Short history of money. Introduction to the Bitcoin. Part 1/2

Before I start writing about Bitcoin, I have to talk about the general essence of money and the basic economic factors that control it. This is needed to understand my articles about Bitcoin that I'm going to publish in the near future. It is essential to understand what money really is and how the financial system works today. This may seem trivial to many people, but I can guarantee that the vast majority of people have misconceptions about it. I will try to be as brief as possible on this subject and will only address the basic and necessary issues. I will also try to present this topic in as simple and interesting a way as possible...

Origin of trade

At first, there was only barter trade. It consisted in the exchange of various objects in exchange for other objects. This was very impractical. Having e.g. a skin of an animal and wanting to replace it with e.g. a tool, the owner of this didn't want to replace it with the skin that we had. He might have cared about meat or anything else we didn't have. It was also difficult to convert the values of different items into different ones, and to divide them into smaller parts if necessary. If someone wanted to buy for example some meat in exchange for spear and the spear was worth much more than we needed this meat, we had a problem ;) As you can see barter trade was very impractical.

How did people start using gold and other precious metals as a means of exchanging values?

Humanity has solved the problem of barter trade by using gold and silver as a means of exchanging values. Why were these two elements used, not the other? All over the world, different civilizations have always come to this metals for a simple reason. The rest of the elements could not be used as "money"...

The element that can become money should have several conditions. It must be easy to store, so it must be in a solid form. All gas and liquid elements fall off. It could not react with other common elements, i.e. e.g. oxidize, corrode, etc. E.g. lithium in contact with oxygen ignites to huge temperatures (you have heard about exploding batteries of phones? :)). Another condition must have been the rare in the nature. Most elements such as coal are popular. It also had to be safe for people. Radioactive or flammable elements also fall off.

Only five elements remained in the elimination process. Gold, silver, platinum, rhodium and palladium. Rhodium and palladium were discovered after 1800. Platinum melts at 3214°F, the temperature that once was unattainable for people, and silver gradually dulls. In this way all civilizations always used gold. In order to eliminate the problem of different size of nuggets and difficulties in assessing their weight, over time a fixed quantity of bullion was standardized by minting coins of the same weight.

How did the paper money come about?

The gold was difficult to divide into smaller pieces, its weight was high and the wealthy were simply afraid to steal it. Over time, treasuries were created which were the protoplasts of today's banks. For a small fee people started to deposit their gold in them. As a confirmation of the deposit, the treasurer issued a paper receipt for the amount of gold he was given for safekeeping. Naturally, instead of paying with physical gold, people started to pay with their vouchers for the gold they had deposited in their vaults, because that was simply more convenient. Instead of paying someone e.g. 20oz of gold, people gave a receipt for it. Then the seller could collect real gold from the treasury on the basis of such a receipt.

This is how the first paper money was created, which was converted into various currencies. Over time, they have been issued by governments. All this money still had real coverage in gold, i.e. $1 was worth one ounce of gold that existed physically and was in the treasury of the country. The name "banknote" is derived from "bank-note".

How did the fiduciary money come into being?

We have a limited amount of gold in the world, so it was not possible to freely produce more money. Money existed only to give gold a more convenient and simpler form, but in fact the trade still was based on gold. In this way the world functioned for a very long time, until in the previous century the countries began to replace the existing money with fiduciary money called "fiat" (from the word "fides" - faith). For example, the government of the United States abandoned the "gold standard" in favour of the fiduciary dollars in 1971. Since then, the US dollar has not been covered by gold or anything else.

Currently, all commonly used official currencies, such as CHF, USD, EURO or PLN, are fiduciary money. They are not covered in gold, nor in anything else that has a limited physical quantity in the world, which would make it impossible to create more of them freely. For this reason, their issuers, i.e. the central banks on government orders, could produce any amount of them. This has had many different economic consequences.

What is money?

Most people don't understand what money is. People live in our civilization and from their own observations conclude what they are, but no-one educates us from the fundamental essence of what it actually is.

MONEY ITSELF HAS NO VALUE. It doesn't matter whether we mean fiduciary money, gold or diamonds. Every money is only a means of value transfer. Let us remember that it exists only to make easier for us to exchange various kinds of goods in trade. Goods and services have value (work is also a service). It doesn't matter how much fiduciary money we produce in the economy we still have the same amount of goods. GDP (gross domestic product) determines how many of these goods are produced by society over a given period of time. If we start producing more goods than we have consumed so far, GDP is rising. The value of a country's currency in circulation depends on the amount of goods in circulation.

