Bitcoin's problems

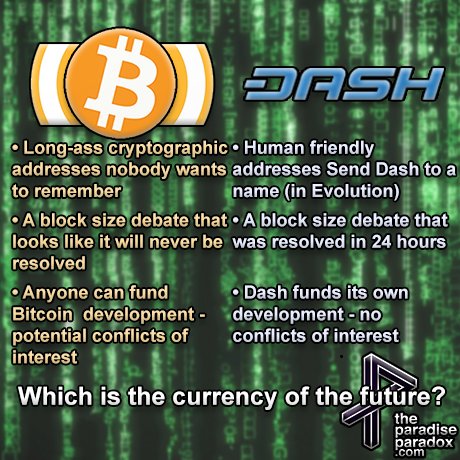

Many people believe that Bitcoin is always going to be on top of digital currencies, because it was the first currency of its kind to take hold, and it now has an established market cap. It's true, Bitcoin is the only case of a widespread, functioning blockchain. However, Bitcoin is not without its problems, the most important of which is user experience.

How the hell do I use this thing?

If people can't use Bitcoin easily, then it doesn't stand a chance of taking off. If Bitcoin isn't as easy to use as PayPal, if people have to use long weird-looking strings of 34 characters, if they have to use a wallet that looks like it was designed in Visual Basic in 1997 (or even 2007), why would they ever want to use it? Bitcoin is great, but it's not so great that people who don't know anything about it will look past its appearances to use it. Normal people don't extend themselves to use new technology - only nerds and enthusiasts do that. Normal people wait for new technology to come to them, or at least meet them halfway. If someone has to understand the technology to use it, that technology is not ready for mass adoption.

How big can it really get?

The other main problem is scalability. When I first heard of Bitcoin, I was seduced by the idea of rapid transactions and low fees, thinking about how micropayments would change the face of the web. When my time preference was low, I would even make transactions without paying a fee, and saw it come through within a few hours. Now, if I try to make a Bitcoin transaction without a fee, it's may take days, or perhaps never be processed. Unprocessed transactions frequently exceed 10,000. Micropayments, and even small payments, are a dream of the past, with transaction fees now greater than 30 US cents. The block size debate has gone unresolved for more than a year, which points to a greater problem.

Who is in charge here?

Bitcoin has no formal governance structure, and the only way to make a big change is to introduce a hard fork - creating a second Bitcoin, and hoping that everyone will come along with it. If the community cannot resolve a simple issue such as doubling the amount of data per block, what hope would it have to solve more complex problems? Bitcoin has apparently fallen prey to the one thing which we thought it would save us from - politics.

The funding for Bitcoin development has come from various sources - MIT Media Lab's Digital Currency Initiative, the company Blockstream, Chaincode Labs Inc., Ciphrex, the Chinese exchange BTCC, and others. Do all these organisations have Bitcoin's interests at heart? Of course there are powerful interests who would prefer to see it fail, and when money gets involved, there's a big chance for there to be a central point of failure.

Dash's solutions

Dash Evolution

Dash Evolution is an attempt to make cryptocurrency accessible to regular people - "cryptocurrency that your mum could use". You'll be able to send currency using a name which looks more like an email address than a computer error. You'll also be able to log into an account from wherever you are, using your phone, your computer, or someone else's computer, while still retaining control of your funds. The user interface will look something like PayPal or Venmo or an Internet banking site - something familiar and intuitive to many people.

The debate is settled on scalability

The Dash block size question was resolved within 24 hours, using a voting system among masternodes - all significant stakeholders in the currency. Yes, the problem which the Bitcoin community has continued to stumble over for months was overcome in just a day, without a hard fork, without any fork, just through a simple show of hands.

Formal governance

Dash has this voting system in place, so important changes can be made without having to introduce a hard fork. Moreover, funding for Dash comes from Dash itself. 45% of the Dash created goes to miners, 45% goes to masternodes, and 10% goes to a treasury - currently more than $1 million per year, which can be used, firstly, to fund the development team, working on creating a user-friendly product, but also to fund the website, marketing, customer support centres, training groups, and perhaps even public events like conferences and concerts.

In a very real sense, Dash owns itself. Masternodes must hold 1000 Dash, so when they vote, we know they are invested. When they vote on whether to fund a project, that's going to be an important factor. And the people who complete projects are, of course, paid in Dash, so they have an incentive to help it grow.

