Just a few hours ago everything was fine, but now I see a number which is equal to ~10% of my initial balance that I had earlier, and lots of people complaining on twitter about losing all their funds, too.

What happened? Let’s take a look.

Bitcoin Rally

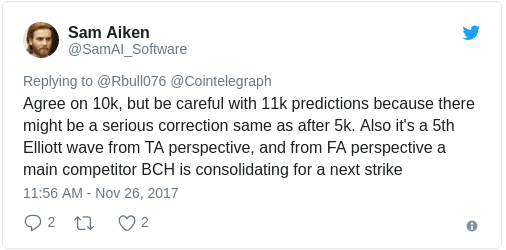

Bitcoin (BTC) price began trending up after a Black Friday with a clear goal of $10,000. This was caused by a spike of new investors and announcements of Bitcoin Futures. Since lots of new money flowed into the market, all crypto currencies also went up.

There were no signs of major trend reversal, but a correction after important psychological level of $10,000 was almost inevitable and most analysts were aware of that. I was also trying to urge people with many tweets.

Since many analysts and professional investors knew about correction that will drag all market down, why so many of them also lost money?

November 29

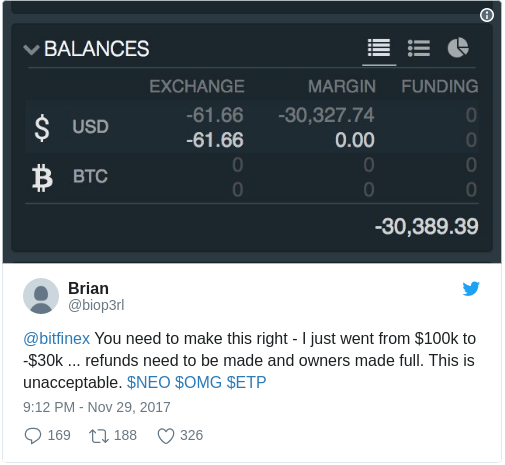

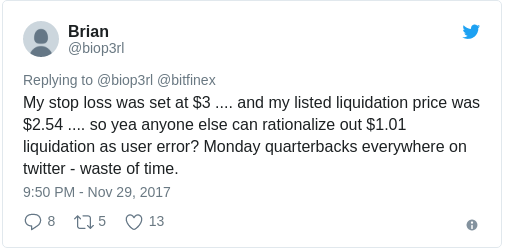

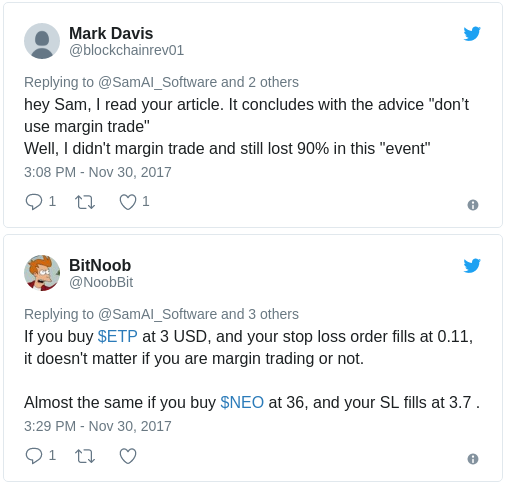

Yes, most of us have used a margin trade on Bitfinex, but not everybody. If you think that all margin traders deserve to lose all their money at any given moment, then keep in mind that people lost up to 90% even without any margin trade, just because their stop loss orders were filled extremely low due to flash crash.

And stop loss order is an essential risk-management tool designed to limit investor’s losses, and it’s being used on most markets. Also there are claims with screenshots that short positions were liquidated even thought price never went so high.

Normally you either put stop losses to minimize your risks in case the price will go down, or in margin trade you can take just a small position in each crypto currency to make sure that your liquidation price is equal to zero.

I don’t trade much, but mostly focus on “leverage investing” since the market is growing and I find this strategy both ethical and lucrative. Crypto market is very volatile, so I minimize risks by having small positions with liquidation price at 0.00 and using stop-losses for double-safety.

This means that even if there will be a crazy dip down, my position will not be liquidated and I will get my funds back after a price correction, or I will just lose a small amount of money due to stop loss order.

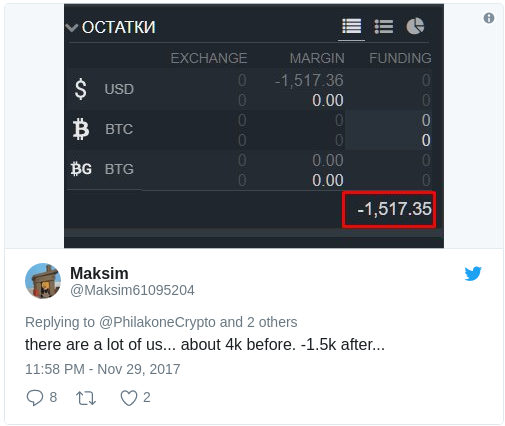

So how did I manage to lose 90% of my money? And why many people got even negative balances?

