Bitcoin touched $10,500 yesterday and bounced back with ferocity. At the time of writing this, Bitcoin is currently sitting at around $15,000. Is this Bitcoin recovery healthy? In my opinion, it isn't.

The reason I suspect this isn't a healthy recovery is simple - it happened too swiftly and too strongly. I believe, from a psychological perspective, that dead cat bounces occur because people FOMO into a recovery with little faith in the price of the underlying asset (Bitcoin in this case) which leads to a nice pump. But when selling occurs, everyone says to themselves "I knew I shouldn't have bought!" and they all panic for the exits.

As such, I will sell a decent portion of my Bitcoin if it reaches $17,000 as there is significant resistance at that level. The reason I'm not selling immediately is because Bitcoin continues to defy my expectations, generally to the upside, so I will give it an opportunity to rise higher. In the event it comes down prior to that level, I'm prepared to hold (or buy if it goes low enough).

In the event it skyrockets (say up to $30k), then I'll provide updates on my expectations and entries. But for now, these are my thoughts on the market. As for altcoins, I still prefer Bitcoin over them given dominance has reverted back to 43%. I will continue to generally prefer Bitcoin until dominance reaches around 50%, although I will provide an update if my mind changes on this for any reason. As such, I believe selectiveness is more important than ever with altcoins right now.

Let me know your thoughts on the markets below - I'm happy to hear them!

Great thoughts and reasoning as always. I was thinking about bitcoin dominance on the market the other day. What if people realized that there are a lot of other currencies which are also worth buying? Bitcoin being the most expensive, "useless" for paying because of high fees and slow transactions, might not be the best coin to buy. It is actually only good for long term investments, not for every day use. "Digital Gold", as we all heard it already. What if people want useful coins to buy? Coins that are on the news not only because some big financial company bought in, but because of something interesting happened to them, like develeopment in their technology, new wallet, more possibilities, etc... can be more attractive. If you have a coin as an investment and you can use it in your every day life, say buying a cup of coffe, you have a good reason to pick those coins over BTC. How about bitcoin's dominance being under 50% or even around 40% or less in the long run, instead of around 60%? I think that scenario is very possible and healthy.

I don't think people want 'useful' coins or we'd see much higher transaction numbers in altcoins than we currently do and we wouldn't see cryptocurrencies that are just ideas with no products have valuations over $1 billion.

I think they do want useful coins, there are just not many ways to make use of them.

Thank you for providing such insightful perspective. I'm following your youtube channel for a while now and this is my first comment here so I hope you find the time to read it. I have many questions since I'm new to crypto space but for now I'm gonna stick to the point.

like every other human I might be making a huge mistake, however the way I perceive the market behavior, it seems to me that most of the big players who benefits from the price going up were scared of the bull run we had recently and they themselves catalyzed the process for a correction. the same people who are believers in the bitcoin brand and the underlying technology as well as future potentials of the whole blockchain industry. I know there are gonna be major sell offs as always, however, I think corrections in the market will recover and we see new capital flow no later that late January. this is mainly because I don't see substantial capital escape from the market and furthermore, I think most of the profits made by sellers is gonna attract more capital simply due to holiday gatherings and people talking about the bull run of past year. this in turn will further increase the confidence of the original sellers in the cryptos they sold and brings them about to re-invest, pouring the lost capital back into the market.

On another point, as a member of the community from middle east, I can tell you that a lot of capital is waiting to enter the market from all these countries that you might not think about them. I myself have many limitations purchasing even bitcoin or ether simply because there are very few providers in my country and for the last month there has been close to no supply at all. Now think about the holiday events that I talked about. The news will articulate around the world face to face and after a while new members will join the network. As a member of academic society in my country I meet many friends coming to visit during holiday season. If I tell them about my investment on verge and how it 40x ed after a month, I don’t think they can resist the temptation to create a wallet and throw 50 bucks when they get back from vacation. I know I’m not gonna fomo people in to buying, however, I suspect many people will. This all is relying on an assumption that bitcoin does not lead us to a bear market in coming days as you mentioned before.

