Dear Steemit Friends,

First of all, Happy Valentines Day! Bitcoin and Cryptocurrencies seem to be getting some love from ole Cupid today. It's a good day (week even) for all of us who are consistently HODLing cryptocurrencies for their impending rise back into the stratosphere and beyond.

I saw an article on CNBC today titled Barely anyone is paying the taxes they owe on their bitcoin gains and it got me thinking. How many people actually report and pay taxes on their cryptocurrency earnings? In the past 5 years that I have been involved in the digital currency space, there have been many discussions, regulations, and laws passed on digital currencies - all of which have held very little water and any real enforcement.

With the increased popularity and visibility of Cryptocurrencies like Bitcoin this past year, I'm sure the IRS has their lenses focused even more on digital currencies. In this day-and-age, some employees are paid with Bitcoin and other currencies, more than a few retailers and online establishments accept digital currencies as payment, and a number of us hold the e-currencies as assets and investments.

In 2017 the IRS clarified the tax treatment f Bitcoin and other digital currencies. In its Virtual Currency Guidance Notice 2014-21, tax is handled depending on how digital currencies are held and used:

Bitcoin used to pay for goods and services taxed as income

If you are an employer paying with Bitcoin, you must report employee earnings to the IRS on W-2 forms.

- You must convert the Bitcoin value to U.S. dollars as of the date each payment is made and keep careful records.

- Wages paid in virtual currency are subject to withholding to the same extent as dollar wages.

Employees must report their total W-2 wages in dollars, even if earned as Bitcoin. Self-employed individuals with Bitcoin gains or losses from sales transactions also must convert the virtual currency to dollars as of the day received, and report the figures on their tax returns.

Bitcoins held as capital assets are taxed as property

If you hold Bitcoins as a capital asset, you must treat them as property for tax purposes. General tax principles applicable to property transactions apply.

If the Bitcoins are held as a capital asset, like stocks or bonds, any gain or loss from the sale or exchange of the asset is taxed as a capital gain or loss. Otherwise, the investor realizes ordinary gain or loss on an exchange.

Bitcoin miners must report receipt of the virtual currency as income

Some people "mine" Bitcoins by using computer resources to validate Bitcoin transactions and maintain the public Bitcoin transaction ledger.

According to the IRS, when a taxpayer successfully “mines” Bitcoins and has earnings from that activity whether in the form of Bitcoins or any other form, he or she must include it in his gross income after determining the fair market dollar value of the virtual currency as of the day he received it. If a bitcoin miner is self-employed, his or her gross earnings minus allowable tax deductions are also subject to the self-employment tax. [Source]

The Bulletin is fairly black-and-white, however, leaves a lot to debate and does not seem as if the government is fully policing the tax policies it has in place given the complex nature and understanding of regulating and tracking digital currency transactions.

Currently, fewer than 100 of almost 250,000 people who have filed their income tax have reported any cryptocurrency gains and losses. This is a small number vs the overall number of tax-payers in the United States. Even less, if any are reported globally. The IRS has been trying to crack down on exchanges like Coinbase by requesting the exchanges user records as a result of a recent court case that was filed. You can assume that the IRS will continue its pursuit with other exchanges as this evolves. This, however, only covers a small percentage of people who are involved with digital currencies since there are millions more transactions and dealings that don't go through public channels that the IRS cannot account for.

Cryptocurrencies are considered to be a property when it comes to taxes. As such, everyone should be reporting any capital gains to the IRS. Currently there are no penalties, however as we move forward in this space, the government will definitely want to get their piece of the pie. I don't know about you, but like most people, I can hardly track my overall digital currency earnings and expenditures and often times just hold my assets without ever really looking at what price I got them at, the value when I mined them, and or how much I have earned, saved, or sold at any given time. It is too tedious and complex and since governments have been so "wishy-washy" about supporting cryptocurrencies, I don't feel any urgency to pay for them. Aside from the fact that I still hold all of my digital assets, the prices can fluctuate wildly from day-to-day making it difficult to determine what to actually list in my earnings and losses.

In countries like the Philippines, where I lived for several years, salaries often times aren't even enough to support an individual's daily expenses. In regions where so many people struggle to get by, digital currencies and platforms like Steemit have helped change lives. For governments like this, who already have high tax rates and show no kind of support for their people and this new technology, I don't see why they should get a cut. Why pay someone something that they don't even support?

No one knows for sure how many people around the world hold a cryptocurrency portfolio as of right now and it's not certain if anyone will ever be able to find out for sure - it is very unlikely. Although there are many more research firms and digital currency tracking tools coming out daily, I doubt that the number of individuals reporting their gains and losses will increase dramatically. Even if citizens start reporting them, it will never be 100% accurate or complete.

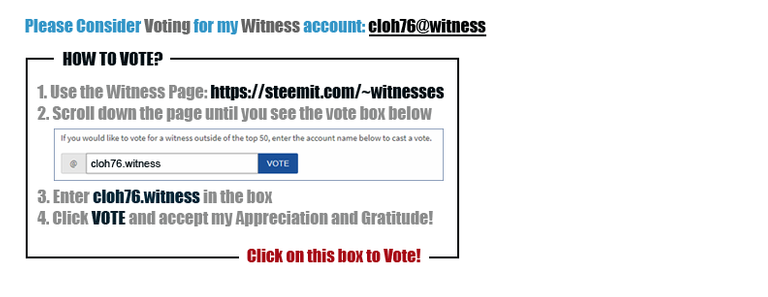

It remains to be determined if any changes or updates will be made on the IRS front, but several people are waiting until the April timeframe to decide how they will proceed. What are your thoughts? Do you report or plan to report your cryptocurrency gains and losses? Let me know in the comments section below. If you do have any questions, inputs, or feedback, please also share those with me. I would also appreciate support in the form of Upvoting and Re-steeming my post if you found it informative.

Please consider Following me if you find my posts interesting!

Image Sources: [1] [2] [3] [4] [5]

Many people don't pay taxes on their cryptocurrency gains.

Yep. According to recent studies, less than 0.04% of the population who own cryptocurrencies

Don't F with the IRS, seriously. They get what they want eventually.

Unfortunately, that is true - even if they don't deserve it!

I don't think you covered the ICO angle, but the rest was helpful. Do you happen to know the tax rate in US (2017 and 2018) for long term and short term capital gains?

Depending on your bracket for 2017, that could range from a tax rate of 10% to 39.6%

If you sold or used any Bitcoin after owning it for more than a year, they are considered long-term gains with a taxable range from 0% to 20% depending on your household income.

I found this on Investopedia - "In the US, long-term capital gains tax rates are 0% for people in 10%-15% ordinary income tax rate bracket, 15% for people in the 25%-35% tax bracket, and 20% for those in the 39.6% tax bracket."

I was under the assumption that the law just passed and changed crypto to property starting in 2018. exchanges did not track or report any trades for 2017. Thats why exchanges now make you use SSN and verification for 2018

That is also what I heard, but I think you are still responsible for the capital gains you earn.

yep...that is what I love about the IRS, everything is your responsibility and you have to prove that you did not do something 6 yrs ago. LOL

Yep you do all the work and the government is there in the hand with their hands out to collect their share.

Coinbase is issuing tax statements for tax year 2017, a.k.a. 1099-Ks. The assumption you can make is that Coinbase has been tracking the trades since the day they started, and have that data.

I don't know what to make of the fact that neither Coinbase, nor GDAX, required my Social Security Number. I volunteered my Date of Birth to Coinbase for some extra level of security, and I did have to send a photocopy of my Driver's License to GDAX. The question I have is can Coinbase issue a 1099-K without the Social Security Number?

Crypto was always property for IRS income tax purposes. The IRS clarified this in 2014, not 2017 as the author states. If you filed a tax return for tax year 2012 with cryptocurrency trades, you would still treat the crypto as property.

The new tax law for 2018 made it crystal clear that one cannot do a 1031 Exchange of cryptocurrencies starting with 2018. Whether one can do a 1031 prior to 2018 is hotly debated. The BIG CHANGE that people refer to is the clarification that no way can you do a 1031 starting with 2018.

Cool. Thanks for the clarification. I did not provide my SSN either when I opened my Coinbase account, however, I also rarely use coinbase for any transactions anyways. Most of my trades, withdrawals, or any other transactions are always peer-to-peer or through smaller exchanges, some even international.

Thank you so much for giving this useful information in the form of giving link. I was looking for information about cryptocurrency.You don't believe that how much you are useful for us because you are giving us cryptocurrency news every day. I love the way you are sharing your knowledge with us.

That's why I'm coming on your profile again and again. Keep sharing such news with us. :) Blessings to you

Thanks for the continued support!

Undoubtedly, Cryptos are decentralized but seems some governments wants to centralize a component of it by adding taxes to vendors of cryptos

Yep. Governments always want their cut when it comes to anything finance related. They always want to maintain some kind of control over their people.

Paying taxes is also our responsibilty:) thanks for sharing this article!!!

It is, but when it comes to cryptocurrencies, it's a mess.

You got a 1.65% upvote from @postpromoter courtesy of @cloh76!

Want to promote your posts too? Check out the Steem Bot Tracker websitevote for @yabapmatt for witness! for more info. If you would like to support the development of @postpromoter and the bot tracker please

thank you D:/@cloh76

please come on my blog