Its been a while since I have looked at the amount of cryptocurrency ATMs and volume on local bitcoins. In the past many people have looked at these two measurements as a sign of real pure adoption mostly because they are natural growth statistics. What I mean by that is you dont hav epeople manipulating exchange volumes or buying back and forth, simply because its really hard to do it profitably on a service like localbitcoins. There are a few other good sights that indicate them as well and they all seem to be compiled on my favorite website which is coin.dance.

Coin.dance is probably the best measurement out there if you want to see how much a country is buying or if the trend is increasing for bitcoin. There are a few countries where it isnt as effective, but I would say for the vast majority it shows what is going on. While the short term trends might look negative on some countries (like China for example) in the long run, you can see that almost everything is up and this will only continue in my opinion.

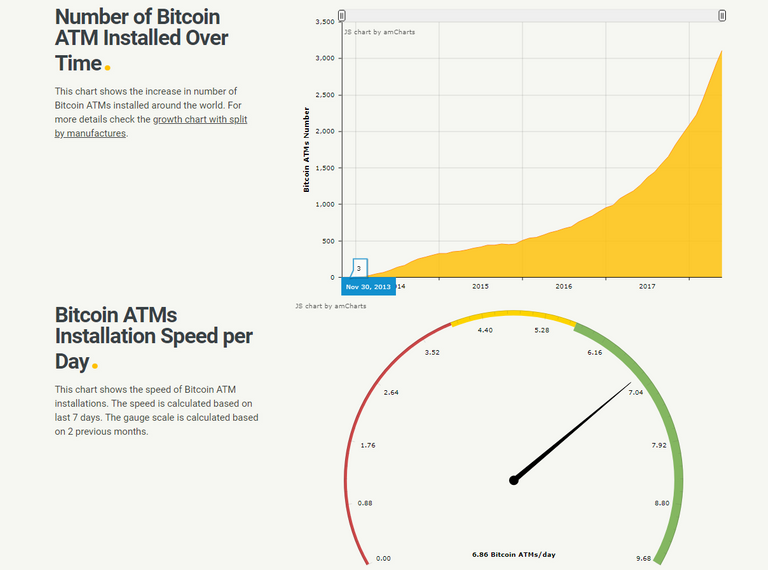

When it comes to bitcoin and other cryptocurrency ATMs, I like to use coinatmradar.com because it shows you not only where the ATMs are, but on average how many are being put out there per day. Right now we are over 3100 ATMs, which is insane compared to only a few year ago. This is only going to continue as the current trend seems to be putting out 6 ATMs in the field per day. While this might not lead to massive adoption, each ATM is not just a place to buy cryptocurrency, but a huge advertisement for the space as a whole. It will pique peoples interest and have them either make their first buy or just simply research it more.

I think in times like this where the price is going down and people are panicking, we need to realize that the internet, Rome and a bunch of other cliché examples, werent build in a day, or even a decade and neither will the mainstream adoption of cryptocurrency. The only trend that matters is one that is over a time of years and as we all know, that trend for this space is extremely positive. Even if we fall 60%-70% from the all time highs, it doesnt matter in the long run. Look at the price of the tech stocks of the biggest companies today, after the bubble burst. Many were down 90% and now they are booming.

We need to look at the things that are positive and show natural growth occurring in the space. I can pinpoint a bunch of other statistics, but for me, I just like seeing the simple growth of the infrastructure because I know that it wont matter in 5 years. Its hard to calm people down especially if they are looking at a negative portfolio, but we have all been there before, this has happened in the past and it will happen again. Play the long game and focus on what really matters, adoption. If people are buying and picking up more and more, the rest is just noise. Take a step back and forget about things for a while and come back if you need to.

-Calaber24p

I love how the Canadian LB action exploded after the big Canadian banks started blocking crypto-related transactions.

Yeah youve seen this with other notable bannings and it only shows that people will continue to buy.

Actually looking at these two measures as a sign of real acceptance @calaber24p

I agree, these two are definitely signs of natural user growth and acceptance.

cryptocurrency and ATMs relationships very intereting report... tanks..