You have most likely heard about Bitcoin by now, the popular cryptocurrency has soared high in value having increased in price by over 20 times in 2017 alone.

If you are interested in buying Bitcoin and you live in the United Kingdom this guide will show you how you can buy Bitcoin as well as other cryptocurrencies including Ethereum, Bitcoin Cash, Litecoin, Ripple, Dash and Stellar Lumens.

You will see Bitcoin Cash mentioned numerous times in this post, if you want to buy Bitcoin then choose "Bitcoin" when buying from an exchange, "Bitcoin" and "Bitcoin Cash" are two different cryptocurrencies.

BitPanda

BitPanda is currently Europe’s most popular Bitcoin exchange and it allows you to purchase Bitcoin as well as Bitcoin Cash, Ethereum, Ripple, Litecoin and Dash instantly using various methods including bank transfers, wire transfers, credit/debit card payments, Neteller and Skrill.

Processing time takes roughly 20 seconds and full Gold verification only takes about 10 minutes and allows you to buy 10,000 Euros (£8,861) worth of cryptocurrency a day and sell up to 100,000 Euros (£88,618) worth of cryptocurrency a day which will really come in handy when you need to cash out.

When you purchase any cryptocurrency it is then stored on BitPanda’s built in wallet (they have a Bitcoin wallet for Bitcoin, a Litecoin wallet for Litecoin, a Ripple wallet for Ripple, Euro wallet for Euros etc.) and you can easily send your coins to another wallet which I recommend if you plan to store your coins long term, I will list my wallet recommendations towards the end of this guide.

A few things to note:

All European countries are supported by BitPanda and as far as I know only countries based in Europe can use BitPanda for now.

You can use any currency to buy Bitcoins and all the other coins on BitPanda but the price is calculated in Euros, you can easily use Google to convert the price, for example if you want to buy £100 worth of Bitcoin you can google “100 GBP in EUR” or “100 Pounds in Euros”.

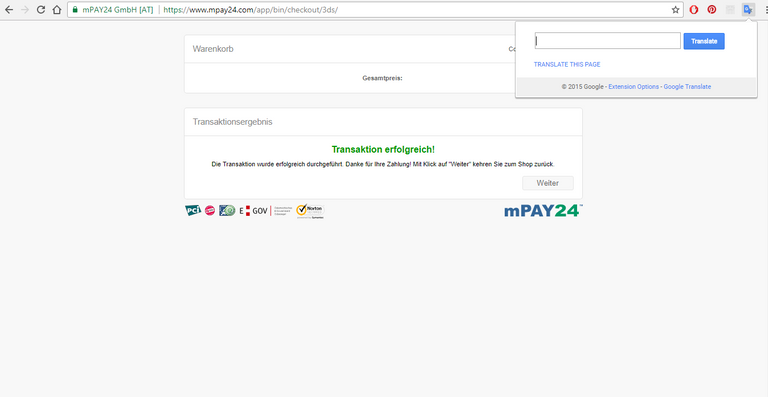

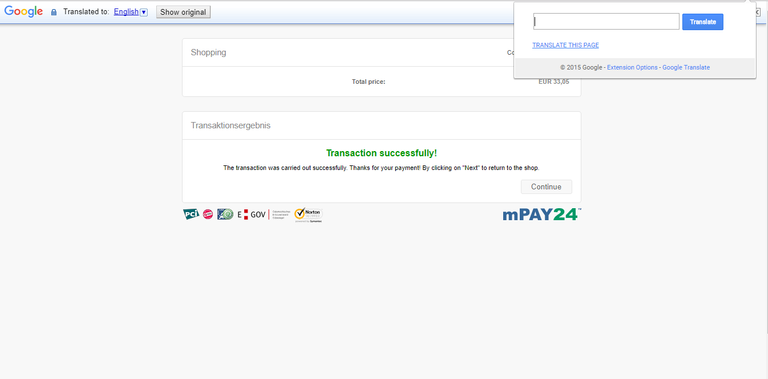

The payment screen is in German but normally Google instantly offers to translate the page once it detects that it is written in another language, if you do not see a “translate this page” prompt then you can always use the Google translate extension on your browser.

If you have made online payments before it is easy to tell which is which and after my third transaction I stopped using the translate feature on chrome.

Google Translate Browser Extension Google Chrome link

Google Translate Browser Extension Firefox Link

I have found BitPanda to be very fast and reliable and along with CEX these two exchanges are currently the best options for investors living in the United Kingdom in my opinion.

BitPanda supports all countries in Europe

Use BitPanda to buy Bitcoin here: Buy Bitcoin from BitPanda

CEX

CEX is another great exchange to quickly and easily buy Bitcoin as well as Ethereum, Bitcoin Cash, Bitcoin Gold, Ripple, Dash, Zcash and Stellar Lumens.

Like the other exchanges it has a built in wallet but you also have the option of sending the Bitcoins to your own personal wallet straight after purchase, using this option can save you money on transfer fees since the Bitcoins are sent to your personal wallet straight away.

Payment methods include wire transfers, online bank transfers and credit/debit card payments, verification is also fast and simple.

A few things to note:

Basic accounts can buy up to £800 worth of bitcoins per day, and up to £2,000 per month.

Verified accounts can buy and sell an unlimited amount of any cryptocurrency offered on CEX.

Basic accounts can only use debit/credit cards to buy cryptocurrency, if you want to use a bank transfer to deposit funds into CEX you will have to verify your account first but the verification process is fast and simple.

CEX is a UK based exchange but it supports all countries around the world.

Use CEX to buy Bitcoin here: Buy Bitcoin at CEX

Coinbase

One of the most well-known sites for buying Bitcoin, Coinbase also allows you to buy Ethereum, Bitcoin Cash and Litecoin using bank transfers, wire transfers and credit/debit card payments.

Like BitPanda and other exchanges listed here, each currency will be stored inside it’s own Coinbase generated wallet and you will be able to both buy and sell those currencies within the Coinbase website.

Coinbase supports the UK, USA, Canada, Australia, Singapore and parts of Europe.

Use Coinbase to buy Bitcoin here: Buy Bitcoin at Coinbase

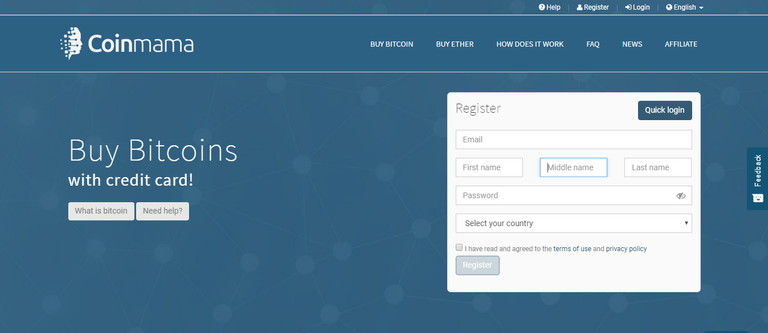

Coinmama

It is very easy to purchase Bitcoins and Ethereum with Coinmama, you can buy Bitcoins using a credit or debit card within minutes.

You will need a Bitcoin wallet address before you buy Bitcoins from Coinmama but there is a built in option to generate a free software wallet using a separate Bitcoin wallet provider.

Accounts verified with a passport can buy $10,000 (£7,146) worth of cryptocurrency, accounts verified with 2 forms of ID can buy $50,000 (£35,734) worth of cryptocurrency and accounts with Level 3 verification and above have no limits.

Coinmama has additional payment methods including bank transfers and wire transfers but the only one I saw was Credit/Debit Card payments, other payment methods might depend on the country you live in.

Coinmama supports all countries around the world

Use Coinmama to buy Bitcoin here: Buy Bitcoin at Coinmama

Where to store your Bitcoins

How a Bitcoin Wallet works

Once you own Bitcoins (or any other cryptocurrecy) you then need to store them in a personal wallet where you control the private keys or wallet seed, storing coins on an exchange long term is not recommended because exchanges can potentially be hacked or taken down by authorities.

Bitcoin wallets are usually comprised of three elements:

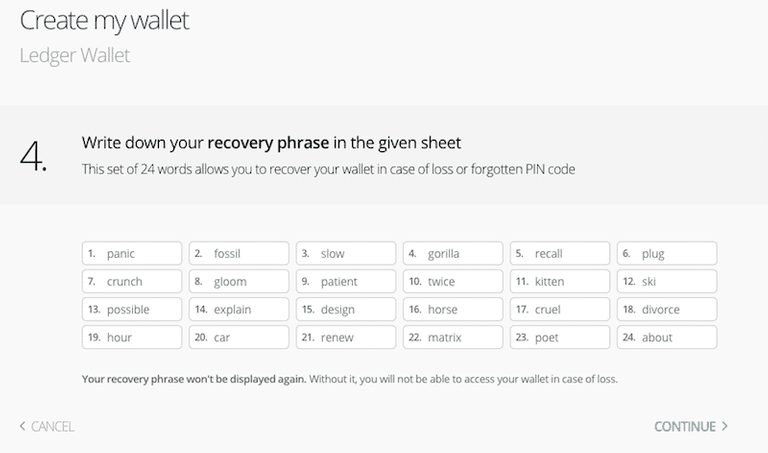

• The Wallet Seed/Recovery Phrase - Also known as a mnemonic passphrase, this is a backup phrase that is used to recover your Bitcoin wallet if it is ever lost. You should always keep a backup of your wallet seed or recovery phrase on a piece of paper or you can even use a physical backup tool.

• The Public Address - This is where you send Bitcoins to, it is a string of alpha-numeric characters that represents a possible destination for a bitcoin transfer.

• The Private Key - In a cryptocurrency wallet, the private key is a secret number that lets a user spend Bitcoins. Every Bitcoin wallet contains one or more private keys, which are saved in the wallet file. All Bitcoin addresses generated from a wallet are related to its private key, it is recommended to keep a backup of your private key if the wallet does not provide you with a wallet seed or recovery phrase, along with your recovery phrase you should not reveal your private key to anyone.

Software Wallets

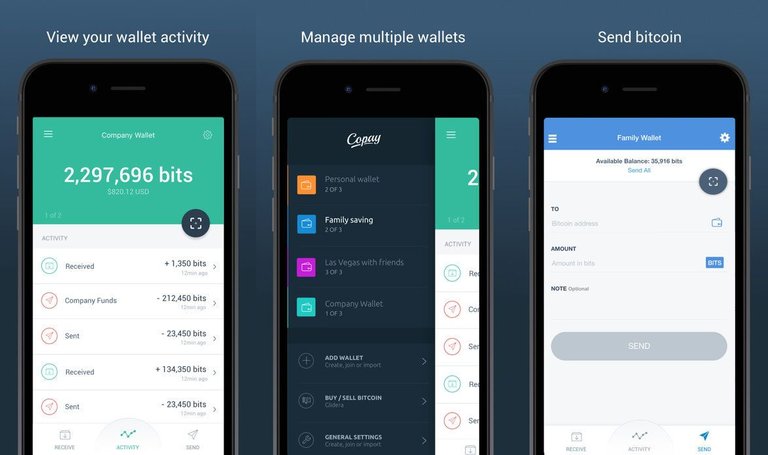

You can store your Bitcoins in a software wallet which is simply a software program or application that lets you store, receive and send Bitcoins.

If you are looking for fast and simple wallet I recommend getting Copay or GreenAddress, they allow you to import your wallet into another device, for example if you create your wallet using a PC you can download the smartphone app and import your wallet into the smartphone application.

