From Coindesk

With all the panic selling following the Chinese government's renewed crackdown on bitcoin exchanges, it's important to remember that the country is no longer the trading hub it once was. All else equal, that means the market may take less time to recover from the latest sell-off than from the one that took place in 2013 (you know, when the People's Bank of China suddenly declared that bitcoin was not a currency and ordered payment processors to stop accepting it).Read more: https://www.coindesk.com/china-shmyna-bitcoin-trading-way-distributed-now-anyway/Just a reminder of how bad the fallout from that that really was, during the three years it took bitcoin to recover from those bombshells, it lost nearly half its value, dropping from an all-time high of $1,150 to under $500.

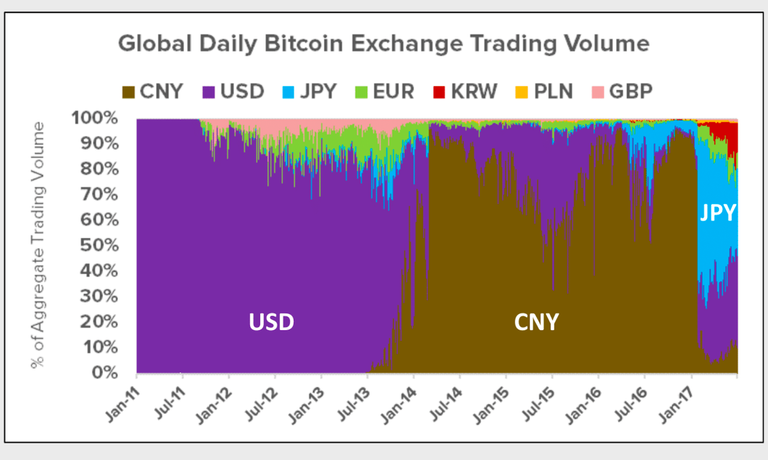

But that was at a time when Chinese bitcoin trading accounted for as much as 90% of global volume (as shown in the chart below from CoinDesk's second-quarter State of Blockchain report.)

This state of affairs persisted until as recently as January of this year:

After hearing the news of China cracking down on exchanges I really thought we would see a much larger crash then we did. I'm glad to see I was wrong.

Leave your thoughts in the comments.

Follow @contentjunkie to stay up to date on more great posts like this one.

It's funny, I was talking about this the other day with someone. This crash was actually a good thing. It allowed people in other countries that were later adopters to buy in, distributing the BTC holdings more equally across the globe.

I don't know that China will be able to crash the markets again with any announcements. They've already done this about 3-4x.

I do think we'll see it happen again if and when the US and the EU put some regulations in place. But, hopefully by that time, more country's citizens are involved and the crash won't be so drastic.

The overall distribution is a great thing because it will give us stability against these types of external influences, which is the entire goal of crypto currencies anyway.

Smart governments would know by now, that they can not stop bitcoin. So, they should think: If you can't beat them, join them.

Governments who adopt btc and the blockchain technology early, will have a larger share in the new economy that will overtake the world sooner or later. Japan is the best example of such a country.

On the other hand, governments who insist on fighting the change, will be left behind.

That is why the communist party in China itself is devided about wether to ban btc or support it. Same thing is happening in Russia and the US.

The bounce back has proven that btc is decentralized and reselient to governments' control.

The Chinese traders have put a tremendous pressure by trying to cash out their btc. Fortunately, the world wide market was able to absorb all that in one week.

This is really amazing, and I am sure it is really terrefying to governments and central bank.

I think we're going to see choppy performance until we get past the Sept. 30 deadline. Anxious sellers will be dumping on any strength, and the smart (big) money will be waiting to pounce on desperation closer to the 30th.

In the meantime? The seas ought to prove rough.

What is Sept 30th?

The deadline for Chinese exchanges to stop trading.

crazy roller coaster ride!

nice post upvoted your vote is important fOR ME @deshwal

Just feel sad that I did not have more liquid cash when I bought yesterday near $3050. I thought that was a risky trade on the way down, but glad it seemed to have worked out. Hopefully we see it near $5000 again in a few days.

Now to watch it soar again! My prediction is $13000 by Feb. if the world doesn't internally combust by then 😹

This post has been ranked within the top 80 most undervalued posts in the first half of Sep 16. We estimate that this post is undervalued by $9.62 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Sep 16 - Part I. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

This post has received a 14.30 % upvote from @bellyrub thanks to: @contentjunkie.

This post has received a 16.57 % upvote from @booster thanks to: @contentjunkie.