Bitcoin’s role in global markets has become clear amidst rising tension between the US and North Korea. Investors have started to include Bitcoin in their portfolios as a safe haven asset, due to its immutability to economic uncertainty and the instability of global markets.

Analysts including InvestFeed CEO Ron Chernesky and Jeff Rosenberg, fixed income strategist at Blackrock, a US-based investment management company with over $5.7 tln in assets under management, noted that the intensified conflict between the US and North Korea has led to equity markets sell-off and ultimately to mid-term economic uncertainty.

As a result, Chernesky explained that a rapidly rising number of investors and traders have begun to shift their focus towards Bitcoin as a safe haven asset and long-term investment.

Chernesky said:

“We’re seeing investors transferring their funds into cryptocurrencies as they try to diversify their risk in case of a severe downturn in the market. The space has gone from niche to more widely adopted with one of the main draws being that cryptocurrencies are seen as less correlated with other assets.”

Niche markets

Today, it is difficult to argue that the Bitcoin and cryptocurrencies industries are niche markets, mostly because of the cryptocurrency market’s staggering $139 bln market cap and a daily trading volume of $5.6 bln. Through strictly regulated Bitcoin exchanges and trading platforms, verified investors and traders can obtain high liquidity.

Already, investment banks including Goldman Sachs and JPMorgan along with multi-billion dollar investment firms such as Fidelity have started to encourage their clients, investors and portfolio managers to consider investing in Bitcoin and cryptocurrencies, considering the market’s growth and exponential increase in global adoption.

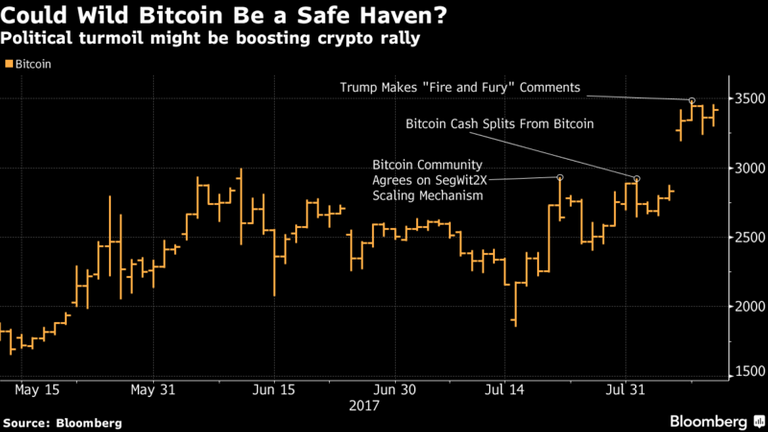

Many analysts and financial data companies such as Bloomberg have attributed the success of Bitcoin’s recent rally to its growing adoption as digital gold or safe haven asset.

Seeking shelter in Bitcoin

Earlier this month, almost immediately after US President Donald Trump made his aggressive “fire and fury” comments while addressing the North Korean issue, trading volume of Ethereum increased by $2.6 bln. In South Korea, Ethereum has become more popular amongst traders, mostly because of their beliefs that they had missed Bitcoin’s previous rallies.

Across Asia, demand towards Bitcoin surged along with Ethereum, as Bitcoin price went on to set new all-time highs and enter the $4,200 region for the first time in history.

Investors and traders are seeking shelter in Bitcoin and other cryptocurrencies such as Ethereum, with Bitcoin being embraced as a safe haven asset and digital gold. As more institutional investors and large-scale traders continue to seek Bitcoin in periods of financial instability and global economic uncertainty, the value of Bitcoin and the cryptocurrency market will consistently rise.

source : https://cointelegraph.com/news/more-and-more-investors-are-transferring-their-funds-into-cryptocurrencies-reasons-trends

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://steemit.com/bitcoin/@loveindia/more-and-more-investors-are-transferring-their-funds-into-cryptocurrencies-reasons-and-trends

The next problem will be the blocksize we need bigger blocks if more and more people want btc (maybe another segwit 😜)

hh yes maybe another segwit will be soon ! ;p