I have been trading Bitcoin futures for 4 years now and only over the last year I have come to the realization that I can not be the best trader that I can be without two things: Portfolio Margin and Options

Both of these are available so far at one exchange only unfortunately:

You can open an account and get discount on commissions here: https://www.deribit.com/reg-1224.6974

Portfolio Margin

Portfolio Margin uses a risk-based model that determines margin requirements based on historical volatility by valuing a specific portfolio over a range of underlying price and volatility moves. This Portfolio Margin risk-based model takes into consideration positions in futures and options combined, which may help reduce the margin requirement of your portfolio. Portfolio Margin accounts offer these potential benefits to traders and market makers who maintain a balanced portfolio of hedged positions:

- Lower margin requirements

- Increased leverage

Simply put if you sell options against your long futures position your margin requirements go down. The same is true if you hedge your futures long position with a Swap short for example. If you are fully hedged you can never get liquidated. Which is not true on other exchanges like BitMEX where you can get liquidated on a big move regardless of the fact that you are fully hedged. Another benefit is that your position gets automatically reduced based on the maximum risk set for your portfolio. Basically this is designed for the professional traders that care a lot about risk management.

Let me get into some strategies I utilize to increase the profit on my trades as well as reduce the risk of big losses and lock in potential profit in case the price reverses before you have closed your position.

Cover your futures trade with an opposite Swap trade

- Let's say you are in a futures swing long that you want to hold for a few days or possibly for a few weeks. In the mean time the price of Bitcoin can swing widely up and down without hitting your sell level. What you can do is benefit by shorting Swap based on a lower time frame support and resistance levels and cover it lower when the price corrects. Since you will be shorting anywhere from 1/4, 1/3, 1/2 or at the most 1 to 1 to your long position the worse that can happen is you can lose potential profit if the correction you are expecting never comes and the price keeps going in the direction of your futures trade.

- Hedge your position when you can not be in front of your computer at all times instead of using a stop order which can be hit and take you out of your position just to continue later in the direction of your trade.

Options

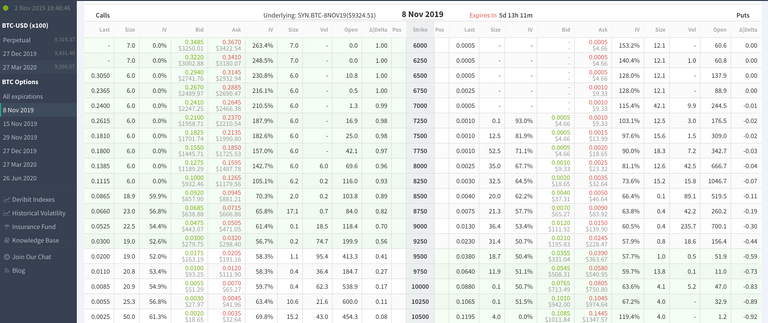

First off all let me make clear a couple of things before I get into the different strategies using options to complement your futures trades. Options have been designed to sell the premium they hold. I would very rarely buy an option for a directional trade. 90% of the time I will be selling options to capture the premium against my futures position. Deribit offers weekly, monthly and quarterly options. Most of the time I will be selling weekly options in the current week or next week. The reason why is because the premium will decay the fastest for these options as well as I do not want to be stuck in my position for long and I can get out easily if I need to once the options premium have come down and my position is in profit.

Sell covered calls against your futures positions

This strategy has to ways that can be executed:

Sell out of the money or at the money options once your futures position is in profit

Let's look at an example of how this would work.

You have purchased 45,000 contracts December futures long at $9,000 (that is equal to 5 BTC). One BTC call option is worth 1 BTC. So you can sell 5 calls against your position. What you will notice is that your margin requirement once you sell the equal BTC amount of options against your futures position will immediately go down a lot and be way smaller than when you only had the futures position.

Let's say your position is now in profit and the BTC price is $9,250. You also need to look at support and resistance levels based on your trade objectives. Let's say your target is around $9,800 resistance area. Once price is at $9,250 you can sell the current week options for a strike price at $9,750 or $10,000. Depends on the current premium and how many days are left until expiration. A good rule is that a good premium to sell is when the IV on the options is over 90%. You can do it when IV is less as well since that will depend on the current BTC volatility.

Let's say the $9,750 calls are around $250. By selling 5 calls you will get $1250 or 0.1388 BTC.