My opinion about bitcoin is that as long as we see potential for further network growth, the bull will beat the bear and taking advantage of the dips seems rational to me. I apologize for my long comment. I'd be glad to hear your response

It's interesting hearing about other countries because you're right, I generally only think about the 'big' capital providers but there are plenty of places to add additional liquidity to the market which will help prop up price.

Most of what you have mentioned in your comment (about new people being dragged in from price going up) is exactly what has caused Bitcoin to rise so much in the first place. So while it is a valid argument, there does have to come a point where it stops because it is circular logic (price is increasing because people see price increasing). It's called momentum, and I'm not saying that it will stop soon, but it is worth noting that that particular catalyst does eventually run out of steam. Thank you for taking the time to comment!

So you're holding all your BTC on GDAX and go directly to fiat ?

I've got some btc on exchanges from selling altcoins (and ready to buy alts, when something dips big time) and some BTC on GDAX.

I guess it would be too complicated to sell all of my bitcoin, so my 'strategy' is to hold the amount of bitcoin I have on the other exchanges and trade the btc I got on GDAX for fiat..

Is this possibly what you're doing as well ?

How does this approach sound to you ?

btw, everyone's bitching about how negative you are in your videos... total bs.

There's a difference between being negative and rational, straight to the point, providing solid facts and opinions. Thanks!

I have a decent amount I leave on exchanges just so that it is fully liquid, because often when you need to sell / buy, that is when the exchanges are the most sluggish and it is difficult to transfer in.

First off, I would like to commend you on your videos, not only in their content but also in their timing. Though you cannot hold someone’s hand or even offer much sought after comfort in the real world of speculation, a calm, even monotone voice of reason is something most welcomed.

I agree with your assessment and think that Bitcoin will continue to correct over the holidays and move back up aggressively around 1/15/2018. There are a lot of eager investors (speculators) who have yet to get their accounts funded, wanting to ride the next wave.

That being said, let’s talk about something that I believe to be very interesting. As I took the time to go through the very, very long process of obtaining a Coinbase account, which now seems light speed compared to that of Bitstamp, I began to look for other was of investing (speculating) in crypto currency. My search led me to GBTC. I have a brokerage account so it was almost an instantaneous process to buy shares of the fund. My thought was that I could get in the game while I was waiting for my bank funds to show up in GDAX. I had done some research and found the fund produced about a 1600% return over the last year, which was indeed lower than a direct investment in Bitcoin, but still pretty good. I have read all about the horrible things that could happen to the fund but have chosen to place some bets there regardless.

I have found that on a buy/sell cycle I can double my money just by following Bitcoin. In a 7 day period, $7500; Bitcoin buy in @ $17500 and sell off at $19500 would yield about $800 in increased value. That same amount of money placed in GBTC just about doubled. I have done this more than a few times with the same results. I wanted to get your take on the topic and would be most interested in what your thoughts are in the long term viability of GBTC.

Thanks and keep up the great work!

GBTC is a double play - you're not just betting on the price of Bitcoin, but also the premium to net asset value (NAV). So you really want to try to line up both where you buy Bitcoin at a low AND GBTC at a low premium to NAV and hope to capture both a rise in Bitcoin AND the premium. It's an odd instrument that I wouldn't recommend to most people, but if you know what you're doing it can be a nice play.

Could you explain the correlation between Bitcoin dominance and the timing to invest in altcoins?

I don't fully understand why it's more favourable to invest in altcoins when Bitcoin's dominance is 50%+ (in your opinion).

It's simple - when Bitcoin's dominance is higher, altcoins have moved out of favor. When they go out of favor, there is more room for them to increase when they come back into favor. It's just another way of saying 'buy low, sell high' except instead of comparing altcoins relative to USD, we are comparing it to Bitcoin.

I think by the end of this entire fiasco, bitcoin (core) will hold 25-30% of the entire cryptocurrency market. This will not happen for probably another year or two though.

Have you seen any well-documented empirical evidence for this inverse correlation? I hear it often so I'm sure it has at least some merit, but I'd like to see some concrete data supporting it.

