Normally the concept of how cryptocurrency marketplaces work is very simple. Basically, it's the same as with any exchange, shopping mall, or bazaar. People come there, offer their products, wares - whatever they are able to offer - hawk that stuff to the customers, get money, pay commissions to the guys who run that exchange, or bazaar, or whatever. The guys in charge generally decide what's going to be traded at that place they run, as well as they make all other necessary organizational or managerial decisions. In other words, it's a centralized structure, controlled by the concerted efforts of a narrow group of people, who generally have the same idea of how the things should be done.

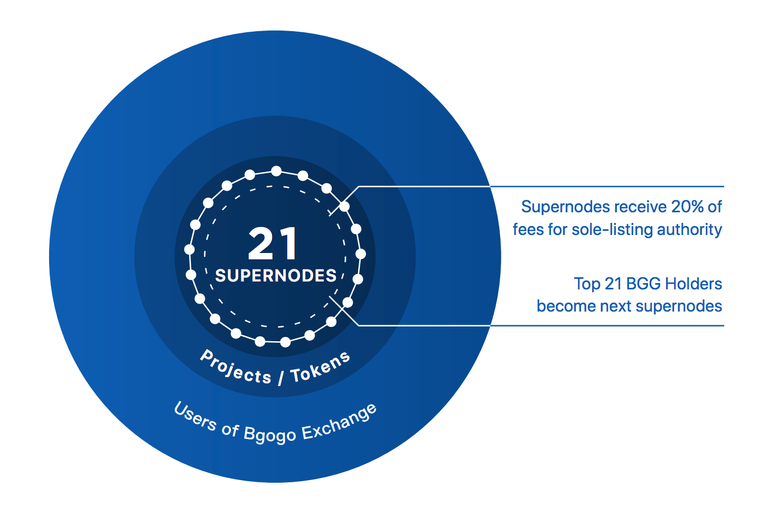

The Bgogo project's concept is that the marketplace should be controlled by a group of supernodes, representing the project's major investors. There's nothing particularly new about a company controlled by its investors - it's somewhat similar to a board of directors, comprised of company's key stakeholders - but in the dynamic world of cryptocurrencies, it looks a bit different. For example, in the corporate world, the list of major stakeholders doesn't change significantly over the company's lifetime. In the crypto-world where the markets are turbulent like boiling water, and where decisions are made in the blink of an eye, the general picture, showing who at some point holds significant parts of project's assets or tokens, can change in a matter of months or weeks. Reflecting this situation, the Bgogo project's decision-making supernodes are re-elected every quarter, based unsurprisingly on who at that particular moment holds the major chunk of platform's assets, I mean, tokens. There are 21 super-nodes that can be perceived as a board of directors that changes every three months. Super-nodes decide what assets - cryptocurrencies and tokens - are going to be listed on Bgogo exchange. Or rather each node promotes one specific token or cryptocurrency. In fact, super-nodes have a good reason to promote popular and highly-traded assets since the platform pays 20% of commissions, gathered from the trade of a certain token or crypto-coin to the node that proposed that token or coin. In a sense, it raises concerns that less popular and widely spread assets are going to be underrepresented in this marketplace. For example, I know that the most well-known and widely traded cryptocurrencies are Bitcoin and Ether. If I invest in Bgogo project and start representing a super-node on its exchange I logically would vote for Bitcoin or Ether since I know that they'll give me the maximum profit as a share of trade commissions. Which, in turn, will reinforce my standing on the platform; I'll keep more platform's assets, get re-elected as a super-node, and keep voting for Bitcoin or Ether. Meanwhile, all the promoters of less popular currencies and tokens will be wiped out because the meager earnings from the feeble trade of those tokens won't allow them to hold enough project's assets to be listed as top investors.

