A million dollar question everyone is asking is the price at which bitcoin is finally going to crash and die out. While there are too many underlying factors to accurately predict a crash, the answer is critical to making extraordinary returns out of the current bitcoin frenzy.

The confusion around bitcoin is compounded when we hear conflicting views on bitcoin price from the market experts. JP Morgan CEO Jamie Dimon’s made a now infamous statement that bitcoin is a fraud and will eventually crash while John McAfee made a presumptuously bold statement that he will “eat his own dick on national television” if bitcoin does not reach $ 1 million by 2020. Cryptocurrency is at best a vague economic concept right now and extreme reactions are bound to come. What we can perhaps do is understand the fundamentals behind this crazy bitcoin price speculation and better manage the risks.

Role of Retail Investors

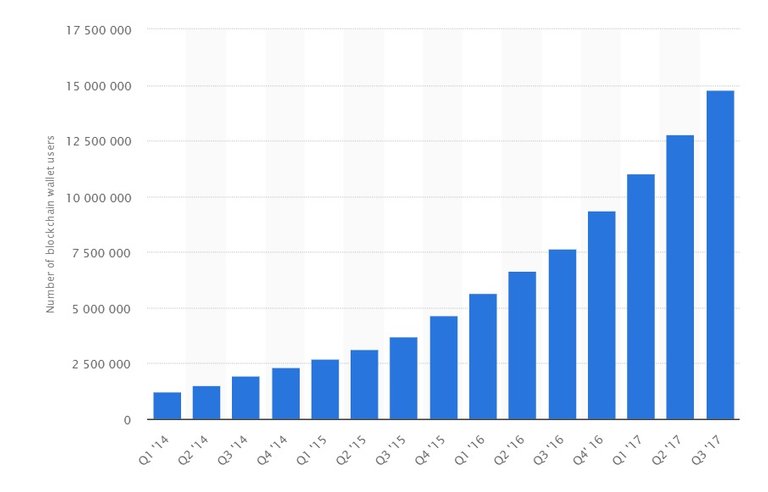

A very widely acknowledged fact is that bitcoin buying is being driven by the Fear Of Missing Out (FOMO). There were roughly 15 million bitcoin wallets by end of September 2017. Even if we make a drastic growth assumption, the number of wallets would not have reached more than 20 million. With every user opening multiple wallets, we can safely assume that the no. of unique persons who have currently bought bitcoin would not be more than 5 million. 5 million out of a world population of 7.6 billion is 0.066%. Thus the current level of penetration of bitcoin is abysmally low. Such calculations clearly show that a lot of steam is probably left in the price growth of bitcoin. Even if bitcoin is purely a ponzi scheme with no store of value, the risk of this speculative bubble bursting would start becoming very high once we achieve a penetration level of around 2-5%. Till then we might see a continuous rally.

Bitcoin and Gold

A lot of commentary is going around with bitcoin believers stating that bitcoin is a substitute of gold. At a market price of $17000, bitcoin has a market cap of $270 billion. Compare this to the market cap of gold at more than $7 trillion. It is incredibly difficult to guess the marketcap at which bitcoin can crash but a marketcap of $1 trillion can be a substantial milestone. At that level, governments and regulators all over the world would start bitcoin a lot more seriously. The key risk being whether the intense scrutiny will trigger adoption of bitcoin or rejection. Bitcoin’s adoption as an official currency by economically powerful nations would stimulate a quick rise to a multi-trillion dollar marketcap and bitcoin may never crash. While banning or lack of widespread official endorsement may trigger the ultimate crash. A sane advice would be to closely monitor the marketcap trajectory of bitcoin.

Role of Governments and geo-politics

We would be naïve to think that the crash of bitcoin can be predicted based on the above two fundamentals. A sphere that merits a lot more seriousness is the geo-politics behind the game. US dollar has for far and long dominated the currency market as the gold standard of currencies. US has benefited a lot by the easy financing its fiscal deficit due to popularity of US dollar. Nations like China and Russia have inherently hated the hegemony of US in the international finance market. There are plenty of media reports which suggest that China and Russia have been buying a lot of gold in order to fight the dollar dominance. Bitcoin and other cryptocurrencies thus present a new opportunity to change the status quo and end the dollar dominance. With Russia declaring its intent to launch its own cryptocurrency, this geo-political fight for domination in the crytocurrency market is going to be far more interesting than understood.

