As the first public asset manager to gain exposure to bitcoin at $250 through the Bitcoin Investment Trust (GBTC), ARK Invest faced a number of questions and much ridicule in September 2015.

Given our research-based conviction, and the knee-jerk reaction of skeptics, we knew we were on to something big.

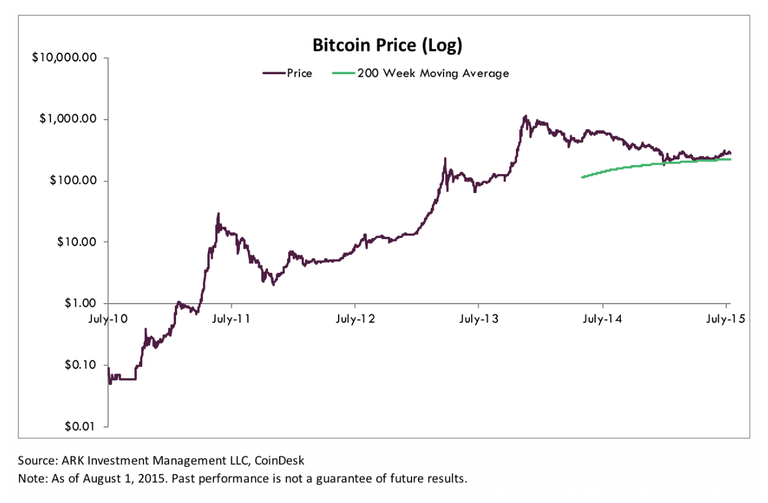

Ending a near-cataclysmic slide from roughly $1,250 in November 2013 to $175 in January 2015, bitcoin’s price stabilized around its 200-week moving average for the next nine months, as shown by the green line below.

At that time, the European sovereign debt crisis was reverberating as Greece threatened to leave the European Union, providing bitcoin with a mid-summer bump.

Bitcoin's price action during those nine months suggested that its ecosystem was much more robust than professionals in traditional asset management were willing to acknowledge.

If nothing else, technicians were paying attention, so moving averages, resistance and support, and gaps were relevant.

Despite the recent plunge in bitcoin’s price from nearly $20,000 in December 2017 to less than $10,000 as of February 6, 2018, we remain convinced that bitcoin is the first of its kind in a new asset class, cryptoassets, and one that is here to stay.

During the past three years, cryptoassets have scaled past $500 billion in network value, with bitcoin now accounting for roughly a third of an ecosystem comprised of more than 1,500 cryptocurrencies, cryptocommodities, and cryptotokens.

Born out of the convergence of technology, financial services, economics, and other social sciences, this new asset class presents a daunting challenge to professionals in each of those fields, not to mention the investing public.

Battle-tested

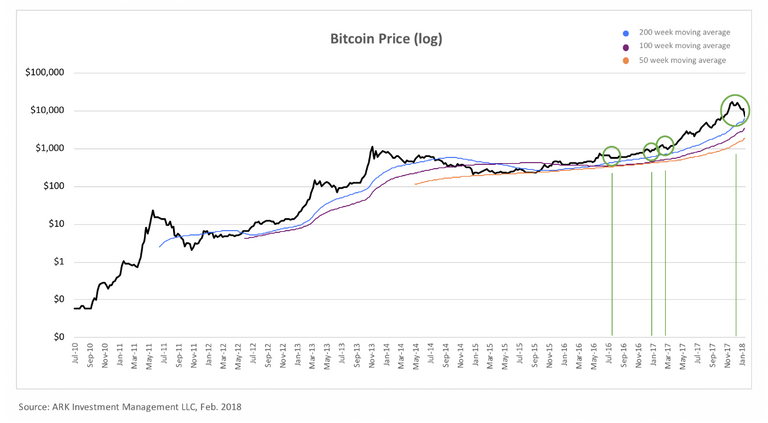

Bitcoin has overcome a number of battle tests during the last few years, as shown below by the fluctuations in its price. Following the graph is a list of the most important among those tests, representing ARK's "aha moments."

The Bitfinex hack in August 2016 caused a flash crash, pushing bitcoin's price below $500 on the day of the hack, at which point it rebounded strongly. The rapid turnaround seemed to illustrate that early investors understood the difference between a software flaw in an application running on top of bitcoin and one in the protocol itself. In other words, the sophistication of the market was increasing, adding to our confidence in bitcoin.

The People Bank of China's crackdown on miners in January 2017 caused more turmoil, pushing bitcoin's price back down to $789. In late 2016, China accounted for 95 percent – at times up to 99 percent – of daily volumes, causing the mainstream media to clamor over bitcoin's dependence on China. After the PBoC banned it (for the second time), its price did flinch but rebounded quickly. This time, the rapid recovery in its price illustrated that bitcoin was becoming "anti-fragile" to the regulatory actions of any one nation state, as countries like Japan and Korea quickly picked up the slack.