Flash Crash

On November 29th there was a major correction and Bitcoin (BTC) lost about 20% dragging the whole crypto market down. That was a usual volatility so most investors were well-prepared.

Liquidation price at 0.00 supposed to save me from any dumps, but since my collateral for margin account was in cryptos (arguable decision, but I had my reasons for that) and all the market went down by 10–20%, I guess a very small liquidation price occurred (or there was some critical bug). Normally small liquidation price won’t cause any problems, but here is what happened only on Bitfinex exchange on November 29th:

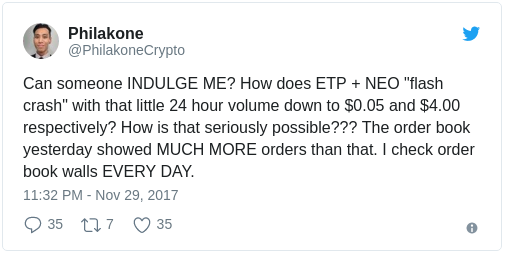

The price of ETP suddenly fell down for just 1 minute from $3.5 to $0.05 triggering all kind of stop-losses and liquidations to be executed way below the price that they were set at. A bit later ETP will fall down again from $2.7 to $1.00 and jump right back. So my position was auto-liquidated at an enormously low price and my overall balance became much smaller. And as I understand from other examples, my balance became smaller by more amount of USD than I’ve actually backed up with collateral to buy ETP, which will later trigger a liquidation chain-reaction.

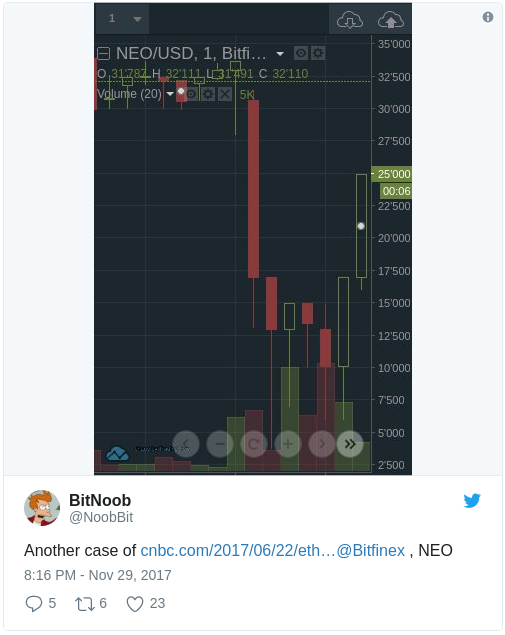

After that NEO fell down from $33 to $4 (almost as in first Matrix), skipping all stop-losses and again liquidated my position at a very low price and that triggered a chain reaction with all my positions being liquidated in a few minutes. As a result I’ve lost 90% of my initial balance.

These kind of dumps can easily happen on small exchanges for small cryptos, but not on a biggest exchange with a few billions of daily trading volume and margin trade enabled.

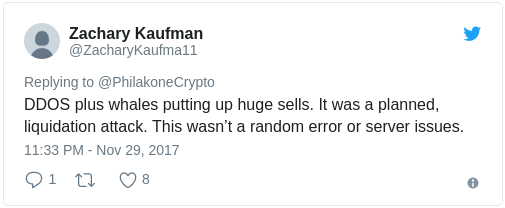

According to some theories, it was a planned hackers + whales attack.

It’s really interesting that tradingview has no data for NEO charts from 19:36 to 20:51 UTC, November 29th — exactly when NEO crashed to $4.

“So all was working great” — is a sarcasm as a reply to other tweets.

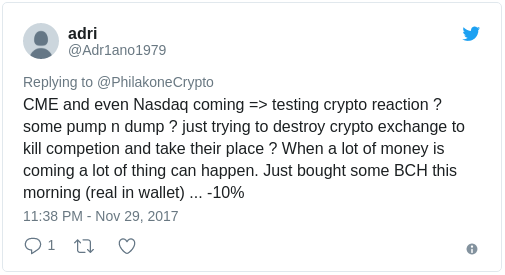

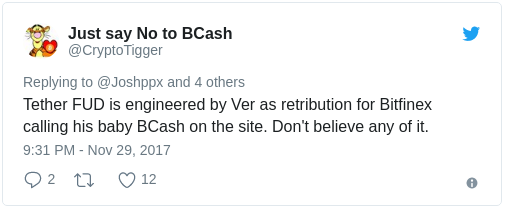

And there is always a room for conspiracy theories, which also might be true.

And it’s funny how people use literally any opportunity to poke Roger Ver :)

It’s hard to say for sure what has actually happened, but if it was a coordinated attack from hackers together with whales, then all money should still be inside the exchange and all withdrawals should be suspended. In this scenario Bitfinex will have an opportunity to refund all the victims, but that’s a very unlikely scenario, unless we, as a whole community, demand a full reimbursement and implementation of a safety "breaks" mechanism that will protect us from flash crashes.

