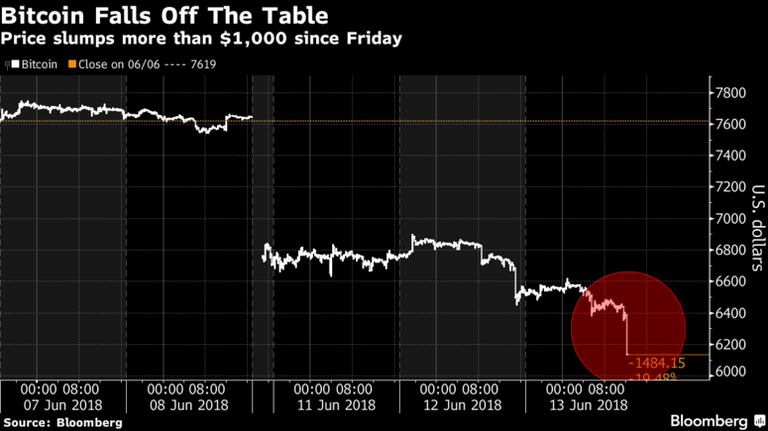

Bitcoin extended losses, bringing its four-session slide to almost 20 percent, as questions mount about whether the world’s biggest cryptocurrency was manipulated during last year’s record price surge.

After rallying more than 1,400 percent in 2017 amid an investor frenzy for digital assets, Bitcoin is down almost 70 percent from its record high of $19,511 set in December. The digital coin has closed below its 50-, 100- and 200-day moving averages for the past 16 days, the longest stretch below those support levels this year.

“Things have changed for Bitcoin and the crypto space,” said Craig Erlam, senior market analyst at online trading firm Oanda Corp. in London. “There doesn’t seem to be as much hype, or positive news. Every time we get a negative news story now -- after a period of consolidation -- we don’t see bullish sentiment come in to support it. It’s almost as if people are waiting to sell it.´´

The virtual currency has struggled to reverse a selloff that coincides with negative news, most recently a study of possible price manipulation using the Tether coin. Bloomberg News reported in May that the Justice Department opened up a criminal probe into illegal trading practices that can manipulate the price of Bitcoin and other cryptocurrencies.

Tether, one of the most-traded cryptocurrencies, shows a pattern of being spent on Bitcoin at pivotal moments, helping to drive the world’s first digital asset to a record price in December, according to research by a University of Texas professor known for flagging suspicious activity in the VIX benchmark.

Read More: Professor Who Rang VIX Alarm Says Tether Used to Boost Bitcoin

Questions about Tether and Bitfinex have dogged the cryptocurrency world since last year when Bitfinex lost banking relationships yet continued to operate. The U.S. Commodity Futures Trading Commission subpoenaed both firms in December, seeking proof that Tether is backed by a reserve of U.S. dollars, as it claims. Tether and Bitfinex haven’t been accused of wrongdoing.

In other technical measures, Bitcoin’s relative-strength index has fallen below 30, a level often used in equities and some other asset classes as indicating oversold. It typically rises, snapping back above 30, in a matter of days, according to a five-year analysis.

Bitcoin extended losses, bringing its four-session slide to almost 20 percent, as questions mount about whether the world’s biggest cryptocurrency was manipulated during last year’s record price surge.

After rallying more than 1,400 percent in 2017 amid an investor frenzy for digital assets, Bitcoin is down almost 70 percent from its record high of $19,511 set in December. The digital coin has closed below its 50-, 100- and 200-day moving averages for the past 16 days, the longest stretch below those support levels this year.

“Things have changed for Bitcoin and the crypto space,” said Craig Erlam, senior market analyst at online trading firm Oanda Corp. in London. “There doesn’t seem to be as much hype, or positive news. Every time we get a negative news story now -- after a period of consolidation -- we don’t see bullish sentiment come in to support it. It’s almost as if people are waiting to sell it.´´

The virtual currency has struggled to reverse a selloff that coincides with negative news, most recently a study of possible price manipulation using the Tether coin. Bloomberg News reported in May that the Justice Department opened up a criminal probe into illegal trading practices that can manipulate the price of Bitcoin and other cryptocurrencies.

Tether, one of the most-traded cryptocurrencies, shows a pattern of being spent on Bitcoin at pivotal moments, helping to drive the world’s first digital asset to a record price in December, according to research by a University of Texas professor known for flagging suspicious activity in the VIX benchmark.

Read More: Professor Who Rang VIX Alarm Says Tether Used to Boost Bitcoin

Questions about Tether and Bitfinex have dogged the cryptocurrency world since last year when Bitfinex lost banking relationships yet continued to operate. The U.S. Commodity Futures Trading Commission subpoenaed both firms in December, seeking proof that Tether is backed by a reserve of U.S. dollars, as it claims. Tether and Bitfinex haven’t been accused of wrongdoing.

In other technical measures, Bitcoin’s relative-strength index has fallen below 30, a level often used in equities and some other asset classes as indicating oversold. It typically rises, snapping back above 30, in a matter of days, according to a five-year analysis.

Many of Bitcoin’s closest peers have also tumbled. Ethereum, the No. 2 coin by market value, and No. 3 Ripple have both dropped more than 20 percent over the past four days.

“The entire crypto space seems to be taking the hit now,” Erlam said. “For Bitcoin, $6,000 seems to be a support level now. If I’m bearish, I’m desperate to see it break below $6,000.”

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.bloomberg.com/news/articles/2018-06-13/no-let-up-for-bitcoin-as-biggest-cryptocurrency-extends-decline