Bitcoin fell out of the declining wedge last night and continues to drop towards the next Fibonacci level, which also happens to be a very strong support level for Bitcoin.

The volume of Bitcoin transactions over the last 24 hours was relatively very high. The volume has not been that high since Bitcoin was peaking near $20,000 a coin. Does this mean we're approaching bottom? Time will tell, but this level of volume is a good indicator.

While many are blaming this market exit on recent news that a few big American and British banks are banning the purchase of cryptocurrency with credit cards, I personally don't see this as FUD at all, but it seems many "crypto investors" are outraged by this and see it as bad news. I'm surprised this did not happen much sooner. In my opinion buying crypto with a credit card is about as myopic as you can get, especially if you were doing so from around the time of the last peak until now.

Maybe I'm being too critical; after all, it's the weak impatient hands in a market that let strong patient hands make money, and buying crypto with a credit card is definitely not conducive to having a strong and patient hand in the first place. People can argue all day that they should be able to do what they want with their money, but a credit card is not their money, it's a buffer (another way of saying its a debt bubble) that comes with worse than unsecured levels of interest payments at best, and creates an economic bubble to end all bubbles if enough of a population are maxed out to their eyeballs in credit card debt.

.png)

Please remember that I am not giving financial advice and this is just my opinion. What I do strongly advise is to get your market information from multiple sources to get a broader perspective on the markets, but ultimately you need to developer your own intuition as well, so that you can feel confident in your market position; If you are smart enough to read this, you are more than smart enough to develop that intuition... but it does take time for all of us. This blog is written for entertainment purposes only. I cannot predict the future; therefore this blog should be considered a work of imaginary fiction.

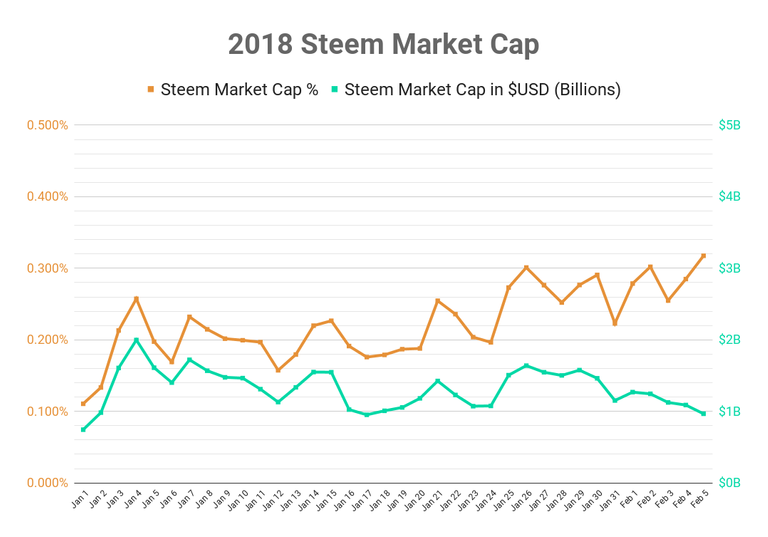

Today's Crytocurrency Marketshare:

- 78.33% - Top Ten

- 42.12% - Top Ten (excluding Bitcoin)

- 36.21% - Bitcoin

- 21.67% - Other

- 0.317% - Steem

.png)

The total Cryptocurrency market cap today was $304,579,000,000. Steem Marketcap Today was $967,012,000, or 0.317% of total.

Today Bitcoin's Price hit a high of $8,365, a low of $6,757 and an average of $7,561 before closing.

.png)

Today Bitcoin's Market Cap was $139,325,000,000 US Dollars.

.png)

Today Bitcoin exchange trading totaled a volume of $9,285,290,000 US Dollars.

.png)

The average Bitcoin transaction fee was $6.19 USD today.

.png)

The average number of new transactions being added every second to Bitcoin's mempool was 2.656 today.

.png)

The percentage of Bitcoin transactions using Segwit addresses peaked at 15.43% today.

.png)

There were 229,467 new Bitcoin transactions added to the mempool today.

.png)

The average block contained 1.12 Megabytes of transaction data today.

.png)

Today there were 5,074 new transactions left unconfirmed by end of day. As per blockchain.info there were still ~29,000 total unconfirmed transactions awaiting confirmation in the mempool by end of day, with ~24,000 of those being stale transactions that may be stuck in the mempool.

.png)

Article Spotlight:

Major Banks Ban Cryptocurrency Purchases on Credit Cards

This pretty much sums up the problem:

When reached for comment by PCMag, all the banks told different versions of the same story: The banks don’t want customers charging crypto purchases because it’s volatile and a high credit risk. I’m sure banks are also concerned there’s no way to repossess virtual coins if they’ve been stashed in an anonymous wallet.

As they point out here, there are still ways around this "ban" as you can transfer cash to a bank account (expensive), or buy gift cards that can then be used to exchange for an online service that sells Bitcoin for gift card balances.

In my opinion, this is neither FUD nor a bad thing that banks are doing this. Overall it raises a red flag if enough people are gambling with credit cards into a system that has no economic borders or accountability, especially if someone goes bankrupt but secretly has a stash of Monero they aren't declaring. The only thing disappointing is that the banks didn't do this earlier when Bitcoin was worth three times as much as it is now, because you can bet there are idiots out there with maxed out credit cards that bought Bitcoin when it was peaking.

Some might argue it's their money and they can do what they want with it, but they're wrong; credit cards are not their money, they're a financial buffer of convenience that doesn't charge the purchaser any transaction fees or monthly account charges, unlike a bank account and debit transactions. They're high risk and unsecured, designed to encourage people to pay their full balance every month and not overspend, or else face serious interest charges that compound and add up to a lot of money over time.

This is a subject where I'm not worried about offending people, because a country full of credit slaves who are up to their eyeballs in debt effects me and the people I care about in the long term, and puts more money into the hands of the proverbial 1%, simply because most people investing into cryptocurrency will lose, or break even if they're lucky.

Video Spotlights

if you want to be more proactive in this community, try using steemfollower (sign in is done through steemconnect using your steemit name and your private posting key - found in your wallet under permissions). This Video will explain how the program works. It is a great way to motivate you to produce great content, and to reward others for producing great content.

Tip Jars:

Dogecoin DDizpbLrYzFNEZtEVvUXo8kKBKu3K7yLry

Bitcoin 32p67yperYxM8dEFXESL3oeBcEn4qP32cQ

Ethereum 0x54c0387Fd48Dc8D48D30069be2e18756b8d203A5

ETC 0x067511c327Bc68b73726F4410fEAdb47ed396425

Ubiq 0x3EDb86c57f7f495aE0963855Cc37BA64B40C7685

.png)

Agree with the fact that buying crypto with credit cards may lead to huge issues with people not being able to afford it eventually. However, i would like banks to do the same for gambling sites etc, because singling out crypto for this is just poor behavior in my view. Good post by the way

agreed. I guess the one difference is that the banks are propping up the economy with a credit bubble, and they don't want that bubble propping up a crypto bubble, as a crypto bubble can then poke holes in their credit bubble. With casinos I'm guessing that Banks are invested into those, so they are just giving people money with one hand and taking it back with the other, so if the person goes bankrupt or can't pay back the credit card bill, the Bank has their money anyway, at least in one form or another.

Bitcoin market decline has likely been caused in large part by the recent news from China that all foreign cryptocurrency exchanges are to be banned by the People’s Bank of China (PBoC)😐

I saw somewhere that $6000 is the 200 day SMAA and it will bounce back from here in few weeks as smart money comes in with their trading bots .

yeah I saw that too, but maybe they were looking at a different scale or exchange than me. I have mine set to the 1 day scale with coinbase, and the 200 day SMA is about $8000, and the 365 day is about $5000 dollars. The Fibonacci support is at 5000 as well, so $5000 is not out of the question as the bounce level, but the price is holding at $6000 so maybe I need to change some things on my chart setup.

How long do you think it will stay at 5k-6k range ?

personally I hope the market stays down for a while so there's time to accumulate, and so that the next bubble is utterly massive.

Nice post.I respect you very much because you contribute to steemit.I will do activities like you.I would like to extend the steemit.

Nice information of bitcoin, great post, thanks for sharing

Very good information has surprised me how the bitcoin has come down the last few days I think it has dropped a lot thanks