Anyone who follows and likes the Bitcoin thesis has probably already understood that central banks practically all over the world print money at will, simply out of thin air. This is extremely damaging for the financial market, since with the unlimited supply of fiat currency, its purchasing power is undermined day by day.

Once again, central banks around the world, especially in China and the US, are adopting policies to inject money into their economies, boosting global liquidity.

In particular, the Chinese economy is going through a rather delicate time, and the government has adopted a series of measures to try to revitalize it.

In September, China launched a massive economic stimulus package worth many billions of dollars, focusing on key sectors such as infrastructure and real estate, as well as trying to boost small and medium-sized enterprises. Part of these measures include injecting liquidity into the market, such as cutting interest rates and reducing bank reserves, freeing up more money for new loans.

These measures have wide-ranging consequences, impacting the commodities market, such as iron ore, and influencing the performance of cryptocurrencies like Bitcoin, as well as increasing concerns about inflation.

Economic growth?

China's leaders are aiming for economic growth of around 5% this year, a rather ambitious target considering weak domestic consumption, the global boycott against Chinese products and a very unstable real estate market.

In September, with the target slipping away, Beijing launched a package of stimulus measures, including interest rate cuts, to try to reverse the situation. However, success is not guaranteed.

Persistent deflationary pressures have also sparked debate as to whether the world's second largest economy is heading for a period of Japanese-style stagnation after 30 years of unprecedented growth.

How is this crisis unfolding?

A few months ago, most major global banks expected China's economy to miss this year's growth target.

Deflationary pressure increased, with new home prices falling at the fastest pace since 2014, while consumer confidence hit its lowest point in more than a year and a half.

The government continued to rely on manufacturing and exports to drive the recovery. Less than 20% of economists predicted that Gross Domestic Product (GDP) will grow by 5% in 2024 in a Bloomberg survey, while analysts at institutions such as Bank of America questioned why fiscal and monetary policies were not doing more to reignite domestic demand.

Trade also remains a risk: while exports have reached their highest in almost two years, Beijing is facing a backlash from countries worried about the impact of cheap Chinese products from the world's largest manufacturing nation. High-ranking officials, such as Vice Finance Minister Liao Min, have defended China's industrial might, claiming that it helps the world fight climate change and curb inflation.

What about you?

A large part of the world's jobs and production depend on China.

The IMF predicts that China will continue to be the main contributor to global growth until 2028, with an expected share of 22.6% - double that of the US.

Mineral exporting countries such as Brazil and Australia are particularly sensitive to fluctuations in Chinese investment in infrastructure and real estate. For example, the domestic recession has left a surplus of steel for the local economy to absorb, increasing exports and contributing to the fall in global prices, which has put other companies and countries in difficulty. Weak demand in China is also hurting the performance of car manufacturers such as Aston Martin. Meanwhile, increasingly thrifty consumers have reduced sales of global brands.

Where are the problems?

China's $18 trillion economy is struggling in several sectors.

Manufacturing activity was in contraction from April 2023 until September, except for 3 months.

Compounding the situation are US efforts to cut off China's access to advanced semiconductors and other technologies that would boost future economic growth.

This is an approach that Washington calls “strategic competition” and that China classifies as “containment”.

Domestic confidence has become so fragile that bank lending has shrunk for the first time in 19 years.

The public accounts of local governments, already overburdened by debt, are among the victims of the fall in real estate prices, as land sales revenue has fallen at a record pace, making it difficult to reverse the fall in budget spending just when the economy needs fiscal support the most.

Where are the post-Covid consumers?

Optimism was high when China came out of the pandemic restrictions at the end of 2022 and reopened its borders, with expectations of a rapid recovery in consumption, driven by “revenge shopping”, going out to restaurants and traveling. But this increase did not materialize, as people began to worry about weak growth and what it meant for unemployment and income.

The years-long real estate crisis has also wiped out some US$18 trillion in household wealth, prompting people to save rather than spend and pushing China into its longest streak of deflation since 1999.

Chinese consumption rose slightly during a major holiday in September, signaling that the recovery in household spending is still far from significant. Unemployment remains a concern, exacerbated by the regulatory crackdown on big tech companies, which has deprived many entrepreneurs of trying to pursue lucrative careers.

The youth unemployment rate rose in August for the second month in a row, reaching its highest point this year.

What is happening to the real estate sector?

The real estate sector has been the main driver of China's economic growth since President Xi Jinping took office a decade ago.

In 2020, the government tried to rein in the highly indebted to reduce risks to the financial system.

This caused house prices to fall and many weaker companies to default.

Developers stopped building houses that had already been sold but not delivered, leading some to stop paying their mortgages. This turmoil was a red alert for the Chinese, who had long considered real estate a safe investment and used it as a store of value.

The attrition continued into 2024, extending a downward trend that began in early 2022.

In May, China announced its most comprehensive attempt to revitalize the real estate market, including a 300 billion yuan (US$43 billion) program of central bank financing to help state-owned companies buy unsold properties from developers. However, progress has been slow, and only a fraction of more than 200 cities encouraged by the central government are adhering to the plan.

What is the Chinese government doing?

After hesitating to take more aggressive measures, the Politburo - made up of the Communist Party's top 24 officials, including Xi Jinping - pledged at a September meeting to pursue annual economic targets and stem the fall in the real estate market.

Acting in coordination with the central bank, the authorities cut interest rates, unlocked liquidity to encourage bank lending and pledged up to $340 billion to boost China's stock market.

The main focus of the stimulus package is to stabilize the real estate sector, with measures such as cutting existing mortgage rates and easing restrictions on the housing market.

Will the stimulus effort solve the problem?

This aggressive round of stimulus could even bring China close to achieving its 5% growth target and enter 2025 with a more optimistic outlook. However, overcoming deflation and reversing the crisis in the real estate market will be a difficult task.

It will depend very much on the scale of fiscal resources that politicians decide to commit. Escalating trade disputes could also dampen growth. In addition, the huge oversupply of real estate means that it will be a while before any stimulus to the real estate sector translates into actual construction - if at all.

With a declining population and slowing urbanization, there are fewer structural factors driving housing demand. As a result, the country could face a prolonged period of weak growth while it tries to solve its debt problems, in the same way that Japan faced in its so-called “lost decade” after the collapse of the real estate and stock market bubbles.

Global impact

The impact of this is being felt globally. China, as the world's second largest economy, influences markets such as commodities and shares in exporting countries.

For example, the price of iron ore, which is important for companies like Vale, has fallen, reflecting lower Chinese demand.

In the cryptocurrency scenario, greater global liquidity generally boosts assets such as Bitcoin, which tends to appreciate in periods of monetary expansion, as investors look for alternatives to preserve value and protect themselves from inflation.

USA and the rest of the world

But global liquidity isn't just rising in China. The injection of money into the economy is growing all over the world, reaching its highest level in history:

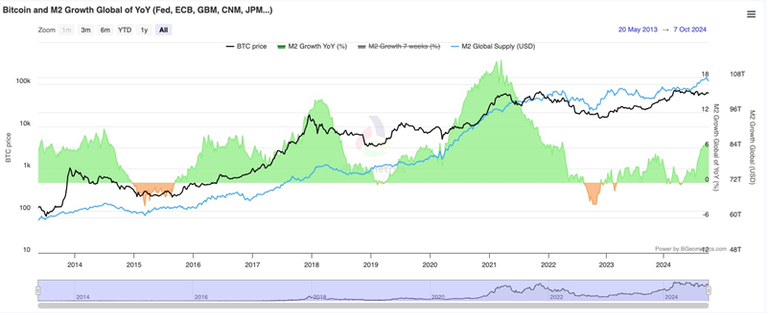

In the graph above you can see that the price of Bitcoin (black line) tends to rise, along with the injection of money into the economy, in the M2 aggregate (blue line).

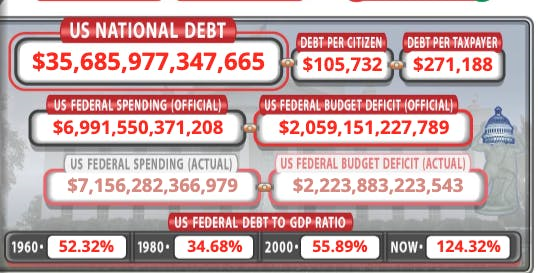

In the US, the world's largest economy, the debt/GDP ratio today is 137%, indicating that the country spends more than it produces. It's as if you were living on an overdraft every month, spending more than you earn in order to survive, running up an infinite and unpayable debt. The American debt is also at its highest level in history, surpassing 35 trillion dollars.

Is Bitcoin about to explode?

With governments printing money and accumulating debt unchecked, we are trapped in a vicious cycle that devalues everyone's purchasing power - and most don't even realize it. Inflation impoverishes you on a daily basis while the traditional financial system continues to fail. In this scenario, Bitcoin has emerged as one of the few viable store of value options, consistently outperforming inflation.

Historical data is clear: anyone who has invested in Bitcoin and held it for at least 4 years has never lost money. What's more, we're still in the early stages of adopting this revolutionary technology. In other words, the opportunity is just beginning.

Posted Using InLeo Alpha