The past couple of months, I have often (but not always) witnessed Ripple (XRP) and DASH, being inversely correlated to BTC in terms of price. DASH often holds, or even grows when BTC falls. Except the recent correction this past week, where only Ripple held close on to its recent gains.

Great song! One of my guilty jams when it comes on in car.

lol...such an appropriate song to describe what has been going on this weekend:)

Hello, Could you make a video about how they manipulate the orderbook on the Gdax? And how we can spot it and what we should do when somebody is manipulating it. Thanks in advance!

Maybe in the future I'll record the order book for a while and watch through the footage painstakingly to find moments where it is manipulated. I haven't read it yet, but I think Bitfinex'd did an article recently about price manipulation on GDAX. He sometimes goes a bit too far with his theories, but he has a lot of good info so you pull from it what is useful.

Good to find you here in steemit land. I enjoy your logical, unemotional analysis on You Tube .... but in future will watch it here where I can throw you a tip {grin}. For the record I hold BTC for long term (2 year horizon) but should it hit $30k in the next month or two I shall definitely liquidate.

Keep up the good work !!

Thanks for stopping by magus, I appreciate it!

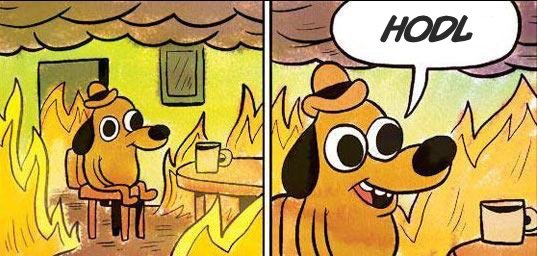

Actual picture of me...

At what dominance level percentage will you start selling your alts? And do you necessarily think that BTC dominance falling is a bad thing. I see it happening naturally as people realise the coin i

I already switched a % of my alts into Bitcoin - I think it's a good time to do so around 45% or lower. Perhaps I'll do more shifting if we hit 35 - 40%. It's not a bad thing for Bitcoin's dominance to fall - but I think it illustrates the speculative nature of the market. There are cryptocurrencies that are nothing but ideas with billion dollar market caps!

Here to. I am out of Bitcoin for this time and think it's shaking off the non believers for the next weeks. I will be back at a realistic price. We are not in economic collapse and people are just gambling. same feeling than the .com Bubble to me.

What value do you think this BTC dead cat bounce will drop to in the coming days/weeks? 8k?

No predictions - if it consolidates between $13,750 & below my limit for few days, I'll likely remove my sell and become more bullish. It just needs to slow down a few days to give people some breathing room and confidence in the market again that there is support under them.

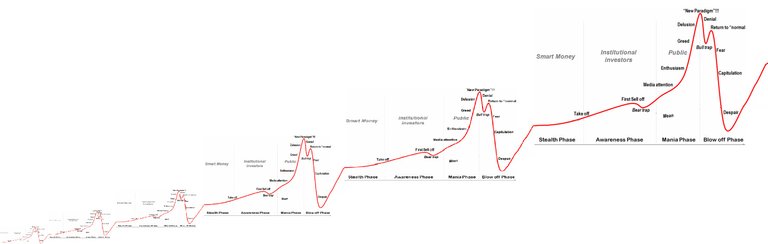

Although I'm very bullish long-term, that's my prediction for the short-term:

It's based on that well known representation of market bubble stages:

However, long-term I see that way:

What do you think?

It's following the short-term prediction! Hope it follows the long term as well!!

Thanks for the video man, I always love your insight. So as prices are fluctuating right now, like even since your video I think it went down to like 14k, would you still plan to buy more btc if it dips down to 12500 or below? Or are you waiting to see if the market stabilizes?

Hello cryptoinvestor, I think the optimal strategy would be to hold small amounts of btc and use some sort of trailing stop, instead of entirely off-loading your holdings at 17k. Given the nature of irrational markets, the run-up could likely exceed your expectations.

I won't be fully offloading at 17k - just a decent chunk. Maybe just the amount I bought at $11.5k and hold rest.