Conclusion

There are problems on the surface of Bitcoin, and the superficial problems are reflective of deeper issues - ones of economic incentives. The economic incentives of Dash are far superior, and the wheels are in motion to allow Dash to take off - not just with crypto-nerds, but with the general public.

Additional resources

Check out dash.org.

And here are some cool videos to watch on the subject:

Donate Dash

If you have some Dash you want to share, this is my address: Xo5fNe1fQGxDYAxKSqBoSqEzZYkCMTCZyB

About me

like The Paradise Paradox on Facebook here, and subscribe to The Paradise Paradox on YouTube, and on iTunesMy name is Kurt Robinson. I grew up in Australia, but now I live in Guadalajara, Jalisco. I write interesting things about voluntaryism, futurism, science fiction, travelling Latin America, and psychedelics. Remember to press follow so you can stay up to date with all the cool shit I post, and follow our podcast where we talk about crazy ideas for open-minded people, here: @paradise-paradox,

Hello @churdtzu,

Congratulations! Your post has been chosen by the communities of SteemTrail as one of our top picks today.

Also, as a selection for being a top pick today, you have been awarded a TRAIL token for your participation on our innovative platform...STEEM.

Please visit SteemTrail to get instructions on how to claim your TRAIL token today.

If you wish to not receive comments from SteemTrail, please reply with "Stop" to opt out.

Happy TRAIL!

Interesting post. Good information.

As it happens I got sent dash for the first time yesterday :)

Great. I've had some for a while, but it wasn't until I saw Amanda's recent videos when I realised how big it could really be.

It could be big. I think there could be a place for it but a big challenger will be Steem and Monero. They are not there yet but its a competitive space.

Yes, and it's exciting to see competition. I do think user experience is going to be a real key thing. Right now, I'd say Steem is the easiest to use out of all cryptos, but it's still lacking a lot. And when I start to explain that there are three currencies involved, people's heads start to spin. It's still early days though.

With Dash, the focus is on making a currency first, which can then be used for other platforms, social media and markets. Steem has a sort of opposite approach - build the social media site first, then try to get it more accepted as a currency.

As far as I know (and perhaps you can enlighten me), Monero isn't focused on user experience at all, so that's always going to be a hard sell.

I think your not wrong, but Monero has a killer feature, privacy.

I think at the end of the day the great UX doesn't necessarily need to come from the currency but can come from clever apps. When you think about making a credit card payment, its horrendously complicated what goes on in the background but the user never needs to know. It all just works.

My Two cents on the viable currencies:

Bitcoin has volume and relative stability. Thats a killer feature for some things, it could form the backbone of some international clearing system or long term store of value. It doesnt necessarily need speed to work for those just stability and security.

Dash/Monero have speed and and are all viable as payment currencies for everyday use. Dash seems to be pulling ahead but lacks the privacy of Monero which could prove more important. It will be interesting to see how these currencies scale and if this uncovers any issues.

Steem is super fast, can handle high volumes and has been built from the ground up. The complicated 3 states of Steem is quite ingenious, I am still trying to get my head around it but your right its difficult to get across to people. And with regards Steem and its future a lot depends on how rewards end up being distributed, what the whales do, future hard forks etc .... there are so many variables with Steem but its promising. I would like to see a nice slick wallet app for it soon. That would be cool.

UX can come from clever apps, but someone has got to make the apps first. Bitcoin has been around for years, and nobody has really improved its UX, so I have to wonder what would make Monero different. No cryptocurrency really has it down yet, but from the information available, Dash is going to be the first.

Bitcoin has stability for now, but if that's its feature, then any currency which overtakes its market cap is going to displace it. It doesn't need to be fast to work for a clearing house, but a currency which is fast is obviously superior.

Dash does have privacy though. You can make transactions private with Dash, and you can make public ones too.

@churdtzu Thank you for this Article. I think you could become right. Do you know any websites where all coins are described and you can see the exact differences between the blockchain implementation? Thank you, Namaste Roland

Thanks. I don't know if there are any great comparison sites which will give you a run down, but here are a few places to start:

http://coinmarketcap.com/

Thank you very much!

There are never just two sides to a question like this.

If Bitcoin is no good:

Then we have many other currencies to choose from.