November 30

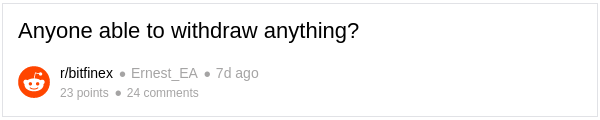

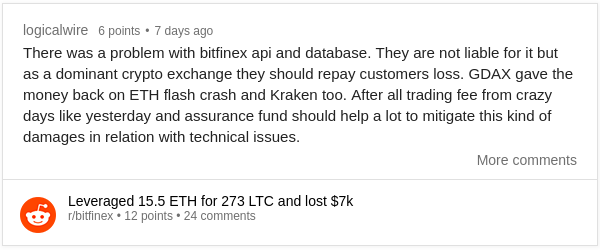

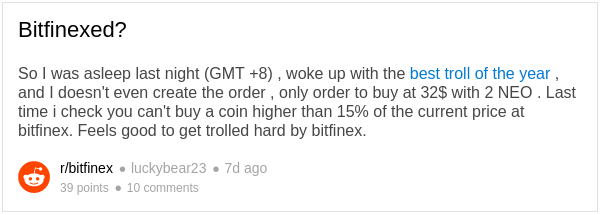

Bitfinex subreddit flooded with different complains about money lost, bugs and flash crashes. Some people claimed that they could not withdraw any funds, while others said that there were no problems and Bitfinex’s address seemed working and processing withdrawals.

Some people claimed that the flash crash was due to technical issues, because API went down, orders didn’t match, and database was corrupt.

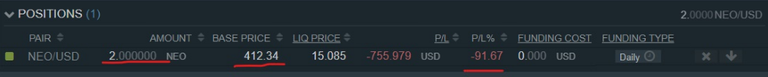

And a little bit of humor. This guy claimed to have a NEO position with $412 base price, while NEO never ever went above $50.

According to news aggregator CryptoPanic, the whole situation started getting media attention (newsbtc, businessinsider, financemagnates, themarketmogul).

December 1

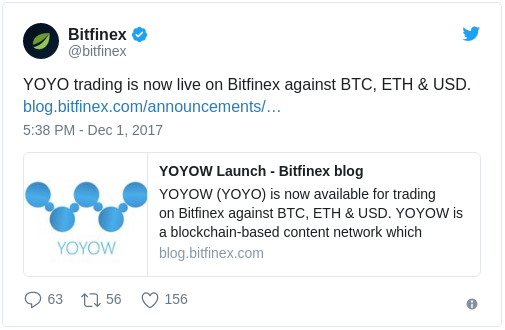

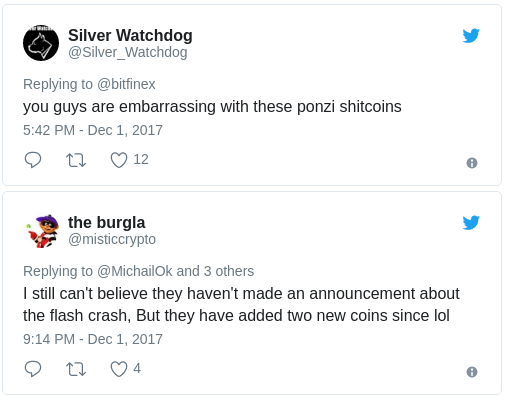

Bitfinex added two new altcoins with low liquidity that can potentially lead to more flash crashes until some “breaks” mechanism will be implemented. Disabling margin trade won’t help, because using stop-losses will still have the same dramatic effect.

However, there was no official announcement about recent flash crash yet, so each Bitfinex’s tweet is full of angry replies.

Many posts about flash crash were removed from Bitfinex subreddit.

December 4

According to CoinDesk and Bitcoin Magazine, instead of an audit and refund for flash crashes, Bitfinex hired lawyers to sue people that “made false claims about the bitcoin exchange”.

Last time Bitfinex handled the situation well and stayed alive even after a huge hack. Soon we will find out whether it will rise again like a phoenix or become a next Mt.Gox.

Lessons to learn (again and again):

- Store your cryptos on a hardware wallet!

- If you really want to trade, then don’t use margin trade, because even on a biggest exchange your stop-losses and zero liquidation prices won’t help.

- Don't use stop-losses at all even with normal trading, because you can lose everything in case of a flash crash, until we, as a whole crypto community, will solve this problem together.

And if you lost all your money today, you should know that you aren’t alone. I feel your pain. We all feel your pain. Feel free to reach out for a community and many good people will give you an emotional support. The only people that benefited today are heartless hackers or whales who planned this attack.

You can join public Telegram group to protest against Bitfinex’s treatment and try to get your money back.

- I’m also covering all main events of Bitcoin VS Bitcoin Cash confrontation in a chronological order so we can see a wider picture.

- And if you want to save your money, you can read why you shouldn’t scan two-factor authentication QR codes.

Follow me on medium and twitter to stay informed about major crypto events.

(This article was originally posted in Crypto Punks medium publication.)

The only reason for time is so that everything doesn't happen at once.

- Albert Einstein

Congratulations @crypto-punks! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP