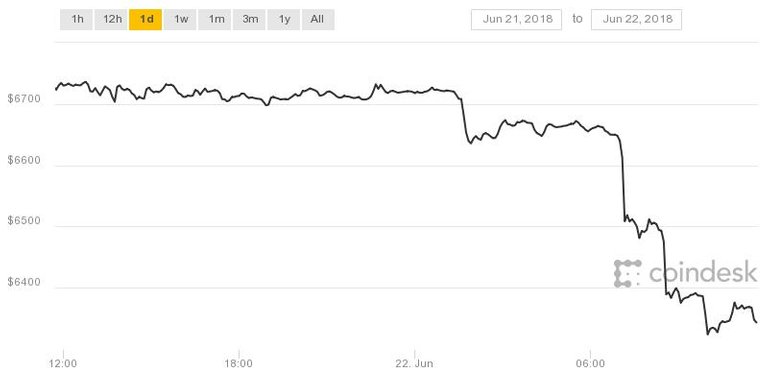

The digital currency hit a four-month low of $6,092.38 and broke below $6,400 for the first time in about a week.

The order led bitFlyer — the largest crypto exchange in Japan — to suspend the creation of new accounts while it makes changes.

The agency gave the same order to five other exchanges after finding weaknesses in their controls against money laundering.

Bitcoin prices fell roughly 9 percent Friday after Japan's financial regulator ordered several cryptocurrency exchanges to improve their practices against money laundering.

The digital currency fell to $6,081, breaking below $6,400 for the first time in about a week and reaching its lowest level since February 6, according to CoinDesk.

The order from Japan's Financial Services Agency led bitFlyer — the country's largest crypto exchange — to suspend the creation of new accounts while it makes improvements, especially in its measures to stop money laundering and terrorist financing.

"Our management and all employees are united in our understanding of how serious these issues are, as well as how serious we are in responding to them going forward," bitFlyer said in a statement on its website.

"In order to maximize our efforts towards building a suitable service and improving on the issues identified, we have temporarily suspended account creation for new customers of our own volition," bitFlyer said.

The agency gave the same order to five other exchanges after finding weaknesses in their controls against money laundering.

"In the long term, it builds a better ecosystem and makes sure this is a legitimate asset class," said Brian Kelly, founder and CEO of BKCM. "This is part of making sure exchanges are up to snuff."

In the short run, Kelly pointed out, it reduces the flow of new capital to the largest exchange in the largest market for bitcoin trading. Bitcoin trading in Japanese yen makes up more than 60 percent of the digital currency's daily volume, according to data from market analysis site CryptoCompare.

Mark Newton, technical analyst and founder of Newton Advisors, said even minor cryptocurrency news has the power to trigger a larger sell-off lately.

"In this choppy range with low volume, it just takes one bout of selling and the entire space goes down," Newton said. "There's just a lack of interest, there's a lack of buying, and the sellers are dominating the marketplace."

Bitcoin could see two or three more weeks of selling, and a possible pullback to $5,000 before finding a bottom, Newton said.

Bitcoin prices have suffered from the lack of new buyers in 2018, dropping by more than half this year after a climb to near $20,000 in December. The entire market capitalization of the digital currency has fallen by roughly 50 percent since January, according to data from CoinMarketCap.com.

Japanese regulators have been in the vanguard of regulation. It was the first country to adopt a national system to regulate cryptocurrency trading after its exchanges were subject to some high-profile breaches including Mt.Gox.

In March, Japanese regulators issued punishment notices to multiple exchanges and forced some to stop business altogether after the $530 million theft of digital currency from exchange Coincheck.

Other cryptocurrencies fell alongside bitcoin Friday. Ethereum, the second-largest cryptocurrency by market cap, fell 9 percent, while XRP was down roughly 7 percent. Bitcoin cash and litecoin both dropped about 11 percen t.

t.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://uk.finance.yahoo.com/news/bitcoin-tumbles-japan-watchdog-orders-113500529.html