropping, and people start running to the exits, suddenly realizing that Tether door is shut down(except for the few elite), it would start a chain reaction that would finally burst this bubble.

And why not make trading fee profits while you still can, before vanishing with hefty profits.

I will focus on ICO's and altcoins in the next part. Until then, thank you for reading, please consider subscribing and resteeming.

Ante

Clearly more security is needed.

Congratulations @botixx! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP