So, I sorta understand cryptocurrencies, but can you explain Bitcoin?

Bitcoin was first. That’s pretty much it. The concept of blockchain was implemented by the anonymous (individual or group) “Satoshi Nakamoto” to create cryptocurrency & Bitcoin – the design being that it’d be used as a digital, ethereal currency (more secure and less traceable than credit cards, PayPal, or bank transfers).

There are numerous methods to create new blockchains, but Bitcoin is “mined”. To “mine” Bitcoin, a “miner” has to devote computing power to solving problems for the network. Once a computer (or sets of computers/servers) has devoted enough resources to the “mining” process, new blockchains are created, and the “miners” are rewarded with Bitcoin and user generated transaction fees. You may say there's no value for a Bitcoin to USD (or any fiat currency) at this point, but valuables have gone into its creation, mainly: time and energy.

But wait… doesn’t that mean the value of the Bitcoin is only based on trust?

You bet your sweet a** it is.

Before you decide that means you’re writing it off, take a long, hard look at the trusty, reliable US Dollar.

The (Not So) Simple History of a 250 Year Old Currency

The US Dollar was, as you're aware of, originally the English Pound. This was scrapped when we became independent. Next, was the Continental Currency, which was crushed due to runaway inflation (because every state printed as much of it as they wanted), hence the reason you’ve never heard of the damn thing. In 1792, the US Dollar (courtesy of the Mint Act) was pegged to something shiny (silver - precisely 23.2 grams). Over time, this shifted to the gold standard, again pegging the dollar to something very real, and very shiny. There was no paper money as we understand it today, only issuances backed by a resource. As the reserves of both gold and silver largely remained the same over the 19th century, but paper issuances increased, the valuation of the issuances decreased. All value was tied to tangible resources.

Then there was the Civil War.

Courtesy Wikipedia:

One of the first attempts to issue a national currency came in the early days of the Civil War when Congress approved the Legal Tender Act of 1862, allowing the issue of $150 million in national notes known as greenbacks and mandating that paper money be issued and accepted in lieu of gold and silver coins. The bills were backed only by the national government's promise to redeem them and their value was dependent on public confidence in the government as well as the ability of the government to give out specie in exchange for the bills in the future. Many thought this promise backing the bills was about as good as the green ink printed on one side, hence the name "greenbacks.”

There it is. After thousands of years of currency being based on valued supplies* (of metals or commodities), it was decided that real world issuances would be no better than a promise. Think “Sticks and stones may break my bones, but words will never hurt me,” except, “Gold and silver is real, you’re offering me valueless words.”

*Fiat currency has been used in past societies such as the Ancient Egyptians, but was always temporary.

As the US worked its way out of the 19th Century we continued to flip-flop on Dollar value. Sometimes the promissory notes could be turned in for gold and silver, but usually they couldn’t be. Battles took place between those that wanted a silver standard and those that wanted a gold standard. At times, the Dollar was a bi-metal based promissory note, at other times, mostly a gold standard. In the end, these “meaningful currency battles” proved fruitless. Why?

Having Fun? Well, stop it. THE GREAT DEPRESSION.

As inflation and economic woes began to spiral out of control throughout the world, the gold standard (or bi-metal standard) was dropped by country after country. This was due to the fact that their reserves could no longer keep up with demand.

Essentially, as bank runs occurred, and the value of paper notes decreased daily, citizens began to distrust banks and paper money. What can you use to trade and barter if paper notes are valueless? Why, you use the metals that the promissory notes are supposed to be backed by. So, the citizenry starts hoarding precious metals, reserves are depleted, and what is paper backed by again? UH OH. Wall Street, we’ve got a problem.

Even through 1933, US bills were denoted as “United States Note”, and had the phrase, “Will Pay To The Bearer On Demand” stamped on the front. However, to combat the depleting gold reserves, FDR implemented a series of laws that “suspended the gold standard except for foreign exchange, revoked gold as universal legal tender for debts, and banned private ownership of significant amounts of gold coin.” United States Notes became Federal Reserve Notes.

This gold standard suspension was considered temporary, but wasn’t reinstated by any meaningful measure until…

World War II and the US Decides to be Boss

We leapt out of the Great Depression by helping England and Russia whoop some ass in Europe, Asia, and Africa. What we weren’t prepared for was how devastated the rest of the world would be in the aftermath. Nearly every nation – from England, to Japan, China, to The Netherlands – found itself utterly wrecked in 1945-46 – well, except for one: the good ole USA.

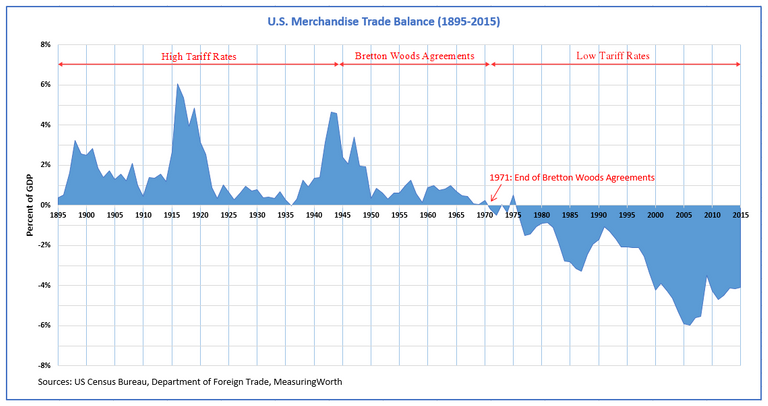

Using a combo of the Marshall Plan and the Bretton Woods System, the US became the strongest and most giving nation on Earth. This allowed us to flood the world with US dollars that were, once again, pegged to gold. And we all lived happily ever after.

Nah, just kidding.

Everything was smooth for awhile, ‘til the Crook from Cali took some currency liberties in 1971.

Nixon's One Finger Salute to the World

Ever increasing inflation and unemployment freaked Nixon out – we’re all well-aware now that he’d do about anything to get re-elected – so he, literally overnight, decided that dollars were no longer guaranteed by gold backing. After years of toying with the idea of making the US dollar a fiat currency (money a government has declared to be legal tender, but is not backed by any physical commodity), we dove in headfirst and never looked back.

That means my US Dollar is worth… my confidence?

That’s about it, yeah. You can factor in costs, like the price of the paper and ink it’s printed with, the energy consumed by printing machines, and the cost of distribution, but if these were the only factors that determined our valuation of US Dollars, a $1 bill would be worth the same as a $100 bill. There is no real difference in the bills besides

- Less $100 dollar bills are in circulation than $1 bills, and,

- $100 bills are printed with the number one hundred, $1 bills are printed with the number one