Why so much fear, uncertainty, and doubt lately?

Rumors and Speculation, That's why... Recent concerns were that China, South Korea, and the USA were planning to make cryptocurrencies illegal. Fortunately that wasn't what happened.

Recap / Overview

China banned all foreign cryptocurrency exchanges from being used by their citizens via their “Great Fire Wall”.

This could seem like a bad thing at first that would negatively influence the cryptocurrency market by creating division, but in reality, it means that Chinese citizens can now relax and use their country’s local exchanges to trade cryptocurrencies without having to fear legal penalties from their Government. Will Chinese citizens be allowed to participate in American initial coin offerings? No, but they’ll be able to legally trade American-based cryptocurrencies that are available on Chinese exchanges, and that new-found confidence will likely result in a lot more money being released into the market. It’s never ideal or preferable to cause compulsory division in a free market, but it’s the ways of the authoritarian and compartmentalized world we live in, and to scale, or relatively, this is more of a win than a lose for blockchain technology overall.

Note: The “Great” Firewall can be negated by using various means like VPNs and Shadowsock.

U.S. Cryptocurrency Senate meeting had positive testimonies and pleads from the Chairmen of both, the SEC, and the CFTC.

The the chairman of the Commodity Futures Trading Commission (CFTC), Christopher Giancarlo, Uncle of a cryptocurrency enthusiast, said at the cryptocurrency senate meeting that, “We owe it to this new generation to respect their enthusiasm for virtual currencies, with a thoughtful and balance response, and not a dismissive one,”, and when Giancarlo was asked about the value of Bitcoin’s underlying technology, he responded with, “It’s important to remember that if there were no Bitcoin, there would be no distributed ledger technology,”. He went on to say, “Sixty-six million tons of American soybeans were just handled through a blockchain transaction by the Dreyfus company to China. So Bitcoin is now being used, it’s being used in our American transportation and logistics system,”. The testimonies by the Chairmen of the CFTC and SEC will surely relieve a lot of the thin skinned investors out there, which means, once again, more money will likely be released into the market.

Note: Europe will probably mirror this demeanour and result in a similar outcome.

South Korean FUD over the absolute banning of cryptocurrenies.

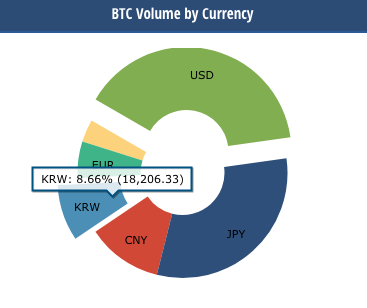

It all started in July of 2017 when South Korea officially legalized Bitcoin service providers like Coinbase to process payments, transfers, and trades in cryptocurrencies. Shortly after, in August, news began to spread that the South Korean Government was planning to discuss regulations on cryptocurrency exchanges in response to hackers targeting South Korean exchanges. The news quickly suffered from an adolescent-like game of telephone where news turned to rumor, and then the rumors turned into news; fake news at that. People were spreading fear, doubt, and uncertainty based on misinformation that South Korea was going to “ban all cryptocurrencies”; such words were never even murmured, yet. This resulted in a lot of people pulling out their funds based on their speculative forecast that if South Koreans lost access to exchanges, that the overall marketcap would take a significant hit, considering South Korea’s level of blockchain enthusiast and their degree of participation (higher trading volume than China). Then, to make things worse, a statement was actually made by the Ministry of Justice suggesting an overall ban on exchanges in South Korea, only this statement was immediately retracted by the office of the South Korean President. As of now, major banks such as Shinhan Bank, the second largest bank in South Korea, equip cryptocurrency exchanges with virtual bank accounts, and there is only focus on banning anonymous decentralized exchanges. While banning anonymous and decentralized exchanges is not preferable, and goes against the foundational tenets of cryptocurrency, in reality it’s not even possible to absolutely accomplish, and this is more of a win than a loss when regarding overall marketcap. A total loss would have been a total ban on all exchanges and forbidding banks to accommodate exchanges and service providers. On January 31st, 2018, the Finance Minister, Kim Dong-Yeon, reassured that there would not be a ban of cryptocurrencies in South Korea. For right now the South Korean crypto-market is a mess, as users are being made to jump through hoops to confirm their identities and finances, but in the long run, it looks like South Korea will move forward with an attitude of allowing cryptocurrency participation from their citizens, which is what matters the most.

Note: Again, these regulations and bans on private, anonymous, and decentralized exchanges can be negated and circumnavigated by those who are technologically literate.

Let’s take a moment and point out that an absolute ban of cryptocurrencies is not possible. The open source code has been written and widely distributed. A ban on cryptocurrencies would prove to be as effective as banning Spanish, English, Korean, Chinese, or the French language. You can’t stop the use of a language or technology from being used or developed, you can only attempt to identify those who speak that language and or who use that technology, and then use threats and or violence to persuade them to stop their victimless actions. It’s only a matter of time until either people have had enough and decide to stop submitting to imperious regulatory capture from oppressive states, or that technology enables individuals with less computer knowledge to actually conduct their online activities anonymously and out of the sight of those who wish to restrict their victimless actions and threaten them with violence. All Crypto-Gamesters should be running a VPN for their own privacy and security.

Too long; Didn’t read:

- China didn’t ban cryptocurrency.

- U.S.A. didn’t ban cryptocurrency.

- South Korea didn’t ban cryptocurrency.

- Cryptocurrencies can not be absolutely banned.

- Use a VPN or Shadowsock for your privacy and security.

- Buy before the next bull-run.