TL;DR: You will lose 0.42 BTC, if you invest 0.722 BTC to Genesis Mining today. The estimation is based on an idealized model

(continued from the previous post)

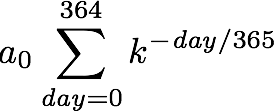

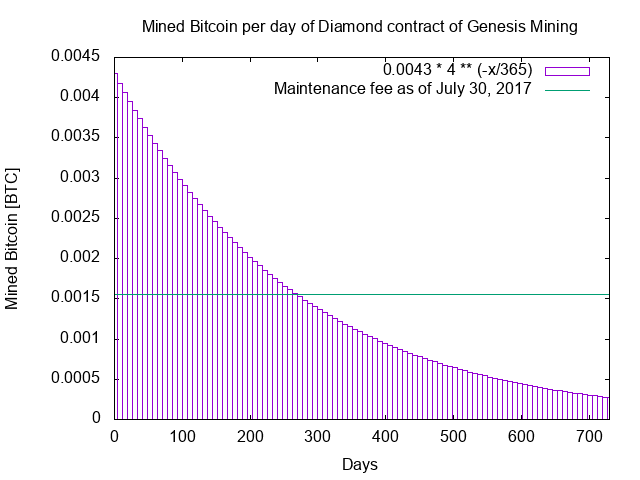

As of today, on the price list in Genesis Mining, the contract "Diamond" is marked "Max Profit". The price (or the upfront fee) is USD 1950.00, the hashrate is 15 TH/s (USD 0.13 per GH/s) and the maintenance fee is USD 0.00028 per GH/s and day (= USD 1533 per year). It is an Open-Ended contract, which runs the mining activity while it is profitable. Namely, it terminates when the Bitcoin mined per day becomes less than USD 4.2 (= 15 TH/s × USD 0.00028 per GH/s).

Here, we assume that the whole hashrate is 6,585,327 TH/s and the hashrate increase per year is four.

It should mine about 0.0043 BTC per day (≒ 15.0 TH/s / 6585327 TH/s × (12.5 BTC + α BTC) × 6 times/per hour × 24 hour).

(See the previous post)

Given k=4 and a0=0.0043, in a year the mined Bitcoin becomes about 0.8475 BTC and the accumulated maintenance fee becomes USD 1533.

Further, we assume the Bitcoin price is a constant (USD 2700, today's price).

On day 229, the maintenance fee is greater than the value of the mined Bitcoin, and the contract will be over.

The reward is about 0.302 BTC (0.658 BTC minus the accumulated maintenance fee USD 962).

In summary, if you buy the mining contract "Diamond" in Genesis Mining at the price USD 1950 (≒ 0.722 BTC) today, the estimated reward in an idealized model would be 0.302 BTC in total.

With Dash you will also not get your investment back.

See my calculation based on 4 months mining results.

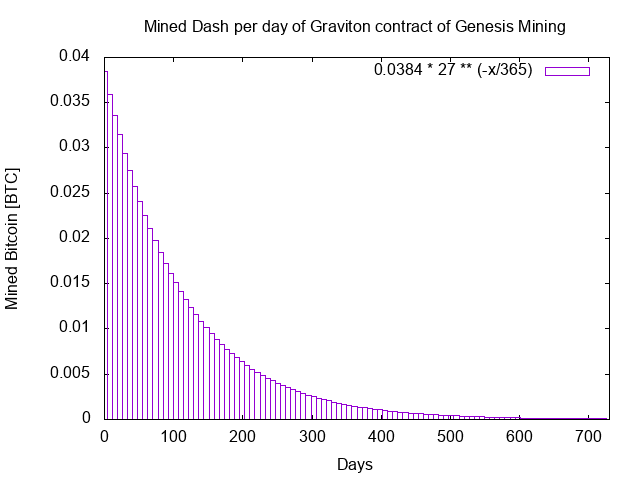

It is nice of you to share your experience! I estimated the profitability of Dash mining by Genesis Mining:

I used the same model.

The Dash hashrate increases by 2700 % in the past year. My model says that if this trend continues and you invest 11 Dash to Genesis Mining today, you will lose 6.77 Dash. (Currently, Graviton contract is out of stock.)

I am wondering whether mining (not only cloud mining) could be profitable.

I know there are a lot of scams.

Among others, at first glance, Giga Watt's cloud mining contract with WTT tokens could be a target of investigation:

How profitable is Bitcoin mining? (Part 3) Analysis of Giga Watt using an idealized model.

I am planning to further analyze the company.

Hi. I am a volunteer bot for @resteembot that upvoted you. Your post was chosen at random, as part of the advertisment campaign for @resteembot. @resteembot is meant to help minnows get noticed by re-steeming their posts

To use the bot, one must follow it for at least 3 hours, and then make a transaction where the memo is the url of the post.

The price per post is the author's reputation, devided by 1000.

(For example 44 reputation means minimum 0.044 SBD or STEEM.)

Even better: If your reputation is lower than 28 re-steeming only costs 0.001 SBD!

If you want to learn more - read the introduction post of @resteembot.

If you want help spread the word - read the advertisment program post.

Steem ON!

I think alot of people assume that the price of bitcoin will go up as difficulty increases, thus extending the life of the contract. However, if the price goes down and stays down, many contracts will stop prematurely and that would leave alot of people with a loss.

I agree that the point is often overlooked. This is why the running cost (incl. electricity cost) is important.

In the next post, I analyzed another cloud mining contract by Giga Watt, which has low hosting fee.