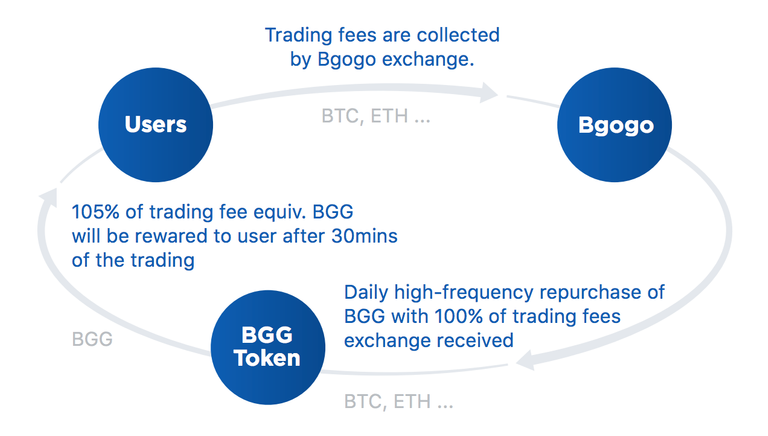

Another proposition that makes it confusing at first, (considering the previous proposition) is that all the transaction fees are going to be reimbursed with 105% rate. In fact, the way I understand it, it means that instead of paying commissions to the exchange, participants are going to get paid for making transactions. 5% of the commission is probably a minuscule sum, but 105% reimbursement means that platform's users get all the money they paid as a commission back, plus a little bit on top of that. This makes me wonder: if the platform pays back commissions then how it collects money to pay super-nodes. Probably the trick is that the platform reimburses commissions using its own BGG tokens, while the commissions themselves are charged in respective cryptocurrencies involved in transactions. This way, the project effectively turns the exchange participants into its own investors. In Bgogo project's terminology, it's called "mining through trading." Logically, in this scheme of things, the platform needs to constantly issue new tokens; the amount of platform's tokens in circulation is going to reflect the amount of all collected transaction fees. The growing mass of tokens can lead to the decrease in their market value, in other words, inflation. Which would, in turn, undermine the position of platform's major token holders, whose investment in the form of platform's tokens will quickly depreciate. To draw an analogy with the traditional financial schemes: if we regard tokens as company shares, those shares are getting constantly diluted by the issuance of new tokens. To avoid this situation Bgogo project is going to conduct regular buybacks of BGG tokens, with all repurchased tokens burned afterward. Apart from keeping the amount and value of the platform's tokens stable, repurchases is a well-known mechanism of distribution of the company's profits among its investors; in this case, profits, accumulated by Bgogo project's token holders as a percentage of trade commissions in the form of BGG tokens, can be converted into tangible assets - crypto or fiat currencies - through the token buybacks.

In other words, when we closely examine the Bgogo project's business model it begins to look clearer and more understandable. A key characteristic that distinguishes it from other cryptocurrency and token exchanges is that it delegates part of the control to its investors, who decide what assets are going to be traded on the exchange. The investors get returns in the form of the percentage of trade commissions, so it's reasonable to expect from them sensible decisions, regarding the matters determining their own profits. At the same time, platform's token repurchases keep token value stable and allow token holders to convert their token surpluses into tangible liquid assets. Sounds like a viable business model to me.

Currently, Bgogo is conducting a token sale, aiming to distribute 10% of its total supply of 10,000,000,000 BGG tokens. The fundraising goal is $6,800,000.

Useful links

Website | Whitepaper | Telegram | Twitter | Facebook | Reddit

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

This post was resteemed by @steemvote and received a 92.34% Upvote. Send 0.5 SBD or STEEM to @steemvote

You have recieved a free upvote from minnowpond, Send 0.1 -> 10 SBD with your post url as the memo to recieve an upvote from up to 100 accounts!

You got a 19.74% upvote from @postpromoter courtesy of @cryptotaofficial!

Want to promote your posts too? Check out the Steem Bot Tracker websitevote for @yabapmatt for witness! for more info. If you would like to support the development of @postpromoter and the bot tracker please

Interesting. 21 nodes seems similar to EOS.

How much money do I need to put inside to have a master node?

How much money do

I need to put inside to

Have a master node?

- cryptoxxl

I'm a bot. I detect haiku.

Hm. That's interesting. Didn't know that I'm a poet.

The idea is interesting but I don't understand why is only 21? Why not 33, 55, 77, 99?

probably for the same reason that bitcoins can be only 21 million ;)

Coins mentioned in post:

That's a really cool article, thanks!