You can get the Copay Bitcoin wallet from here: Copay Bitcoin Wallet

You can get the GreenAddresss Bitcoin wallet from here: GreenAddress Bitcoin Wallet

Leaving your Bitcoins on exchanges is another option but it is always better to keep them in your own personal wallet. The most secure option for storing your Bitcoins (or any other cryptocurrency) is a hardware wallet which I will describe in detail after the "Cold Storage" section.

Cold Storage

Cold storage is simply storing your Bitcoins offline, it can be done by using a paper wallet or a hardware wallet.

A paper wallet is simply a document that contains your wallet seed, public address and private address, paper wallets are best used for long term storage and each wallet should only be spent once, you should also keep a backup of your paper wallet stored in a separate place or scanned and saved on an external hard drive or offline PC.

Potential Drawbacks of a Paper Wallet

One drawback about paper wallets is that they need to be imported into a software or hardware wallet if you want to spend or transfer funds out of it.

Another drawback with paper wallets is durability, since they are made from paper, they are very vulnerable to damage from water, fire and wear and tear.

Finally, a paper wallet can be deposited into an unlimited amount of times but it is recommended to create a new paper wallet after spending or transferring out the balance due to security reasons.

When creating paper wallets it is best to stick to official paper wallet generators for the specific coin, for Bitcoin I recommend bitaddress.org due to its mouse movement based random number generator.

Hardware Wallets

A hardware wallet (or a physical Bitcoin wallet) is a special type of Bitcoin wallet which stores the user's private keys in an offline environment using a secure and encrypted hardware device.

Hardware wallets have major advantages over software and paper wallets:

• More than one cryptocurrency can be stored on a hardware wallet so if you decide to invest into additional cryptocurrencies you won't need many different wallets to store them in.

• Hardware wallets can be used to send cryptocurrency an unlimited amount of times, paper wallets can only be sent from once for security reasons.

• Hardware wallets are immune to computer viruses or malware that attempt to discover a users private keys, this is due to their built-in encryption procedures that make the private keys unrecognisable to any unauthorised parties.

• Hardware wallets can be used to to receive and send cryptocurrencies at any time, as opposed to a paper wallet which must be imported to a hot (software) wallet if you want to transfer your Bitcoins out of it.

My recommendations:

Ledger Nano S

The Ledger Nano S is currently the most popular hardware wallet, along with the Ledger Blue it supports the largest amount of cryptocurrencies and is routinely adding new coins.

Check it out here: Ledger Nano S

Ledger Blue

The Ledger Blue is Ledgers latest physical wallet that also supports hundreds of cryptocurrencies and it includes a large, color touchscreen.

Your wallets private keys are stored securely offline using BIP 16, BIP 32, BIP 39 and BIP 44 encryption.

Check it out here: Ledger Blue

Ledger Cryptosteel

The Ledger Cryptosteel is not a wallet, instead it is a backup tool where you can store your wallets 24 word recovery passphrase/wallet seed using engraved stainless steel letter plates instead of writing it down on paper

If you are planning on storing your Bitcoins (or any cryptocurrency) for a long time then this is a must in my opinion since it is resistant to fire, water, wear and tear and shock damage.

Great article @cj900! Based on my experience and the advice of expert Steemians, your article shouldn't be long as long as you have a user base that will be reading your articles in the daily basis. My third article was long and too comprehensive for my readers. As a result, I broke down the entire article into three articles. You'll save time at the end.

Another cool topic that you could implement in your article, is how to save money with transactions when buying cryptos. Always, check the transaction cost on this page before buying. You can avoid large mining fees like this.

Here's the website: https://bitinfocharts.com/comparison/bitcoin-transactionfees.html

Thanks for the feedback! @cryptofortuna. Having shorter guides does sound like a good idea, especially for the regular readers.

Also thank you for mentioning the transaction fee monitoring tool, I have also noticed that transaction fees change depending on the time (possibly due to congestion), I will add the tool to one of my future articles.

It's my pleasure! It's very useful and it's a quick way to monitor the transaction fees for all the cryptos. Upvote my comment if you found it useful and I'll always be doing the same. Until next time!