Bitcoin has been hitting an all-time high lately that it isn't proud of: the backlog of transactions. While this would normally be seen as a strong suit for the cryptocurrency, in that it proves there is much more adoption going on, when you dig a bit deeper, that isn't the case at all.

The Maximum Transactions Per Block

Bitcoin's block size as of this writing caps out at 1 MB, and most blocks are completely full. In terms of the actual number of transactions this equates to, it differs depending on the transaction sizes, but is generally around 3,000 per block. Breaking it down into time, it means that the network can support an average of around 5 transactions per second, assuming it's running at its normal rate (1 block per 10 minutes). The issue, however, comes in when the blockchain falls behind.

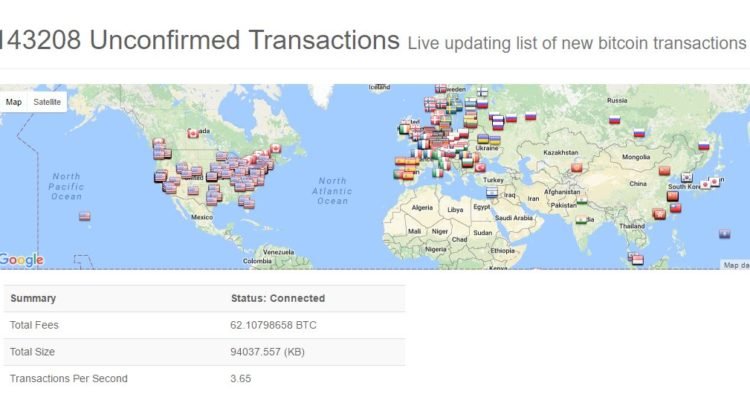

As of this writing, the blockchain has a backlog of ~144k transactions, or around 94MB. (Now 168k) If it were to be frozen right this second, it would then take 940 minutes, or almost 16 hours, to clear the backlog. But it's constantly having more transactions added, so that's not really feasible. It is worth noting, however, that it hit a high of 220k a few days ago, though it's fluctuating somewhat wildly due to attacks and spam on the blockchain still.

Transaction Fees and Waits Become Problematic

Being that there are only a finite number of transactions that can make it into a block, they use a system of fees to determine which ones are accepted first. Those that pay more in fees are generally going to be accepted over those that don't, with some taking days or weeks to be accepted (if at all – it's potentially possible for a transaction to never confirm). Now, under normal circumstances, the fees are minimal, coming in at around $0.15-0.20 per transaction to get it included in a reasonable amount of time. Lately, however, that has more than tripled, with many cases requiring a multitude higher ($2.00+) to even get in within a few hours. This has caused two issues: those who don't keep up with the minimum fees end up not being able to get their transactions in, and those who do can end up spending a lot to get a transaction through. Neither of these are favorable, and mixed with Bitcoin's high price, they make it hard to do smaller transactions – they just aren't justifiable. After all, spending $2.00 to send $0.50 just doesn't make sense.

Attacks and a Push for Bitcoin Unlimited

It's hard to tell exactly what's going on, but the last attack wasn't just spam attacks, it also included a lot of double-spend attempts (fake transactions that won't be confirmed, but still need to be processed). As a result, it's safe to assume that it wasn't organic growth that caused the massive backlog, and rather a deliberate attack on the network. With Bitcoin's civil war going on with regards to how to scale, though, it's hard to tell whether this was a push for Bitcoin Unlimited (probable) or just SegWit and the Lightning Network. In either case, despite being an attack, and not true usage, it is yet again proof that something needs to be done. For the system to handle a large number of transactions, it needs a change. As it is, it's severely crippled by its transaction cap.

Will it Spark Change?

With multiple attacks just over the past year, nothing has happened with regards to Bitcoin Core yet. There is still talk about SegWit and the Lightning Network, but so far, no real movement has been made. It is worth noting, however, that both of these are in testing on Litecoin, so that could absolutely be what sparks the same to move over to Bitcoin, assuming nothing goes severely wrong with it. But for the time being, understand that Bitcoin is in a very delicate spot – while most would argue that it's "fine" as it is, the simple fact is that we need one or both of the aforementioned changes before it catches on. Otherwise, nobody's moving anything – regardless of the fees paid.