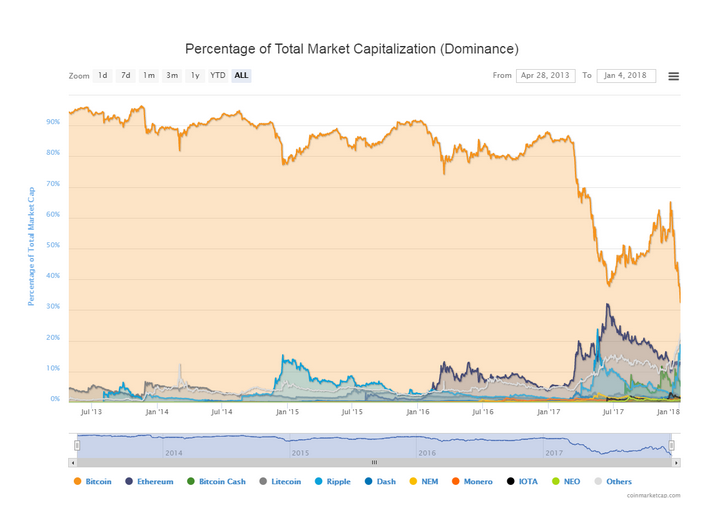

Today was the first time in history when the market capitalization of bitcoin (circulating supply * market price) fell below 1/3 of the whole cryptocurrency ecosystem. It used to be around 90% and 80% for many years until 2017. Despite these late figures and rankings, bitcoin has a solid and diverse role within this ecosystem of 750 billion dollars. It started as a spontaneous experiment that soon reached such forms and impact that has amazed even the most visionary pioneers. Bitcoin made legends, brought early pioneers together and constitutes the most utilized digital "reserve currency" of cryptocurrency exchanges online. In order to understand what is really going on, it is still necessary to go beyond bitcoin and even blockchain technology. People who have emphasized merely technical details of a given blockchain solution (like bitcoin) at a given historical moment may have not realized the development potential and social circles around it. Even plain economic understanding of popular talking heads has not mainly been sufficient to generate insightful commentaries. At times when praising or criticizing something specific around this broad topic people tend to confuse blockchain technology, bitcoin as single application of that technology, cryptocurrencies as an ecosystem, tokenization as a business solution, coin offerings as a crowdfunding mechanism and digital asset class. I am going to discuss the challenges of understanding cryptocurrency markets.

Economic theory helps us to go further from technical details. For example, subjective and social user perspective, network effect and complementary aspects explain why certain solutions are being adopted despite some questionable technical features. Financial journalism is full of examples how sticking to separate rational economic tools may also hinder understanding of the topic. It goes to philosophical fundamentals. Professionals of established fields like finance and accounting master tools and theories that articulate with a part of our world to a sufficient degree. Even in cases like efficient market hypothesis (EMH) and capital asset pricing model, where certain assumptions are being widely questioned and argued, theories and models have a role in making sense of our world. Professionals have tried to understand cryptocurrencies by familiar concepts such as legal definition of money, EMH and tools like earnings-based asset valuation method. Cryptocurrencies at this moment cannot be equated with foreign currencies nor established companies generating earnings. Many are honest to admit that their professional understanding does not match with the particular phenomenon in question. By now it is also common to have witnessed more arrogant approaches too: if the real world does not fit into some separate models, there is something wrong in the reality.

In fact, I would hold that the problem does not lie in financial or economic theories in general, but in the narrow and separate use of them. It is unlikely that theoretical tools that were developed to explain a slightly different part of our world could sufficiently capture what is going on. However, combining them and getting to know the real world contexts behind the phenomenon like cryptocurrency ecosystem offers a fruitful path of interesting discoveries for those who try to explain the world. For years there have been notable people suggesting a crypto bubble to burst at any moment. Of course, there is a chance that suddenly their scenario comes true after all. However, as time goes by without making predictions happen, analysis should get more sophisticated and critical to whatever direction. While it seems obvious that blockchain technology and cryptocurrencies are being hyped, it would be lazy to explain all this by just making vague notions about irrationality, greediness and fear of missing out (while mentioning about the tulip mania). I agree that they do seem to be a critical part of this phenomenon and they seem to be part of other less discussed trends too. However, they are not alone able to provide a sufficient explanation of the things we have seen within a year or what we are about to see during this year.

Many people confuse corrections and bubbles. In traditional financial language already a heavy cycle ending in correction may get called a bubble, leaving no qualitative difference. When discussing about cryptocurrencies or bitcoin, "bubble narrative" treats cryptocurrencies as a thing that will eventually shrink to a permanent marginal or even die. Attributes of a pyramid scam can be seen attached to this narrative, making it completely different than the famous idea of a hype curve: inflated expectations will become corrected harshly, but provide hope of a modest incremental development in the post-burst period of time. Today it seems likely that cryptocurrency markets as we know still continue to perform heavy rises and dramatic corrections as it has done in the past, but the ecosystem is gaining strength every day and becomes less likely to be wiped out. What critical commentaries have not been able to foresee is institutionalization, different innovative forms and mindset. Blockchain databases, virtual currencies and digital assets are elements to solutions that await people to build them and find problems to solve. The order may sound peculiar, but that is totally not abnormal in the world of technical innovations and extreme uncertainty - especially concerning upside potential.

Bitcoin gets criticized about being "virtual" and containing "no real value". Comically, many conventional assets and even currencies could be criticized for the same reason. One of the extreme misunderstandings is a notion that cryptocurrencies were not comparable to IT-startups, because the tokens would not be backed by even non-material intellectual capital. The basic thing about cryptocurrencies is that they are not all competing variations of each other like in the early days. There are segments. In fact, in many cases this comparison to information intensive startups is probably the most relevant one: there is an idea, there is a project, and hopefully there are suitable capabilities to materialize it. Using a cryptocurrency token in crowdfunding can be flexible, but aligning incentives and matching it later with everyday business is still a challenge. Probably one of the key drivers in the recent initial coin offering (ICO) boom still relates to the revolutionary experiment of establishing speculative markets for startup projects. There are developer communities with a drive of rethinking existing world and making experiments to change it. Surprisingly, digitalization is not just a buzzword for them – it is inseparable part of their spirit.

Beyond bitcoin and technical blockchain solutions there seems to be an emerging, yet little explored ecosystem that may some day be remembered as the edge of digitalization.