The dominance of Bitcoin will start to shrink in 2018, many great projects are going to start to offers real use cases for the mainstream population. I think Ripple and privacy coins will increase a lot in the coming year.

This is possible if we continue to see a bull market - but given the level of institutional support behind grand daddy Bitcoin and the amount of altcoins that really don't have use cases and are nothing more than ideas at this point, I wouldn't be surprised to see dominance stay more resilient than you might expect. This is especially true given that Bitcoin gets majority of the love in media and the only reason other altcoins are starting to get any love in mainstream (mostly ETH, LTC and IOTA) is because Bitcoin is causing so many waves.

Any thoughts on RaiBlocks (XRB)? They've been around for a while, but only recently stopped the initial distribution of coins. Anyways, great work on the channel, I never regret taking the time to watch your videos, and I like how you challenge assumptions.

Your content is tremendously helpful for me, as well as new people getting into crypto. You have a great niche as the "Voice of Reason" in this volatile space.

My question is in regards to what kind of consolidation (post the recent pullback) you would like to see in order to be bullish again on Bitcoin (Dollar amount, length of time, etc.). You mentioned that it has risen to far, too fast since the pullback and will be selling at 17,000. Do you have a specific methodology you use, and if so, do you apply it to all cryptos, or just Bitcoin?

Thanks again for your consistently solid content.

P.S. - I just picked up Cryptoassets today.

No methodology on it being too fast - this is the art of understanding market sentiment and trying to deduce what market participants are feeling. It bounced back 35% in a day, nearly 55% at one point - when I think of how most people will respond to that, I don't think many people will have full confidence in that rally and if it sells off, others will follow as they will collectively see it as a dead cat bounce.

We are starting to see substantial support at $13,750 which is making that level more and more critical moving forward. If we see Bitcoin consolidate between $13,750 & below $17,000 I'll likely remove my limit and just hold.

Great book by the way, you should find it useful (or at the very least informational). Thanks for commenting and the nice words.

Hi Cryptovestor, I only recently got into trading crypto currencies and I found your videos extremely helpful and informative. Which led me to watch all the videos you posted, because it gives me a bit recent history and background for this market.

It seems that your main focus is on decentralized currencies like Bitcoin and Ethereum, what are your thoughts on those centralized currency/token controlled and used by the banks and financial institutions. Ripple, for example, has the 4th biggest market cap right now, but I am not even sure if it can be consider as a crypto currency. Do you think these are worth investing? Since they are controlled by regulated firms, would you consider they are more stable comparing to the regular cyptos like Bitcoin and Ethereum?

Thanks a lot for all your videos and posts!

Given the amount of demand for me to discuss it, I will have a video on Ripple at some point in the future - so until then, keeping my thoughts on the down low.

Hey Crypto Investor,

Before you decide not to read this, please consider that I have put a great deal of time in writing you this tailor made comment.

Thank you for providing consistent quality content, I thoroughly enjoy hearing about your insights and have been a fan since watching your well made video on How the Bitcoin bubble will pop.

I am extremely new to the cryptocurrency and investing scene in general. I have read a few introductory books, including cryptoassets which you have highly recommended, as a basis for entering into cryptocurrency.

At the cost of being a casual investor that is riding the current wave of Bitcoin and soaking up any altcoin I can get my hands on, I have taken the time to understand the basic principles surrounding cryptocurrencies (I do not want to be one of those people who have sent BTC into an ETH wallet and wondered why the balance is not showing).

Could I have your thoughts on what you think the best methods are for a beginner like me to learn about finance and investing in general (for e.g. online courses). Furthermore, what basic investing principles do you believe everyone should have a grasp on before entering the market, particularly cryptocurrencies. Thanks!

Well it's difficult for me to tell you exactly how to learn finance from scratch because admittedly I have had a professional interest in finance, not just personal. But there are sort of 'holy grails' when it comes to books on investing. I'd recommend "The Intelligent Investor" by Benjamin Graham as it is the defacto bible for investing.

Unfortunately, a lot of what I know is from learning about equities, fixed income, real estate, derivatives and other traditional financial investments. There was also a short lived period of time that I was obsessed with Forex, which is when I learned the majority of what I know about TA (and where I learned to scrap most of it too).

The truth is, you don't need to know much to be successful. I'd study more about how to control emotions in investing and set a foundation so that you win no matter the outcome (even if it goes down). I have enough invested in other assets that it doesn't matter to me what happens with Bitcoin. I also have made enough with Bitcoin that I'll never exit the market with less than I put in. While it is a fallacy to think that you are only playing with 'profits' (as there is no difference between a 'profit' dollar and a normal dollar), it does prevent you from making stupid decisions that make it so you don't come out ahead.

Probably the easiest way to learn is to put in the Goldilocks amount of money into the market that you are 100% willing to lose, but it will suck / bother you if you do. That amount is different depending on your income and net worth, but find that amount and put it into market based on your thoughts and see how your emotions play with you. Best of luck!

This response does it for me. Such a sober and simple approach. Thanks for sharing these experiences and helping the community to be a reasenable investor! Also I enjoy reading and hearing your proper use of the english language.

Hey, @cryptoinvestor, I'm into Crypto for a month now, and a huge fan of yours. You helped me understand and learn a lot in such a short period. How can you explain the current stability and lack of volatility of ETHBTC? It is almost impossible to day trade it at the moment.

I’d love to see a tutorial on how to trade crypto to crypto. Currently I’m only familiar with how to evaluate US dollar valuations.

I keep selling off and rebuying my bitcoin all the time when it's not going straight up. This dip wasn't really all that bad, it was 'moderate' on the Fibonacci scale and stopped at .618 exactly - very foreseeable (I'm saying that with hindsight ;) - others this year were worse, and this is Christmas so your fears may be exaggerated. Also the Bitcoin Cash crew launched an attack at a tactically well-chosen time, otherwise the dip might have been even milder... they will of course keep doing that, destabilizing the market some more. All these things are factors. Day trading will keep us safe ;)

Thanks for your thoughts jojo.

De nada - here come the lows you were missing, a typical sign the so-called Christmas Market has finally taken grip with a double set of head-and-shoulders, big and small (but you have to look at the charts from some distance to see that).

Hopefully that will make your 17k scenario obsolete.

You refer to behavioral finance and market psychology frequently in your videos. Do you have a book(s) or source(s) you would recommend on the subject?

Thinking Fast & Slow and Irrational Exuberance are good books on behavior. I've read other books on the topics as well, but I tend to forget names. There was an interview in Market Wizards too that I recall liking, but don't remember which book it was in the series. You really don't need to read too much on it as it is fairly intuitive.

I’ve just got done reading cryptoassets. Great book and would like to continue down the rabbit hole. Any books you could tell me about, would be great. I consider you the master. You represent the way I would like to trade and want to learn from the best. I dabled in the crypto market several years ago and didn’t do my research. Ended up buying litecoin, leaving it in the cryptsy wallet. Totally forgot about it as life goes on.. wait litecoins over $300 i think i have 25.. oh that computer broke 2 years ago. Three days later, after providing life support to my hard drive, i can see they were sent to cryptsy. They are gone now. Anyways, I’m diving in head first for the long term, want to educate myself as much as possible over the next three months.

Hi, I was wondering how far in advance you plan your buying and selling? You mentioned youll sell at 17k as you think it will drop, do you have a set number you plan to buy back at before you sell at 17k? Or do you wait and see more than plan? Thanks.

I think that Bitcoin is the index of concurrency. We are pretty far away from a dominate alternative for Bitcoin in my opinion and the exchanges reflect that

I like how you calmly and logically look at all of this. Too many peaple are getting in without even knowing anything about this tech.

While I am more interested in the actual applications of crypto, it is impossible to divorce that from the market price. Once I actually get in on the market this will be a great help!

Many of the new investors I know, surprisingly held on. If anything, they wanted to buy more at 12K, 11K, and on the way up as well. Not because they give a shit about Bitcoin, but because they need to buy bitcoin to converts to Alts. We went in the Alts that we believe will eventually overtake Bitcoin.