Japan is the first major economic power to give legitimacy to bitcoin as an officially recognized “method of payment”. Japan hopes that this early recognition will spur fintech innovation and growth of its financial markets.

Small countries traditionally troubled by runaway inflation or geopolitical uncertainties might adopt bitcoin early. We have already seen a huge demand for bitcoin in countries like Zimbabwe and North Korea. But large countries would be far more reluctant. For example, China has for decades not artificially kept renminbi devalued in order to support export competitiveness. If China were to formally adopt a universal crytocurrency like bitcoin, it would no longer be able to manipulate its currency market.

It is said that 1000 individuals roughly own 40% of bitcoin. If bitcoin were to really become a store of value like gold and the dominant currency of the world, it is clear that these few individuals can easily manipulate the market. No powerful government can allow its official currency to be manipulated by a few and I see this as a big problem hindering bitcoin’s formal adoption. However, what we do not know is whether these 1000 individuals also comprise of US or China’s central institutions? Any country which knows that its central institutions or its citizens control substantial bitcoin holdings would feel comfortable adopting bitcoin as a formal currency.

Another scenario that looks likely in the short term is some governments may officially allow dealing in bitcoin but also keep their own domestic currency as official. In such a case bitcoin will become a replacement of US Dollar or Gold.

Another factor to be kept in mind is that price of bitcoin rises quickly whenever the level of hostility between the US and North Korea increases. It is understood that North Korea is actively supporting bitcoin mining and even hacking bitcoin exchanges as a way to reduce the impact of recent stringent US sanctions.

Role of Banks

It is no secret that US and European banks have monopolised the currency market, especially international transfers and remittances. Banks like JP Morgan move trillions of dollars everyday and even a small transaction cut manifests into a generous contribution to their bottomline. A successful cryptocurrency like bitcoin is like a death knell for them. Banks had dismissed bitcoin as a speculative mania not warranting their attention but are now genuinely troubled by what to make of it. With the launch of futures on some of the largest US exchanges and talks of ETF’s as well, they can no longer afford to ignore it. The tipping point will come when large institutions like pension funds start investing in bitcoin. The recent launch of futures will certainly help diversify the base of investors who have exposure to bitcoin. With the new pragmatic realities, banks have started adopting crytocurrencies and blockchain, albeit reluctantly. What is of immense interest is whether they would eventually support transactions in bitcoin or some other currency like ether, which is designed for smart contracting.

So when will it crash?

Bubbles crash as a reaction to some adverse news or when they become so large that their growth can no longer be sustained. News like US Fed banning bitcoin can quickly trigger a crash.

Bitcoin may eventually rise to a level where the no. of investors who want to buy is less than the no. of people willing to sell. That level may take some time going by the current adoption levels. FOMO will continue to feed bitcoin frenzy till the time the Fear Of Losing All (FOLA) takes over. A sharp fall can trigger a FOLA as everyone would want to exit before the price reaches to zero.

But can bitcoin not crash ever? The answer lies somewhere in its mainstream adoption and the transformational value it generates by reducing the transaction costs.

Please leave your comments as would love to hear out any voices and views.

Disclaimer: Bitcoin articles are intended for informational purposes only and should not to be considered as trading advice.

Hello and welcome to the community. I followed you and would appreciate a follow back. I'm looking forward to see more posts! Have a great day and have fun. Welcome!

get back to back in touch for upvote....

follow me for more dollor upvote because i m a bloggerPlease upvote, comment, resteem and follow @niteshbaniya

Thanks Nitesh!!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://coindexo.com/price-will-bitcoin-crash/

Congratulations @coindexo! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Congratulations @coindexo! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!