As of mid November 2017, the crypto world is nearing a total market cap of $250 Billion as new coins pop up every day while Bitcoin reaches for the $10000 mark. This leads us with hundreds of new alternative options (altcoins) that we can invest in, but of course, "scamcoins" and "shitcoins" plague the market.

Sometimes these "scamcoins" and "shitcoins" may look perfectly legitimate, with a 20 page whitepaper and a well made website along with a twitter alias and a github page. Those scamcoins and shitcoins may seem like they are unavoidable, but every moneymaking scheme has some sort of flaw that you can watch out for. Really, the best thing you can do to prevent yourself from investing in a scamcoin or a shitcoin is thorough research; and it works quite well.

With thorough research and by looking at details, you can find certain signs that may change your investment decisions. Some of these signs are dead giveaways, while others may signify clumsiness or lack of attention to details.

- An anonymous coin dev team

This one is slightly controversial, but it is a good indicator. In the crypto community, Satoshi Nakamoto, who made the Bitcoin source code, presented himself as an anonymous identity. This has led to a rather alarmingly high amount of trust in anonymous users in the crypto world. This is not always bad, there are successful coins with anonymous dev teams, but when a dev team is transparent about their team, to the point you can check their career and education history on LinkedIn, and further confirm with their previous employers, then they bear the pressure to make sure their project work as they claimed.

Anonymous dev teams, on the other hand, bear no pressure at all to perform. They may simply create a coin, sell their premine, and disappear from the internet; behind 7 proxies, of course. Without any pressure that somebody will sue them over it.

This rule does not always apply, but if you see a combination of scammy signs along with this, then you might be looking at a scamcoin/shitcoin.

- No whitepaper

If a coin does not have a whitepaper or a similar equivalent, I would immediately flash the red alert. Whitepapers generally require some time and effort to write, so most quick money schemes will not have one.

I'm not saying that a coin that just because a coin has a whitepaper, is not a scamcoin many scamcoins do have whitepapers. I will talk about those in the next point. Likewise, just because a coin doesn't have a whitepaper, it doesn't always mean it is a scamcoin.

- Badly written whitepaper

You might not want to read the entire whitepaper, but there are many reasons why you should.

Just because a coin has a 20 page whitepaper, it doesn't mean its not a scamcoin. This is where good coins differentiate themselves from the scamcoins, and where the shitcoins reveal their identities. A good, legitimate coin with a strong development team will write a whitepaper that in detail, shows what exactly their concept or innovation is, along with solid research and reputable sources to back their claims.

A scamcoin or shitcoin will almost always have a whitepaper full of simple language mistakes and typos. And thats on the surface level. If you find any kind of discrepancy or flaw in the paper, you should ask the dev directly on their forum announcement. If they can't provide a compelling response, or take too long to do so (for no apparent reason), then the coin is likely a scam, or at least a poorly planned coin.

- no https on official website

This one is easy to check. If your browser's address bar shows a lock icon, and the link starts with https:// then their site has https. You should reduce your trust by half if you see a coinsite without this. Do note that even if a link has http://, you NEED to check if the lock icon is showing up. If the link does start with https:// but the lock doesn't show up, it means that the devs misconfigured it. How can you mess up such a simple step? I would begin to doubt the dev's credibility and ability.

- cloudflare free https

This one is not always true, because many legitimate sites use this free option. When you see a website that uses a better cert like Symantec, you can actually be a little more certain that the website is not a scam. But do be aware that elaborate scamcoins will still use this because they know it can trick people.

- Poorly made website

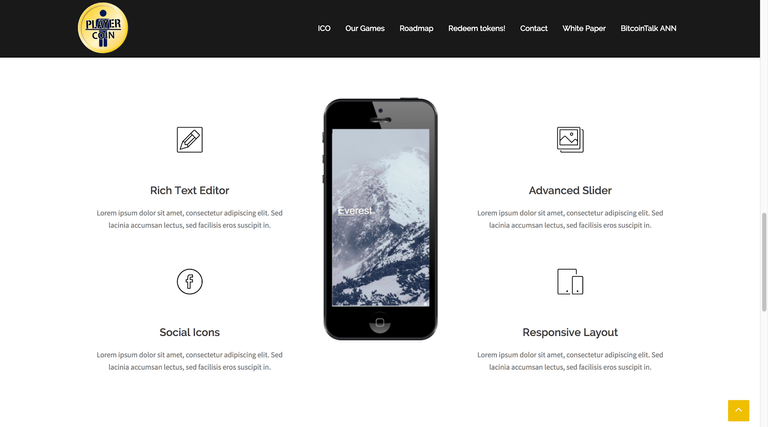

This one is easy to pick out. If you see something like in the image below, then you shouldn't be investing in something like that.

There's nothing wrong with using a template, but at least you should finish setting it up before you release it to the public domain. This is just a sign of a sloppy, quick job. I wouldn't trust someone this sloppy to develop a reliable coin and deliver on their roadmap goals.

- 40% premine, to fund "development" .......

Please. Just no.

Unless they can clearly justify this and provide transparent, untampered evidence that they are legitimately using the premine money for development. Some devs even do completely with donations from the community.

There are obviously many other signs that can reveal a scamcoin/shitcoin but these are the most common ones.

This is not a definite and confirmed list, but these signs are commonly seen on scamcoins. If you see one of these signs, then theres a chance that its a scamcoin, but you can be certain that a combination of 3 or more of these signs will almost certainly be a scamcoin/shitcoin.

What are your ways?

This article was taken from my blog