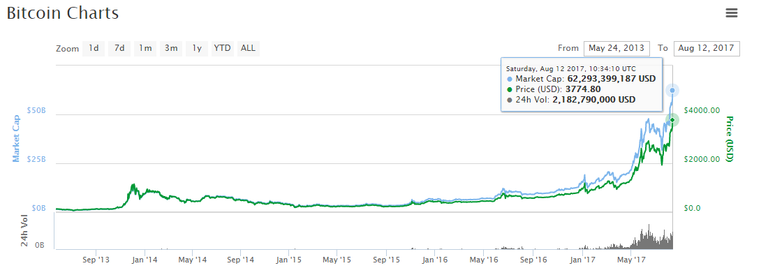

Bitcoin hit another untouched high today, taking off past its past record hitting $3,793.86 before sliding back, as one bitcoin is at present worth $3,744.56, as indicated by information from CoinMarketCap.

The digital money's new record pushes its market top to $61.7 billion, with the whole cryptographic money biological community now being worth $132 billion. Amid the most recent 24 hours, bitcoin's esteem surged by 7.44% as its predominance is presently at 46.49%.

Back in July, Goldman Sachs' central specialized examiner Sheba Jafari precisely anticipated that bitcoin's cost would pull back to about $1,850, before setting another record high. As indicated by his expectation, the cryptographic money could go as a far as $3,915 before it quits surging.

Some anticipate that bitcoin may soon hit another point of reference: $4,000. Despite the fact that it isn't clear what will occur next, there are some identifiable factors behind bitcoin's climb.

As indicated by the South China Morning Post, a few speculators are utilizing digital currencies as a place of refuge, as the war of words between U.S. President Donald Trump and North Korea heightens.

Bitcoin hit another record-breaking high today, taking off past its past record hitting $3,793.86 before sliding back, as one bitcoin is presently worth $3,744.56, as indicated by information from CoinMarketCap.

The digital money's new record pushes its market top to $61.7 billion, with the whole cryptographic money environment now being worth $132 billion. Amid the most recent 24 hours, bitcoin's esteem surged by 7.44% as its predominance is presently at 46.49%.

Back in July, Goldman Sachs' central specialized examiner Sheba Jafari precisely anticipated that bitcoin's cost would pull back to about $1,850, before setting another record high. As per his expectation, the digital currency could go as a far as $3,915 before it quits surging.

Some foresee that bitcoin may soon hit another development: $4,000. Despite the fact that it isn't clear what will occur next, there are some identifiable factors behind bitcoin's climb.

Rising pressures between the U.S. also, North Korea

As per the South China Morning Post, a few speculators are utilizing digital forms of money as a place of refuge, as the war of words between U.S. President Donald Trump and North Korea strengthens.

Speculators are swinging to digital forms of money, as their autonomy from any focal specialist is a protect against national banks and governments, implying that if North Korea and the U.S. enter a military clash, bitcoin won't experience the ill effects of conceivable results, for example, high expansion, a debilitated money, or capital controls.

As InvestFeed Inc's CEO Ron Chernesky put it:

"We're seeing financial specialists moving their assets into digital currencies as they attempt to enhance their hazard in the event of an extreme downturn in the market"

As of late, North Korean pioneer Kim Jong-Un undermined to flame four intercontinental ballistic rockets (ICBMs) to the U.S. island of Guam, in the Western Pacific. As a reaction, Donald Trump expressed that he will "think twice about it quick" on the off chance that he facilitate dangers the U.S. Different nations, including Canada, asked the two countries to de-raise the circumstance.

Bitfinex suspends U.S. confirmation demands

Well known digital money trade Bitfinex as of late declared that it will never again acknowledge U.S. customers. As per the declaration, the trade will suspend singular confirmation demands.

The trade included that the move has been considered some time recently, however now that is it experiencing issues giving USD stores and withdrawals to U.S. subjects, it trusts the time has arrived at quit tolerating U.S. customers.

It peruses:

"We lament to report that, as of now, we will never again be tolerating check demands for U.S. people. We have for quite a while considered pulling far from the retail commercial center in the U.S., and now with a present overabundance of check demands and progressing challenges in giving USD store and withdrawals to U.S. people, we feel that the time has come to start separating from U.S. retail clients."

Among the components that prompted the choice, Bitfinex uncovered that a substantial part of its assets go to U.S. clients, while just a little level of the incomes originate from them.

The move viably limits liquidity and makes a feeling of shortage, which additionally prompts a bullish market.

i am upvoted and reply your post plz visit me

upvoted,reply,follow and resteem when you work in steemit thanks alot,

Yes @pranashroy we work together. we help each other

Congratulations @cryptoplayer! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIt is now miracle in currency market, the world is staring with excitation.

Someone said bTC go 100,000 in 2021

Yes we i know btc will touch 4k but its going more then 4k.

Yes offcourse BTC will go 5K very soon

yes bro....

Thanks for commenting @munna

wish u best of luck!!!

Nice post.