Imagine if one day, Apple lost half of its market share across all its smart device categories. Would investors continue to support AAPL at its premium price tag in the markets? More likely than not, Wall Street would punish Apple with a crushing re-evaluation.

Losing a percentage of market share to upstart and copycat competitors is to be expected. Anything worth doing is worthy duplicating, says an rival organization. But to lose half of your consumer base is something that is often not recoverable.

We already saw the devastation in the independent oil and gas stocks during the horrific energy deflation of 2014. Those companies that survived often did so by jettisoning assets that did not meet suddenly raised productivity standards, and making other painful concessions.

On Wall Street, competition is only good, so long as it's manageable.

The Real Bitcoin Revolution

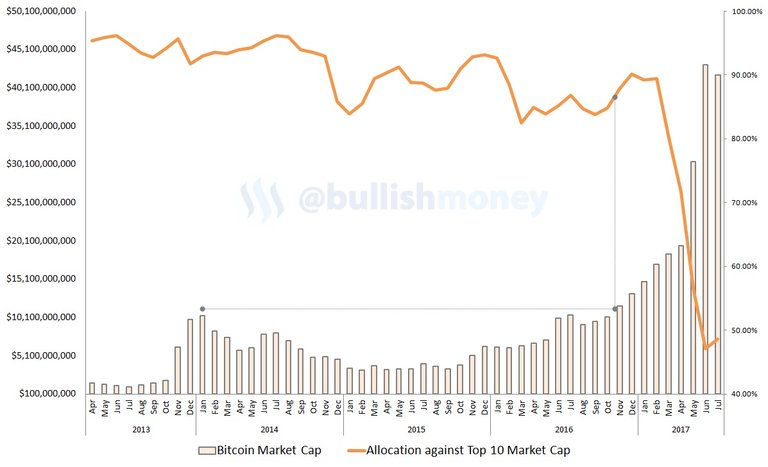

However, bitcoin and the entire cryptocurrency complex completely upended this concept. From 2013 through the end of 2016, bitcoin's allocation against the market capitalization of the top ten cryptocurrency assets averaged over 90%.

But in 2017, that average fell to a crushingly low 69%. Moreover, in this month, bitcoin allocation fell to 48.6%. Effectively, bitcoin lost more than half of its market share to competing cryptocurrency coins. Yet, the exact opposite of what we would expect happened.

Rather than a complete abandonment of bitcoin, investors jumped on the orange cryptocurrency en masse. Instead of a flight to cheap competitors, we witnessed a flight to quality -- something that rarely happens in actual consumer psychology!

Yet here we are with bitcoin, enjoying record-shattering market capitalization right as it incurred a "devastating" blow in market share.

Non-Zero Sum Game

Fellow Steemians, this is the new paradigm of investment! Instead of rewarding cut-throat behaviors, the cryptocurrency markets have proven to us, beyond a shadow of a doubt, that integration and mutually beneficial relationships improve the entire ecosystem!

The most profound lesson of cryptocurrencies is NOT that it is a tremendous investment vehicle. It's that finally, both man and machine have simultaneously proven that non-zero sum games not only exist in high-stakes finance, but that it is FAR superior to the zero-sum game of Wall Street.

Amazing. I hope people can make movies about this. Bitcoin is a bigger story than alleged Wolves of Wall Street, starring Leo.

Bitcoin will become so big that people will eventually forget that Wall Street ever existed!

That would be a blessing!

Уже снимают))

@fiord18 ... yup! :)

@bullishmoney well said!! Thanks for sharing.

Thank you! :)

This is big, can't wait for the future!

It's even bigger than most people can imagine! :)

Love it!! Amazing article ! I will remember and remind others who will try to steal :)

They can "steal," but they'd be in big shit if they try ... I have massive documentation and paper trails for my professional work, and I am more than willing to sue to protect myself!

Interesting..... watch out for thieves!

I have double and sometimes triple records for my professional work. Plus, I have a working relationship with Yale so any impropriety will be quickly and painfully penalized!

Thanks for this, you've definitely gained a new follower in me. Your content looks great.

I'm not sure if I agree with this.... YET.

I've had this worry for a while too now and have continued to speak to experts about Bitcoin v Etherium and whether they think that they can coexist. Consensus seems to be that they can because they are completely different. ETH seems to be the driving token of an invention platform, while BTC is primarily a currency.

So does bitcoin REALLY have the competition that we see in normal products? It's a huge wait and see in terms of how the industry as a whole develops before we can say that it's any different to the mainstream investment scene.

Of course, time will further solidify whether bitcoin and cryptos are truly different from the traditional investment markets, but the facts, not the opinions, are clearly visible -- bitcoin experienced record-shattering market cap at a time when it is hardly the only choice available. If Apple suddenly lost more than half its market presence in a matter of weeks, no one is going to bother paying 12x earnings or whatever it is for AAPL.

Excellent point mate. I'm on your side here.

Great article as always, an interesting perspective and just another reason why the banksters fear Bitcoin!

They absolutely fear Bitcoin because it does away with their controlled, zero-sum game paradigm...thanks for your comment! :)

interesting perspective bro, if you have time do you mind making a video? I think this calls for a video xD

Good luck with your thesis submission! I really liked your post! I think you are bang on about quality over cheap quantity in the face of a rush of ico's