Some critics label Bitcoin as a 'fraud' or 'magic internet money' that is created out of thin air. They either do this for one of two reasons:

They don't understand how money (and our current monetary system works) - which only proves they are speaking from a place of ignorance.

They see Bitcoin as a direct threat to the current monetary system (of which they are profiting from) - which proves they are speaking from a place of fear.

Smarter individuals know that Bitcoin is far from 'magic internet money' and that the real imposter is fiat. Backed by nothing and capable of being printed into oblivion. Let's take a moment to examine my favorite Fed-fuckery, bonds (the real 'magic money').

Bonds

Bonds are nothing more than a glorified IOU. Issued by our Treasury Department. They are, essentially, fancy pieces of paper that say, "Loan me 5 million today, and I'll pay you back over the course of 10 years + interest." Treasury bonds are what make up a majority of our national debt.

When the U.S. Federal government needs more money than it has on hand, for things like rebuilding the nation's water supply infrastructure, it will ask the Treasury Department for a loan.

The Treasury Department will then hold a bond auction and other world banks will compete to buy those bonds. These bonds are generally believed to be good investments because of one belief: the U.S. economy is strong and is unlikely to default on its payments. However, this conviction doesn't seem to hold the same weight as it once did, but I'll talk more about that later on (in a separate post).

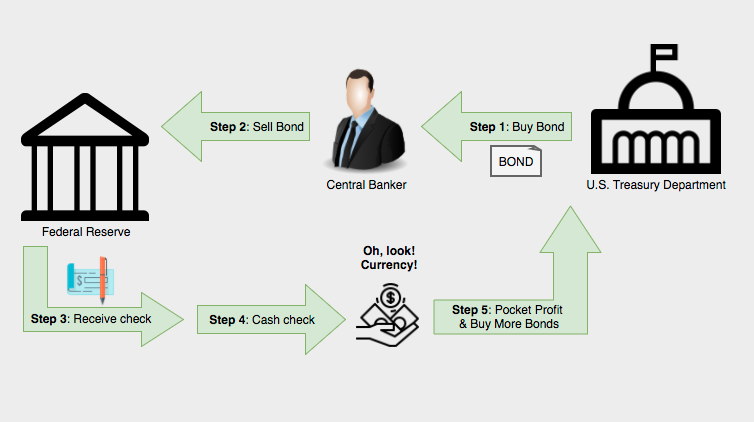

After the bonds have been auctioned off to other global central banks, they sell those bonds (get this) to the U.S. Federal Reserve - for a profit. You heard that right. The U.S. Federal Reserve will write a check (another glorified IOU) to the seller of the bond.

Once the Fed hands over the check to the seller, the seller cashes that check and currency springs into existence!

Maaaagic!

The banks then take that "magic money" and hit up more Treasury bond auctions. It's a never-ending cycle of magic money making.

Figure 1: The magic money bond cycle

So, what's really happening is the Treasury Department (U.S. Gov) and the Federal Reserve (private bank) are swapping IOUs and using other global central banks as middlemen to magically create currency into existence. Hmmm.

Sounds sketchy, doesn't it?

So, as this cycle continues, more currency is introduced into the system and the national debt continues to grow. What ends up happening is the Federal Reserve ends up with a ton of IOUs on hand and the Treasury Department ends up with a ton of cash on hand.

Now, there's more to scrutinize in this magic money-making scheme, and that is the Federal Reserve check itself. The check is written against an account that carries a zero balance. But don't take my word for it.

“When you or I write a check there must be sufficient funds in our account to cover the check, but when the Federal Reserve writes a check there is no bank deposit on which that check is drawn. When the Federal Reserve writes a check, it is creating money.”

~ Putting It Simply by Boston Federal Reserve

Conclusion

Next time someone tries to say that Bitcoin (or any other cryptocurrency) is 'magic internet money,' remind them of the bond auction process.

Congratulations @cryptobruc3! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @cryptobruc3! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP