This is the 2nd article in the series of — How to Find Your Next Cryptocurrency Investment?

As the word portrays, this is electronic cash, currency or money which can be stored on a smart card or in a mobile wallet. Digital cash is a system where one can make payment electronically involving the bank/financial institution directly for the transaction to take place. It is clear that this is a century where technology has become the pillar of advancement in all activities conducted. Many people have drowned into this technology which is much preferred nowadays since it is much quicker and safe. One can also define digital cash as a ,system used to purchase cash credits and then storing them into the computer where one can use it to do e-purchasing through the internet.

How Digital Cash Works

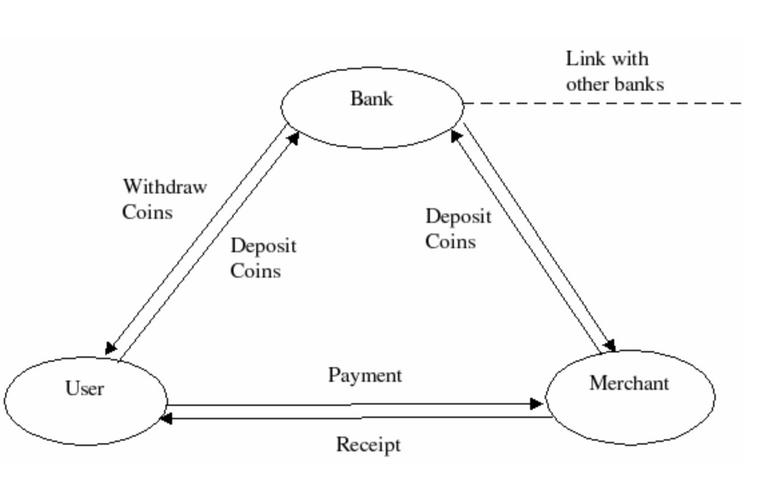

Just like any other currency, this is a legal currency which is backed by banks and the government. Not many people have an idea of how it works. This has been the trend of making payment after a purchase especially if it is a transaction that involves different countries, for example, online shopping or online payment for a service.

A simple illustration will help you understand how digital cash can be used. For example, “A” is the user who obtains this digital cash from his bank and wants to make a payment using the digital cash to complete a transaction to user “B” who is a merchant. “B” will receive the electronic cash and makes sure that it has been verified by the financial institution.

What Benefits Does Digital Cash Have?

#1 The system is secure

This is a secure system that uses serial numbers to avoid any duplications. There is always a central system which verifies each and every transaction happening through it.

#2 Simple to use

This digital cash is simple to use when it comes to both receiving and spending perspective. Due to its simplicity, users have increased in number and everyone is running into this technology. You do not have to hold a degree in cryptography for you to be a user. Simplicity is the key to creating acceptability for the public.

#3 Offers two-ways services

With digital cash, it is possible for the peer to peer transaction to happen without either of the party requiring a registration merchant status. It has made it possible for a transaction between parties to be easy and fast.

#4 Has facilitated payments

A person from a different country can be able to purchase goods or service and make the payment within a few minutes using digital cash. Are you in the restaurant and as a group have planned to share to cost? This is an easy task, one can make the whole payment using the digital cash and the rest send their share to this one person who has paid the whole bill.

Cryptocurrencies As Digital Cash

As the white paper of very first cryptocurrency Bitcoin says- It is a purely peer-to-peer version of electronic cash that would allow online payments to be sent directly from one party to another without going through a financial institution.Even though the existing digital transactions are secure, but it relies on financial institutions to serve as a trusted third party for processing. The system works well for most transactions but it still depends on the trust based model. Completely non-reversible transactions are not really possible with this model.

So here comes the cryptocurrencies where the payment is based on cryptographic proof instead of trust, allowing any two parties to transact directly with each other without the need for a trusted third party. Transactions that are computationally non-reversible in this case.

So digital cash is a general, inclusive term for all types of immaterial monies, while cryptocurrencies are a particular sort of digital cash which has special features for decentralization and trustlessness.