Not just Dash.

Pick out of the hundreds that exist wisely.

Don't just believe propaganda like this.

Think for yourself and do your own research.

Yes

rEsteemd because I agree with many of your conclusions. The governance model was such an important adoption, and the proof of stake of 1000 Dash is a great Bond idea for raising mining investments. Thank you for sharing.

Thanks, appreciate it. Yes, it's important to make sure people are invested in the network if they want to have a say. In Amanda's speech at UNM that I linked to, she compares the Bitcoin discussion to having Samsung start /r/Samsung to make decisions, without even knowing who works for Samsung and who doesn't.

This post has been ranked within the top 80 most undervalued posts in the second half of Feb 16. We estimate that this post is undervalued by $5.21 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Feb 16 - Part II. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

She's doing great at her job selling Dash. Her main argument is flawed though, in that she lacks evidence that people are only, or mostly, buying crypto for investment. Moneros jumped way up in value when they were added to darknet markets, which tells me a lot of it is being bought for the privacy utility.

You mean the main argument in the Bitcoin bubble video. Yes, people are certainly using cryptos to send stuff. I use Bitcoin to send money every month or so, and sometimes it's certainly convenient to send it that way. However, I certainly wouldn't hold as much bitcoin if I didn't expect it to increase in price.

Perhaps she overstated the case a bit, but I'd say the housing bubble analogy could be accurate. People still use houses for living in - even the majority of people do so. That didn't mean that housing wasn't in a bubble. Time will tell.

I think bitcoin still the most important cryptocurrency in the market

Yes, I agree in many ways. People are still building a lot of things for Bitcoin, it still has the biggest network effect, the biggest market cap. But to get an idea of what will happen in the future, you have to look at where the trends are leading. Are the trends for Bitcoin going to make it better, or worse?

I don't see how anyone is assuming that. I'm not assuming that. Value is subjective, and it has little to do with how much energy is spent. But I'll have a look at the article.

How does Bitcoin work on the principle that value spent is value stored?

Currency is certainly subjective. I can buy much more with a dollar in Mexico than I can in Switzerland, and a dollar bought more in 1913 than it does today. That's because people assess the value differently depending on their situation and knowledge.

If you think that currency is not subjective, then try to tell me an evaluation of a dollar, or an ounce of silver, or any other currency, which does not change depending on time or place.

You mine for it, but that doesn't mean it relies on the idea that value spent is value stored. That doesn't follow. Precious metals have value because people see them as valuable, and it's the same with Bitcoin.

I'm willing to consider what you're saying, but I find it very difficult to imagine what you're describing.

A good currency should have stability, yes, and bitcoin has gained more stability over time. However, it would be very difficult for a currency to retain exactly the same amount of value, with one pound always and everywhere buying 10 loaves of bread, ten pounds always buying a ladder or something like that. Is that the kind of thing you're describing, or have I misunderstood.

I have no problem with currency being both a measure of value and a store of value, though obviously it's an imperfect measure of value because of the factors I've mentioned. I'd say all forms of money are commodities in some sense.

Well... I don't know what to say. What you're writing here is just false. People use money as a measure of value all the time. If someone tells me a craft beer is worth 50 pesos, I can compare that to the amount I earn per week or to the amount a standard domestic beer costs in that bar or in the supermarket. I do get an indication of the value from that. It's not a perfect measure, but it is a measure.

The numbers are a measure of value. The object is a store of value. If I mention the figure "5 ounces of silver", you have an idea of much that is worth. If I have the five ounces, I can keep them and store value with them.

I'm trying to think it through and see your point... Can you tell me this: what are the implications of it? And what should money look like in your opinion? Alternatively, what would an excellent measure of value look like or what would it do?

Okay, but even if I accept that's the case, I have no idea how it will affect my actions or my thinking, how I use money or how I evaluate prices.

It is a unit. It's not a perfect unit. You seem to be implying that's a contradiction, but it's not. A sweater might not be a blue sweater, but it's still a sweater.

Okay, then why did you say "either it is a unit or it isn't"?

I can measure things in pesos and dollars. I do it all the time. I literally do it every day, so I'm not sure how you can tell me that I can't.

That's fine if you say it's not a standard, because a standard implies that it will be consistent over time. But it is a measurement.