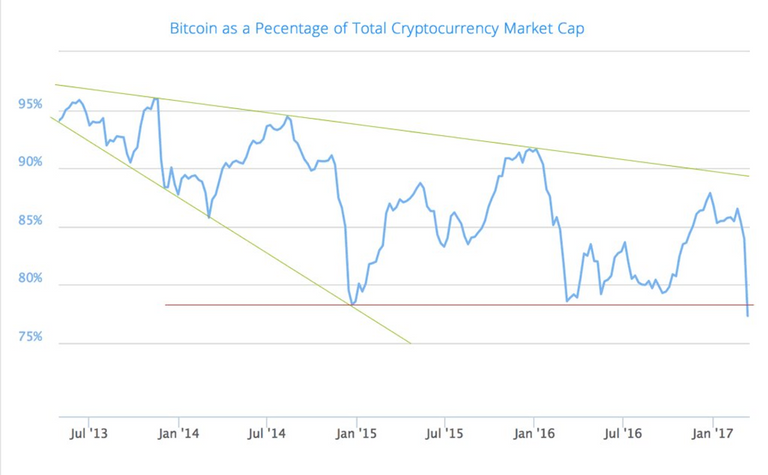

In the past week we just hit a price large milestone for the future of altcoins like steem, ethereum , ect. Bitcoin total dominance, which is how much money is in bitcoin versus all crypto combined, fell below 50%. This is monumental, as for the majority of the lifespan of cryptocurrency, bitcoin has always been above 80% or more. Things only seem to be looking worse as well, with bitcoin dominance still shrinking day by day.

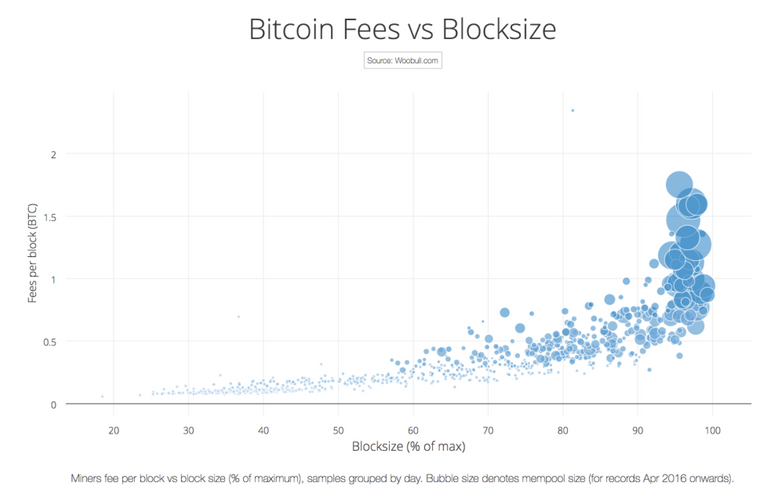

Despite bitcoin moving up in price, there is still something fundamentally wrong with the currency and many people are moving out into altcoins that don’t exhibit the same problems. For starters the transaction mempool is over 200k transactions filled and the cost of a transaction is ridiculously high. Neither side is willing to budge on which direction they want bitcoin to move, so a stalemate seems to be the only thing happening in the near future.

Most people say that the money invested in altcoins is purely speculation and that people are really still only using bitcoin and maybe a few others, which I might have agreed with a year ago, but I think that is not the case anymore. I believe that people are genuinely looking into other currencies now because they are getting priced out of using bitcoin. They might transact back into bitcoin to store value, but if they have to actually make multiple payments, using other coins like litecoin might be happening.

Its hard to tell on a mass scale who is really using what or what currencies are being mostly speculated on, but I think to write off all altcoins as 100% speculation is very foolish. Look at us here at Steemit for example. We have a currency that works and is proving a concept that is working everyday. You cant say steem is purely speculative because I see tons of people around me using it for the exact reason it was created and not to simply speculate value.

The idea that bitcoin is king is going to be severely challenged in the next year and this is not only good for steem, but all alternative projects that are looking to start up. Perhaps if bitcoin were to stop growing adoption that it has at a current pace, we could learn from the problems that is hurting it overall. I plan to write another article later about how ridiculous the zero cooperation idea is and how developers on both sides are essentially killing bitcoin.

For now though, I think that if you are a bitcoin investor, or an altcoin investor, the percent dominance is something you are going to want to keep a very close eye on in the coming weeks. Many bitcoin maximalists are calling for an altcoin bubble burst, but as long as problems continue to pile up in bitcoin land, I see more and more people looking for alternatives that don’t cost as much and can do the same thing. The network effect can only take bitcoin so far, if it continues to become unusable people will continue to pull money out.

I'm not quite sure if it's a bubble. To me it seems that the world begins to understand the potential of blockchains and start to take advantage of it

If it is not yet a bubble. it will become a bubble. Its hard to say what its true value is

if you look at the real market cap of alts its even worse. Ripple market cap is already as large as btc

what it the main point of ripple by the looks of it it gains power by bank accepting them how is it a decentralized currency

By the looks of it, Bitcoins is hitting a celling sort of speak and, while giving exposure to the world of cryptos, will expose the world to the matters that prevented it to be as powerful a cryptocurrency as Bitshares or Steem. From there, the logic is rather positive for our platform! Joy!!!

Namaste :)

Bitcoin will continue to dominate for a few years yet. Its market cap is on the increase and will keep increasing exponentially over the next 2 years and especially when mainstream public start to invest their expendable % of income into the crypto-space. It will also stand strong until alternative, more functional measures for buying and trading alt-coins is developed. We will see however specific alt-coins starting to match Bitcoin in market cap as we have seen with Ripple this week which is making a serious stand and others will follow suit although will struggle to catch the mother of all cryptos. In 5 years time we may see a divergence to a new coin, gateway or system that allows more fluent transactions between all currencies and the current monetary system.

This is a great piece. Pleased to share on twitter for my followers to read. Thanks for sharing. Stephen

Yep, I noticed that as well. Check this out:

https://steemit.com/bitcoin/@jrcornel/bitcoin-now-accounts-for-less-than-half-the-market-cap-of-all-cryptocurrencies

Great minds think alike ;)

Hey Jrcornel, I wish I saw your piece, i just read it now and you made many better points than I did! I actually just checked too and I thought you were on my feed, but apparently you werent so i just added you. Look forward to what you write next!

Thank you! I have always enjoyed reading your stuff as well. You do a great job!

It makes sense what you are getting at but people will continue to invest in Bitcoin for the namesake. People outside of the crypto world are most likely to be aware of only BitCoin (Its a very small fraction of people) . There is a lot of emotional attachment towards the technology. I will be really surprised if it goes down in the next 3-5 years.

Personally I think as long as the other currencies are traded using Bitcoin it will be holding value. Bitcoin is like the petrodollar for cryptocurrencies (in many exchanges you need to buy in with BTC, can't use visa / mastercard etc)

I think bitcoin will continue to rise. It has gone from $700 a coin to $1,800 in 6 months. This chart looks like bitcoin is going down? But that is because there are new alt coins created almost daily. There are thousands of alt coins and only one bitcoin is why this chart looks like BTC is going down but it is still going up in value overall. Btc will always be a store of value. I would be foolish if I said not to invest in Bitcoin. Bitcoin is still a store of value and should not be overlooked because of one chart. You are comparing one coin to literally thousands of coins combined. I say invest in multiple currency's do not put all your eggs in one basket, diversify yourself. Diversifying is for the rich.

It does not say Bitcoin is going down! Only his "total dominance" value at the moment IS! ;)

that why i say seg wit now fuck you bitcoin unlimted the battle is going to ruin bitcoin, oh well better start diversing my fund now and stop buying bitcoin until the petty battle is over!

Yes, bitcoin will soon be just one of the cryptocoins out there. It will probably take the rest of the year for some of the alt coins to create entry points that don't include bitcoin.

I believe the pressure will force concessions on both sides. No fork (resulting in new coin(s)) but a hard fork nonetheless is in the offing. It's either that or watch market share continue to shrink and a forward thinking newcomer fill the gap. Bitcoin miners/big players hear us now...we love the currency/money that BTC represents the ease and the market driven aspects regarding value. We love the lack of inflation associated with BTC. It is Money in the same sense as Gold or Silver in hand is money. Fiat currency WILL fail IS failing. If you do not get your head out of your collectives asses the bright promise of BTC will be relegated to the dustbin.

Motherships are not the fast space ships !

BTC Dominance should be renamed to BTC Prominence when marketshare drops below <50% (if i remember economics correctly)

Whilst bitcoin ownership as a percentage will never be as it once was, I see the % increasing once all the 'Mickey Mouse' cryptos die off...

In my opinion Bitcoin will fail. Can you trust a currency that is reliant on vulnerable technology?? With the creation of a number of new competing cryptocurrencies being developed and eventually diluting the market. If a cyber attack occurred would your Bitcoin be safe. Would you intrust thousands of dollars to the system? How long before Government infiltrate this technology and causes it to fail? Why would Government do that? Because central banks will not tolerate a currency that they do not have complete control over, thats why. If they cause a failure in the system, then people will lose confidence in them, unless of course the federal government comes to the rescue and offers to insure the currency FDICA baby. Look what they did to Precious metals. The feds found a way to manipulate it and fix it. The banks simply print and sell enough paper contracts to dilute the market. Some say that there are up to 200 hundred paper contracts per ounce of gold. The silver and gold markets are easily moved by the simple push of a computer key. They must regulate it in order to keep the value of the dollar intact. The same is true with cryto. If they let the market run, paper currencies would diminish in value. Is it possible that the cryptocurrency was ordained by the central banks as a trail to see if people would buy into this type of monetary system? But for now enjoy the wealth it has created, just don't think they will let the party continue.

Not a bubble. Simply there is a diversification. Some coins offer real solutions and many have real products going even before their icos. 50 something billion is nothing to the actual valuations cryptos have. Now, if we have spiked immediately to a trillion, then we would have a problem.

Solid blog. I was about to post a similair post. Though prices might seam inflated for now I don't think they will look like this 2, 3 years from now. Besides coinmarketcap.com there is: https://www.coincheckup.com The site lets you check all there is to know about the team, product, communication transparency, advisors and investment statistics on every crypto. Go to: https://www.coincheckup.com/coins/Bitcoin#analysis To check Bitcoin Analysis