Dipping cryptocurrency markets are hurting not only crypto holders but also a number of related businesses and sectors. Manufacturers of hardware that can be used in mining applications, like GPU makers Nvidia, AMD and their OEM partners, are also hit by weak demand in the sector which is pushing inventories up.

Excess Inventory Due to Weak Sales in the Crypto Segment

Recent tech media reports suggest that the leading video card maker, Nvidia, is experiencing excess inventory issues in the GPU channel. The surplus is most likely the main reason for the delay in the launch of Nvidia’s new gaming card based on the Volta architecture, which was expected to replace the Pascal generation. The postponement was confirmed in comments made by Nvidia CEO Jen-Hsun Huang during Computex 2018. He said the company is not planning to release new graphics processors in the near future.

Crypto Markets, Weak Demand from Miners Hurt GPU ProducersWith crypto markets reacting to a number of negative events in recent weeks, like the hacks of Korean exchanges Coinrail and Bithumb, regulatory actions in Japan, and the exposure of scams and suspected market manipulations, the rumors of a technical issue with the new consumer lineup have been replaced by another explanation – inventory buildup. Observers say it is probably due to overestimated demand in the gaming sector and the underestimated impact of the declining demand in the market for mining equipment.

These suspicions have been increased by rumors that a major Taiwanese OEM partner of Nvidia, ASUS, MSI or Gigabyte, has reportedly returned 300,000 graphics cards to the company. According to reports by Seeking Alpha and Semiaccurate, the giant has been also aggressively buying GDDR5 memory, which indicates an excess stock of lower-end GPUs that need to be made into boards. Quoted sources from the industry claim the return of the chips is related to the decreasing demand from cryptocurrency miners.

Nvidia has previously shared its expectations that the crypto fever would last until at least the third quarter of 2018, but obviously GPU sales have already started to go down. The prices of many altcoins that are mined with video cards decreased along with that of bitcoin. BTC is trading well below $7,000 and experts believe the downturn in the demand for graphics processors is largely due to the prices under this threshold.

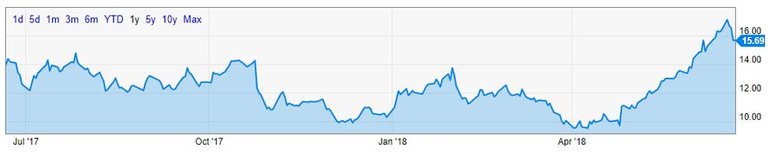

The crypto market ups and downs and the weak demand from miners have also affected Advanced Micro Devices, Nvidia’s main competitor. According to Investopedia, AMD’s shares rose by 25% in February before plunging by 30% in April, then soaring by 50% in May, until reaching around $17 on June 18. At the time of writing, their price is $15.69, according to data provided by Ycharts.

A Shift Towards Modest Expectations, Results

In April, AMD announced revenues of $1.65 billion dollars for the first quarter of 2018, with net income reaching $81 million, a 40% year-over-year growth. The company benefited substantially from the increased sales to crypto miners, which allowed it to reduce the gap between its results and those of Nvidia. In the last quarter of 2017, AMD’s share of the GPU market rose from 27.2% to 33.7%. AMD products remain cheaper while offering similar productivity, when it comes to crypto mining.

In May, Nvidia announced its revenues for Q1, noting that the total has increased by 66% year-over-year, and 10% sequentially, to a record $3.21 billion. For the first time, its quarterly report mentioned separately the amount generated from sales to the crypto market. The total GPU business revenue was $2.77 billion, up 77% from a year earlier and up 12% sequentially. $289 million of it is related to sales of GPUs for mining.

The two leading producers of video cards reacted differently to the increased demand for hardware for mining applications. In February, AMD said it was planning to increase production. Nvidia initially took steps to limit GPU sales to crypto miners. Then it was rumored that the company might launch a dedicated mining card called “Turing.” Later reports suggested its launch has been postponed to until at least July. If the current trends persist, however, both companies are likely to announce more modest plans and results in the coming months.

According to sources quoted by Digitimes, Taiwanese suppliers of graphics processing units are also expected to experience dropping shipments and profits in the second half of this year. Companies like Asustek Computer, Gigabyte Technology, Micro-Star International, and TUL have seen their inventories increase significantly, mostly in result of shrinking demand from the mining sector. Observers expect a shift in the focus towards the gaming and datacenter segments.

What are your expectations for the future of the GPU market and the crypto mining sector? Share your thoughts in the comments section below.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://news.bitcoin.com/crypto-markets-weak-demand-from-miners-hurt-gpu-producers/