Following are some of the examples that can be considered as digital cash in crypto-world. These cryptocurrencies can easily replace existing digital cash:

*Bitcoin

*Ethereum

*Ripple

*Litecoin

These are just a few cryptos which are mostly popular, there are others but as for now the above are the one with a larger share in the market. Bitcoin and Ethereum are the strongest cryptocurrencies that face up and downs but still emerge to be the best in the market.

Bitcoin

Bitcoin (BTC) is the first cryptocurrency ever created and got a widespread adoption over the years. Bitcoin is generally traded against FIAT, as the years progressed Bitcoin is also used as a transaction of value. The total supply of Bitcoins is set to 21 million units that can be cryptographically mined over a period of time.

Ethereum

Ethereum (ETH) is the second most popular crypto-asset after Bitcoin. While Bitcoin is created to be a store of value, Ethereum was created to be the ‘World Computer’. Ethereum provides a platform run by something called ‘smart contracts’ which allows others to build protocols and applications on the Ethereum platform. These protocols and apps can provide different functionalities based on the services they provide, opening to a wide range of different sets of crypto assets.

Ripple

Ripple (XRP) is the most controversial of all the crypto-assets. Let’s break down ripple into two categories: Ripple Protocol and XRP (Ripple Crypto currency). Ripple raised in popularity when its protocol challenged the way the entire banking system works. The current system, SWIFT, which the banks use is time-consuming and a very inefficient way of information transfer between two banks. Ripple’s protocol can be used to provide lightning fast transactions between different banks in two different continents. One of the reasons why Ripple is most controversial is because of the centralization of its network. While most of the crypto assets are decentralized, over 70% of XRP’s reserves are held by its founders and they dictate how to develop and use Ripple. Also, XRP is not strictly required to be used in Ripple’s protocol creating more negativity around its value over time.

Litecoin

Litecoin is another peer-to-peer cryptocurrency that is similar to Bitcoin. As more and more people started embracing Bitcoin, there came a time where people thought Bitcoin won’t be scalable in long term due to its mean block time of 10 minutes. As more and more transactions happen in BTC, the more time it takes to confirm the transaction resulting in higher transaction fees and a blockade of unverified transactions in memepool. Hence Litecoin was born hard-forking the Bitcoin network making some slighter modifications to its protocol in order to accommodate for less mean mining time resulting in more transactions without clogging the network. The mean block time for Lite coin is 2.5 minutes and the total supply is capped at 81 million.

Apart from these top cryptos there a few more cryptocurrencies which can be used as a digital cash for payment: Dash, Monero, DigiByte, ReddCoin, Bitcoin Cash, Bitcoin Gold, Vertcoin etc.

Major Differences Between Digital Cash And Cryptocurrencies

1.The verification of Bitcoin or other cryptocurrencies transaction uses a private key to make payment where each and every person who possesses ownership has a private key; this is how the Bitcoin is decrypted. On the other side, digital cash uses a public key to decrypt the note provided by the bank.

2.Cryptocurrencies use blockchain where verified transactions are stored; in this case, the financial institutions are not involved in verifying the transaction. Current digital cash is verified through the note that contains a unique serial number that the financial institution provides the user with each note used in any transaction contains a new serial number that helps the bank in the verification process.

Bottomline

As discussed above it shows that digital cash has a big difference when it comes to the techniques used in its operation compared to cryptocurrencies. Theft or fraud in cryptocurrencies is very rare since the process is secure and very safe for the transaction. But the cryptocurrencies have a basic problem for scalability. Bitcoin blockchain can process only almost 5 to 7 transactions per second while current digital payment system like VISA cards can process up to 2000 transactions in a second. Many developments are going on to solve the scalability issues for the Cryptocurrencies. If this happens then cryptocurrencies have a great future ahead as a payment medium.

In the next article of this series, we will discuss about Privacy Coins.

CoinSwitch.co is the world’s largest cryptocurrency exchange aggregator. It provides exchange service of 300+ coins and over 45,000+ pairs from leading exchanges like KuCoin, Bittrex, Cryptopia, ShapeShift, Changelly, and Changer. It provides an easy way for users to trade coins across multiple exchanges based on price and reliability.

Please do write us to [email protected] if you have any queries.

Join our telegram group to stay updated on new coin additions and other updates

Happy Switching :)

*This article was originally published on CoinSwitch Blog