“A futures contract is a legal agreement, generally made on the trading floor of a futures exchange, to buy or sell a particular commodity or financial instrument at a predetermined price at a specified time in the future.” Investopedia

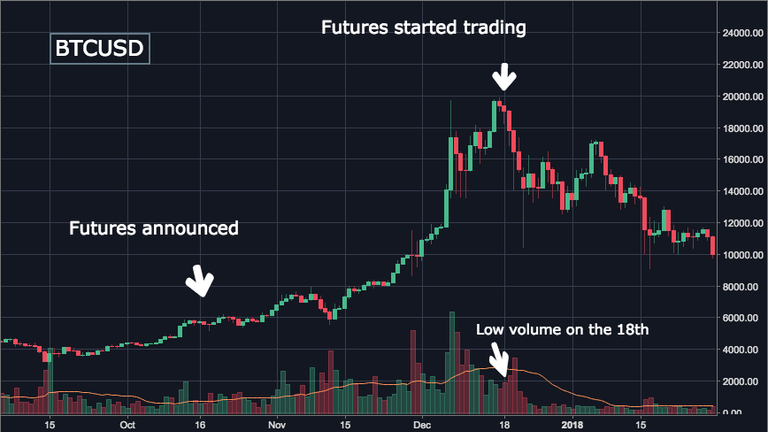

Bitcoin futures were undoubtedly a key driver behind the huge price run up we saw in late 2017. Interestingly however, they may also have been behind the following disastrous 50% plus sell off we saw in January.

There are obviously a number of reasons behind any market movement. In cryptocurrency, these are almost solely news events which change people’s speculative opinion. There are no company earnings to create fundamental value estimates with, and the assets have not been around long enough for reliable fundamental valuation methods to exist.

Bitcoin futures were taken as a significant sign of mainstream acceptance of cryptocurrency. Two well respected US financial institutions were ready to allow customers to trade bitcoin contracts on a large scale. Years of consistent condemnation of bitcoin as a tool for criminals, and now wall street was going to actively invite investors to trade the asset. In October last year this information hit the news, and gained huge traction. This was right around the beginning of the bull run. The announcement of futures was undeniably a factor in this surge, and for good reason. It was a piece of genuinely good news for the cryptocurrency. The ascent was what many might call parabolic price movement, it was unsustainable and a correction was inevitable. What is interesting is how closely correlated the correction was with the launch of futures.

Since many bitcoin traders are new to the financial world, they often have little experience of the market. It is therefore suspected that many people did not fully understand how the futures would work. The contracts are made and settled entirely in US Dollars. Not a single bitcoin has to be bought or sold by any of the participants in the futures schemes. They are tantamount to placing a bet on the price of a bitcoin, as opposed to actually buying one. This means that the futures contracts, while certainly a positive sign for bitcoin, would not bring any actual new cash to the market. Trading volume would not suddenly spike once futures came out. Bitcoin would gain almost zero trade volume on account of the contracts. This fact was not well known to the community. It is therefore easy to imagine that when futures came out, and, lo and behold, bitcoin didn’t see a volume spike, this could have caused a large deflation of expectations and significantly negatively impacted speculation on the price of the asset. Trade volume in fact saw a short term low the day the majority of futures came out. The contracts had managed to bypass the need to purchase any actual bitcoin and the market was underwhelmed.

CBOE, the smaller of the two institutions offering the contracts, launched theirs on December the 10th. The considerably larger CME group did the same on the 18th of December. By this time bitcoin was trading in the $19,000 range. On Christmas day, a week later, the price had dropped to the $14,000 dollar range, having begun its bear run the very day after CME launched their futures.

The bitcoin futures announcement came in October, and the contracts started in late December. These periods are the very close to the start and end dates of last years unprecedented surge in bitcoin price. It seems that futures had much to do with both the rise and the fall of bitcoin in 2017.