Have you considered making alt buys based on likelihood of new listings on Coinbase? For example XRP seems heavily favored in the rumor mills and listing it would be inline with Coinbase's push to seem legitimate to institutional players. It appears to match almost all the criteria with the exception of perhaps centralization. The prospect of retail investors seeing that $1 price and however falsely considering it "cheap" seems too good an opportunity to dismiss.

That's more a longer-term catalyst, but yes larger cap cryptocurrencies and ERC-20 tokens might be good to look into given any listing on Coinbase can lead to a pump (similar to how listing on Bittrex does).

What if it doesn't go to 17000$ but keeps downward pressure? As I type this it seems to wanna dip further. At what low do you decide to unload at that junction...or do you hold...

Hold and buy more if it goes low enough. Tons of support at $13,750ish level so will be hard to break below that.

Bitcoin looks super unhealthy. Couldn't break $15550 and is collapsing fast.

Yup,it seems to be going down for the moment.The recovery seemed very fast yesterday.Perhaps the whales wanted to let people throw some more $ at BTC before continuing selling.

http://prntscr.com/hrony2

I think it can continue rising above 17K just because it always manages to beat its previous ATH after every dip . Will sell it if it reaches 21K before new year though.

What are your thoughts on creating a coin that's stable in value (max prices swings of like 5% either way), but still decentralized? It would seem with all these "smart" contract tokens, there would be someone who figured out how to create a stable coin, without having it to be centralized (like Tether)

Well the real world shows us how difficult it is to create a pegged currency, so it's not really a programming problem as much as it is an economics problem.

couldn't we peg it to the number of people on earth?

I have had simiar thoughts. I got lucky when my gut told me to sell at 18. I bought back in a little at 15 and a little at 11.5. Told my self i was going to sell at 16. I dont transfer to usd. I have been buying gold and silver with bitcoin. What are you thoughts on gold/silver? Also wondering what you think about steem. Its a crypto with a actual use case, low/no cost transactions and the network can handle transaction volume

Gold is a decent hedge against loose monetary policy, but as policies tighten up gold is in a weird situation. Geopolitical instability is on the rise, but given gold is driven more by monetary policy than geopolitical instability, this factor matters less than I would like it to. I don't hate holding gold now, but I generally prefer other options.

I like Steem - It's awesome seeing all the hard work people are putting into the platform. There is a tad too much abuse of the reward pool for me to be 100% confident in it - that needs to be sorted out at some point, but hopefully it gets better. It's definitely far ahead of majority of cryptocurrencies given that it has actual use cases and people are actually investing into developing new apps for it. I'd really like if full effort was put into this site as it has the potential of becoming one of the first killer apps for crypto if it were optimized and less abusable.

When you say abusing the reward pool, what exactly do you mean by that? Does it just mean posting shitty viral content rather than valuable content? Secondly, what do you mean by people are developing new Apps for it, can you build on top of the network in the same fashion as ETH?

@cryptovestor, I really want to thank you for your content. I got the crypto fever 2 weeks ago, and as you can imagine I keep reading, watching videos and consuming all possible content I can. I'm a Computer Scientist, so I understand a lot about the technology behind, but I know nothing about investing. All other analysts make me dizzy with all their jargon and, although it's clear you do know your trading and investing, I understand what you say and, BTW, I'm going to take a similar approach: If it gets to $17.5K, I'm selling half my Bitcoin. Then if it goes to $20K and starts to drop slightly, I will sell the other half. I'm convinced a sudden drop to $6-9K is coming, and I will immediately buy as much as I can then. Please, let me know if you think it's crazy. I don't even have 3% of 1 BTC yet, so...

I don't think you're crazy, but you might expose yourself to overtrading. While my channel may make it sound like I trade frequently, I really don't - just when I have sizable conviction.

Thanks for the article, and I like your pairing of a a written expository along with the video. That show some comprehensiveness to your delivery. More people here on Stemmit could learn from writing and delivery style imho. Due to the recent announcement with LTC and the technical analysis and market factors, I see a 4x gain in LTC by early 2018. I've moved much of my BTC position to LTC for this upward trajectory.

Thanks for noticing - it takes a little extra while to write the descriptions I do, plus there are other parts that take extra time (e.g: writing unique tags on YouTube), but I think such optimization helps in the long run. Good luck with the LTC investment!

Interesting perspective! I always enjoy your videos, especially when they seem contrary to my thinking because you divulge your thought processes and logic. My optimism leads me to think we are headed to 30k soon in the new year, but the climb back up to 20k will be reasonable and solid unlike the initial explosive frenzy that made those highs unstable. The gaps have been filled and there is room to breathe into new highs now, especially as a second wave of new investors will enter who heard about this opportunity from the wave at the beginning of December. Of course, this is not financial advice and is for educational purposes only. ;)

As a new guy in the financial world, how do you determine a 'healthy recovery'? Is this typical for bitcoin only or overall in stocks?

I'm holding tether till it dips lower I'm hoping to buy @ 8K. Do you think is is good to sell your alt holding and btc and hold tether till a low support level and buy in again? Ride up till whenever? Possibly when you also give a update I'll be sure to keep you advice in mind at 17k.

Do you use any robots for doing analysis or trading?

Hello I've been following you on youtube for quite some time. Unfortunately I didn't listen to you and bought at some of the highs, 17,000-19,000.

Right now I definitley see it trending downward. I did see that you mentioned bitcoin's 'market dominance' What do you think its threshold is or what it should be at healthy levels? Right now it's stayed between 40-50% market dominance. What do you think it means at 45% currently?

Currently bitcoin is hovering around 13300 USD , Should I buy now ?

I greatly appreciate your perspective as it helps me to be more pragmatic. What are your thoughts on taking a long position in litecoin right now? It just seems so undervalued. Thanks!

Why do you think that Bitcoin dominance should necessarily be higher than 45%? Could it be just that people are now beginning to see more and more value in altcoins relative to Bitcoin and 45% is about the highest Bitcoin is going to be from now on?

Hi I found your Steemit via this YouTube video.

What's your take on Ripple? Do you think it will be influenced by Bitcoin too or go its own way?

I'll be doing a video on Ripple at some point given the demand for me to discuss it, so will be keeping my opinion on down low until I do that.

Do you think there will be a mass exodus come the 1st of the New Year? It seems like a lot of people dabbling have held off on selling only to avoid capital gains tax this year.

No opinion really one way or another. If Bitcoin consolidates a little longer, it usually breaks out to upside rather than downside (at least that's for sure over past few months), but the party does have to end at some point so who knows when.

I think it's important that an altcoin finds a way to be independent of bitcoin. So if bitcoin crashes immensely, they wont be drug down too.

Love your videos and tips on approaching the coin market with the proper emotions.. was wonderinf if you could do an updated review on trx, they have a 20% coin burn coming up next week, and I think long term it is promising too. Thx

You stated that your ETH price target is 5.5 - 6 million Satoshi.

If/when this target is met, do you sell ETH for BTC?

Or would you sell for a fiat currency?

My original USD investment into BTC was extremely small (less than .15 BTC at time of purchase) so I held onto most of my alt coin positions during this dip. I sold a few that bounced back a bit faster than BTC did just to maintain my satoshi gains.

I'm considering moving my BTC into ETH if BTC continues to rise again as ETH seems like the better long term investment at this point. I still have a few alt coins that I plan to hold onto for at least a few months but I have set sell points for those as well.

Your videos are one of the few consistent spots I find logical and well thought out information, so thanks for your updates.

Thanks for the kind words - best of luck with your investments.

Dude,you are killing it.You offer very rational advice.Ignore these "wannabe-investors" and critics that just "know" better.Had they sold BTC at 16k-17k they could have bought it back at lot more BTC at 11 to 12k for a massive discount.What was their advice?"JUST HOLD" :))

Holding is a safe move for people not doing daily trades , first they get less stress when it drops , health first :) and then they believe on their project investment , on the idea behind and the team working it , so chill and wait it to moon

Agreed, you are not always right but who is in this market? At least you make rational predictions based on evidence rather than emotion.