Bitshares is a decentralized exchange built by Dan Larimer. Dan left the project a while ago and in the recent bull market bitshares has done nicely. This is not an indicator of success though because all cryptocurrencies, regardless of the underlying fundamentals, have done well. Bitshares has a fairly unique set of assests on the exchange such as bitgold, bitsilver and bitusd. These tokens are supposed to be pegged by actual assets in the real world. But behold:

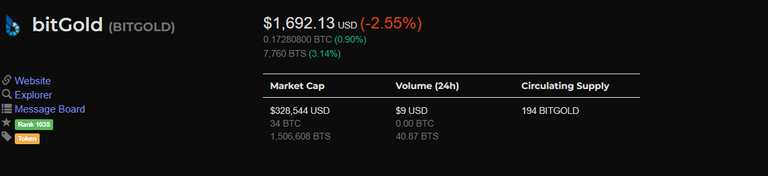

Bitgold is trading at (as of post) $1692. Gold is trading at around $1300. And look at the volume! $9 in 24 hours. BitBtc is trading at $12016 Bitcoin is $9875 on GDAX. Bitbtc has a volume of $450 USD.

There are equal problems with bitusd, biteur and bitSilver. The price is completely over inflated and no one is using these pegged assets. Whilst bitshares has tether the last time I tried to exchange USDT the gateway (openledger) was offline.

Is this something to be worried about or is it a misunderstanding my end? Any views would be appreciated. Thanks for reading.

BitUSD has quite good liquidity and works really well. And most of the time tokens are actually cheaper on bitshares compared to the coinmarketcap, but only if you trade against bitUSD.

The other pegged assets have never taken off like you write. Except perhaps bitCNY.

I'm a big fan of bitshares, but having a liquid bitEUR market would improve it like crazy for me.

BitGOLD and bitSILVER will probably never take off now that the quint has been announced, if you saw that?

That could really shake up the bitshares system.

thanks for the comment. The problem with bitusd is its around 7% ($1.07) over its actual value and fluctuates to as high as 15% this means you pay a premium to get into it.

Depends how you get into it. Most people buy bts, use it for collateral to borrow bitUSD and then you're suddenly on the discount side of the equation.

But of course it's impossible to have a perfect pegged token unless there's a direct fiat gateway to it. But it seems like that's in the works from several places.

what if you borrow bitusd against bitshares and bitshares goes down and you're magin called? That's a big risk no? and this only works if the price goes up, which its not doing.

Sure you need a good ratio and to check up on it sometimes. I kept a 10:1 ratio which kept safe even during these crazy dips.

And if you believe the price is going further down and staying there.

Then yes it's probably pretty bad.

But if you use the bitUSD to invest with profit and then keep paying them back every time, then the risk is not very big.

thanks for clearing that up :)

Users create bitAssets borrowing them. Bitshares is the platform to do that possible. bitGold is a dead market, you can not create more of them at the moment because it "black swanded". bitGold doesn't follow its peg. bitUSD works quite well, it doesn't follow the peg perfectly but is the easiest way I know to short 1x BTS without relying in shady centralized entities. When the market is overinflated is a good refuge. Borrowing bitUSD is useful if you know what you are doing. Leverage is always risky.

very insightful post... something does seem alil bogus....

I Upvoted and Followed You. Do the same For me and we could Help each Other Earn !!!

Awesome post