The amount of money in circulation and its value

Not many people understand it, but in the economy EVERY NUMBER OF MONEY IN THE ECONOMY CENTER IS GOOD. Economics automatically regulates the value of a given currency through inflation and deflation.

If we start to produce fiduciary money in increasing quantities and the gross domestic product remains at the same level, then the effect of inflation occurs. Money is starting to lose its value. If a government did not produce additional money, which would be released into circulation and the amount of goods would increase, there would be the opposite effect, namely deflation. The money would start to gain in value.

No matter how much money there is in the economy, the market automatically regulates its value by means of these two factors. Inflation and deflation.

Hyperinflation

If we become aware of these facts, it will be clear to us that creating additional money does not give us anything. MONEY HAS NO VALUE. We are only increasing the number of units in circulation that serve us to trade goods and services.

Imagine that the U.S. government produces huge amounts of additional fiduciary money and distributes $10,000,000 to each citizen, and then the entire society, trying to spend it on various types of goods, would quickly consume all the goods it has and the service providers would not be able to satisfy the huge demand for their services. Everyone could afford everything. If all of a sudden every citizen wanted to buy an expensive property, Lamborghini, thousands of different items, they would quickly become missing for everyone. For example, a car manufacturer might have sold all the cars and got a lot of money for it, but he wouldn't have used them himself because he wouldn't have been able to hire more people, buy components and produce enough more cars. He would not even be able to spend that money on anything, because the economy would start to run out of everything.

Companies increases prices. A car manufacturer with few and many more cars to buy would increase prices. For people, money that they have a lot of and cannot buy anything for loses its value. We are ready for goods whose deficit is to be paid more and more. In this way, inflation works and the value of money decreases.

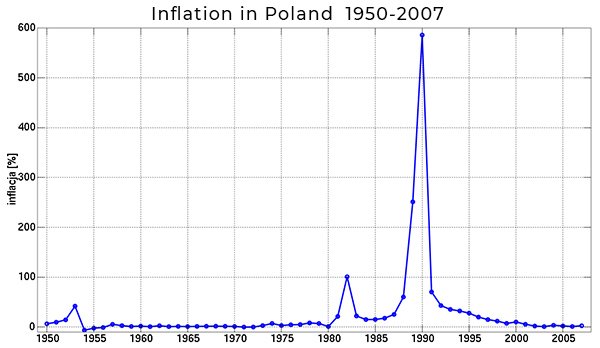

After the change of political system in Poland in 1989 and the change of system from socialist to capitalist, Polish zloty was affected by hyperinflation. Its value fell at an incredible rate. After the zloty exchange rate stabilized in 1995, the zloty was redenominated by cutting four zeros. At that time, no coins were left in circulation as they were of too low a value. The smallest denomination was a PLN 100 banknote, which was replaced with a 1gr coin after the denomination. The PLN 1,000,000 banknote was replaced by the PLN 100 banknote...

A well-known example of hyperinflation is the Zimbabwe dollar, where the authorities have been repeatedly printing huge amounts of fiduciary money, resulting in a steady decline in its value at an enormous rate. The denominations used were still too small to be handled comfortably, so the government was constantly putting more and more banknote denominations into circulation.

The dependence of the value of money on the value of GDP during wars is very visible. If a country starts hostilities, its economy becomes paralysed and the value of its state currency automatically drops because it is the same, but the amount of production of new goods is very slowed down. The last example of such a process is Ukraine and the fall in the value of hryvnia.

A graph of Ukrainian Hryvnia to the USD over a 10-year period. Decrease to less than 20%

This is the end of the first of the two parts. Expect the second soon ;)

Guys, if you want to have a look and get some information in a good ICO that will start by the end of the month, I can suggest you RAWG.

The ICO site is this one: https://token.rawg.io/.

It's a video game discovery platform that converts your skills into goods and services.

You can earn tokens by playing your favorite games. The site is already working, with more than 50,000 games in the database and new games are getting added every day. This is the site: https://rawg.io/

Quite good looking, don't you think?

Have a look! I hope this information is helpful.

Hi @cyberpunkbtc! You have received 1.0 SBD @tipU upvote from @cardboard !

from @cardboard !

@tipU pays 100% profit + 50% curation rewards to all investors, allows to automatically reinvest selected part of your payout and other cool stuff :)

If you want to delegate, write a comment: @tipU I want to delegate X SP - where X is the amount of SP, and @tipU will answer you with a link :)

tipuvote! 1 :)

Thanks bro :)))

Short and sweet. You deserved more votes xD