Here it comes the hard part. Knowing how to handle you positions from this point forward until option expiration on Friday is more of an art. There are so many possibilities, but I will try to cover the basics.

- On option expiration day the price of BTC is between your entry of $9,000 and the calls strike price of $9,750

You collected all of the options premium plus the profit from your futures position. At this point you can decide to close your futures position or keep holding it and sell the next weeks options. - BTC price is more than $9,750, but less than $10,000

You have a smaller profit from the sold calls since you collected $250 per option, but now the option is worth the current price of BTC minus $9,750 plus a bigger profit from your futures position.

Again you can keep your futures position and sell next weeks options. - BTC price is more than $10,000

In this case your options trade will be settled at a loss (it's worth mentioning here that Deribit options are European style options that get settled in BTC and you never get assigned a BTC position like in the American style options). However your futures position will be in even bigger profit. Basically you have limited your futures position profit up to $10,000.

In this case I will most likely close my futures position as well to capture the whole profit sine my original target was $9,800. In theory you can keep it and sell next weeks options if you believe price is now over resistance and will keep trending upwards. - BTC price is less than $9000 but more than $8,750

In this case you collect the full premium of the options, but lose on your futures position. You are still in profit however. In this case I will close the futures position or I would have already closed it at break even and leave the calls position naked (not covered). In case price starts going back up after I closed my futures position I can go long the futures again to make sure my options position is covered as the potential loss is unlimited. That said I can wait and don't have to panic as I will only start losing money over $10,000 since I collected $250 per call for the $9,750 strike. I can literarily put a stop market buy at $10,000 to make sure I will not lose any money from the option position. If that trade executes now you have to manage the downside by making sure you don't let it fall bellow $9,750 as after that you will not be covered by the options premium. As I said it's more an art than a science, but usually it doesn't get that complicated if you picked proper strike near resistance and option expiration is not far away from the time the trade was executed.

You can do the same for short futures positions by selling covered puts. I was using going long example just to make the writing easier.

Sell covered calls as soon as you enter the futures long position

This is very similar to the above strategy, but in this case you sell the options right away. You don't have the benefit of having a bigger cushion to play with as in the first example, but also don't need to worry about adding a close stop to your futures position as in the first case where you are not covered with options right away.

In this case you capture the premium right away. I will use this when the premium is very high and I want to make sure I lock in the profit. Let's say the $9,500 strike call options are trading at $500 and I am locking in the $500 profit upfront and will be sure to make that all the way to BTC price of $9,500 (current price is $9,000). Over $9,500 my profit from the options will start reducing and it will be 0 at $10,000. However at this point I will be up $1,000 on my futures long.

The same maneuvers are required as in the first case if price start falling instead of going up. Close your futures long and then reopen it if price reverses and starts going up again. Obviously you don't need to do this on every $50 movement of price and have to be more patient and only do it if you see that your position has a potential of going into a loss. You have enough difference between the price you entered the futures trade and the strike price of the options to not get in and out and get chopped out of your potential profit. This strategy works both when price is trending as well as when the price is in a consolidation. However managing the futures trades in both cases is a little bit different, but I will not get into more details in this post.

Sell naked options

In this case you are selling the options at a strike price where you know there is resistance or you are expecting the price to fall (in the case of selling calls). Since you are protected by the potential profit of the options you don't need to cover your trade with futures all the way until the strike price + the premium of the option. In the case of selling the $9500 calls for $500 you don't need to cover your options with futures long until price hits $10,000. In some cases you might want to go long the futures earlier than $10,000 if you see that the trend has changed and the price movement is very bullish. You don't have to wait for price to hit your break even point as you want your trade to be profitable in all cases. If price stays bellow $9500 at all times you don't have t open a long futures position at all.

In case price start falling fast you can decide to close your options position early by buying back the options and taking the profit. However you will only be taking the profit resulting from the fall in price since the premium of the options will still be mostly intact. Another thing you can do is buy a futures long position when price hits near support. By doing that you make sure you lock in the profit generated from the options when the price fell, but also cover with a long in case price bounces back from support and goes all the way back to the price where you sold your calls. The goal is to be able to stay in the position until expiration or very near when the premium of the options will be mostly gone.

There are even more advanced strategies involving options and the combination of options and futures, but I will leave them for another post. Let me know what do you think or hit me up on Twitter @GlobalLife365

Congratulations @cryptoaddict! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!