The SEC denied the Winklevoss Bitcoin Trust proposal on Friday, March 10, 2017, causing a weekend tailspin in the price to $935… before a rebound on Monday that set it up for a 20-fold move to $20,000 during the next nine months. While many commentators pointed to the SEC’s denial as a negative turning point, not only did bitcoin’s price reverse but the entire cryptoasset ecosystem caught fire and roared in a bull market even stronger than that for bitcoin. Ether, for example, soared from $15 to $400. This price burst illustrated that bitcoin and other cryptoassets are not dependent on traditional capital markets, and therefore could disintermediate and disrupt them.

Despite myriad concerns around scaling, forks, merchant adoption, and fees during the second half of 2017, the price of bitcoin increased nearly 20-fold to $19,500 in December 2018. That price action suggested that too much capital was chasing too few opportunities at this nascent stage of bitcoin's evolution.

Momentum reversed convincingly in January 2018 under the weight of concerns around Bitfinex and Tether, the largest dollar value hack of a cryptoasset exchange, and a slew of regulatory actions focused on cryptoassets broadly, among other pressures.

Now What?

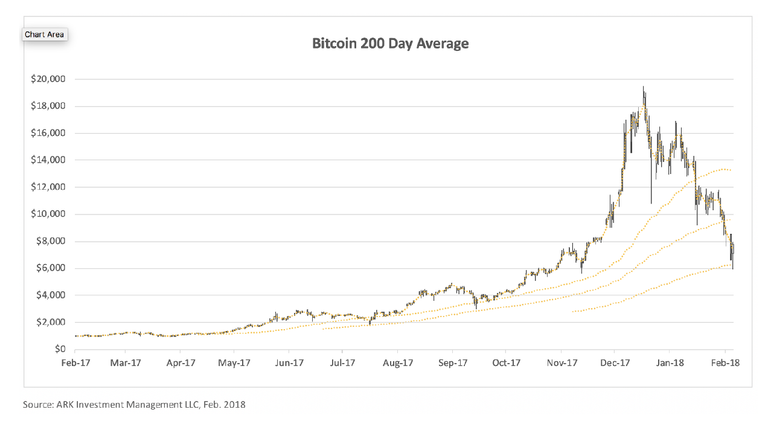

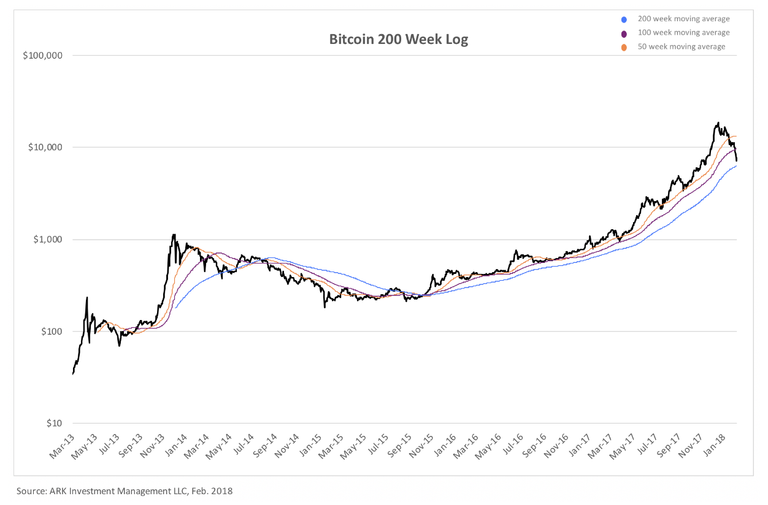

If technicians and global macro traders are dominating trading activity now as they did in 2015, then the price of bitcoin could test a number of different technical levels ranging from $8,350 to $1,650 … and still be in a bull market.

I am not a technician but have learned their ways as they have influenced the behavior of stocks in our portfolios during major turning points in the market.

Among the levels of bitcoin's technical support, depicted on the graphs below and rounded to the nearest hundred, are the following:

- $6,400: the 200-day moving average, a critical area of support according to traders.

- $4,600: the last significant peak in September 2017.

- $1,700: the 200-week moving average, the area in which bitcoin had bottomed when we started our journey in 2015, and a level last seen in May.

If bitcoin is leading the way to a new asset class, then we believe these price points are nothing more than psychological supports and will pale in comparison to its ultimate destination. We believe the price will bottom when buyers return and overcome or overwhelm sellers.

Adding to our confidence in the outlook for bitcoin are the numbers of developers and lines of code they are contributing to the community, not to mention the much anticipated and rapidly expanding Lightning Network.

As long as they are on board for the ride, so are we.