Bitcoin’s very public scaling debate is entering a crucial phase. Two of the most popular scaling proposals available today — BIP148 and SegWit2x — both intend to trigger Segregated Witness (“SegWit”) activation within a month, which means that the protocol upgrade could be live within two.

At the same time, there is a very real risk that Bitcoin “splits.” Both BIP148 and SegWit2x could diverge from the current Bitcoin protocol, which could in turn lead to even more splits.

SegWit

SegWit is a backwards compatible protocol upgrade originally proposed by the Bitcoin Core development team. It has been a centrepiece of the scaling roadmap supported by Bitcoin Core since the protocol upgrade was first proposed in December 2015, and it is implemented on many active Bitcoin nodes on the network today. SegWit is now also part of the “New York Agreement”: an alternative scaling roadmap forged between a significant number of Bitcoin companies, including many miners. And Bitcoin Improvement Proposal 148, or BIP148, a user activated soft fork (UASF) scheduled for August 1st, also intends to activate SegWit.

The first and original option was proposed by the Bitcoin Core development team. Their SegWit code, defined by BIP141, activates if 95 percent of hash power within a single difficulty period of about two weeks signals readiness, before November 15th. Assuming that the miners who signal readiness are actually ready to support the upgrade, risks of a split in Bitcoin’s blockchain and currency are minimal.

However, currently only some 40 to 45 percent of hash power is signaling readiness for BIP141. This is why a segment of Bitcoin users plans to activate SegWit with the BIP148 UASF. Starting on August 1st, their nodes will reject all blocks that do not signal readiness for BIP141. If this proposal is supported by any majority of miners (by hash power), these miners should always claim the longest valid chain, which should activate SegWit on all SegWit-ready Bitcoin clients and avoid a split. But if this proposal is only supported by a minority of miners, a “BIP148 chain” could split off from the current protocol.

The New York Agreement, also referred to as the “Silbert Accord” or “SegWit2x,” plans to activate SegWit through BIP91. Like BIP148, all BIP91 nodes would reject any blocks that do not signal readiness for BIP141. But unlike BIP148, BIP91 nodes would only do this once 80 percent of hash power signals that they support BIP91, within a period about two days. This should also minimize the chance of a split.

However, the second step of the New York Agreement is a hard fork to double Bitcoin’s “base block size.” This change, as opposed to Segregated Witness itself, is not backwards compatible, and could therefore lead to a “split” as well.

July 21st - Beginning of the End

The SegWit2x development team aims for July 21st to be the day that BTC1 nodes are actually up and running, and, importantly, the day that miner signaling should commence.

This shouldn’t really affect regular users either.

But if you are a miner, you may want to help activate SegWit by signalling readiness for BIP91. (This is done by mining “bit 4” blocks; for example, by mining with BTC1 or with Bitcoin software that includes a BIP91 patch.) The precise threshold for BIP91 activation requires that within a pre-defined series of 336 blocks, 269 blocks must signal readiness. That’s some 80 percent of hash power, over about 2 1/3 days. So assuming the SegWit2x roadmap is followed, BIP91 could, at the very soonest, lock in on July 23rd.

Again, this shouldn’t really affect regular users. But if you are a miner, and BIP91 does activate, you now have another day or two to comply with the BIP91 soft fork. If you don’t, you risk mining invalid blocks.

Reduced Transaction Charges in Blockchain

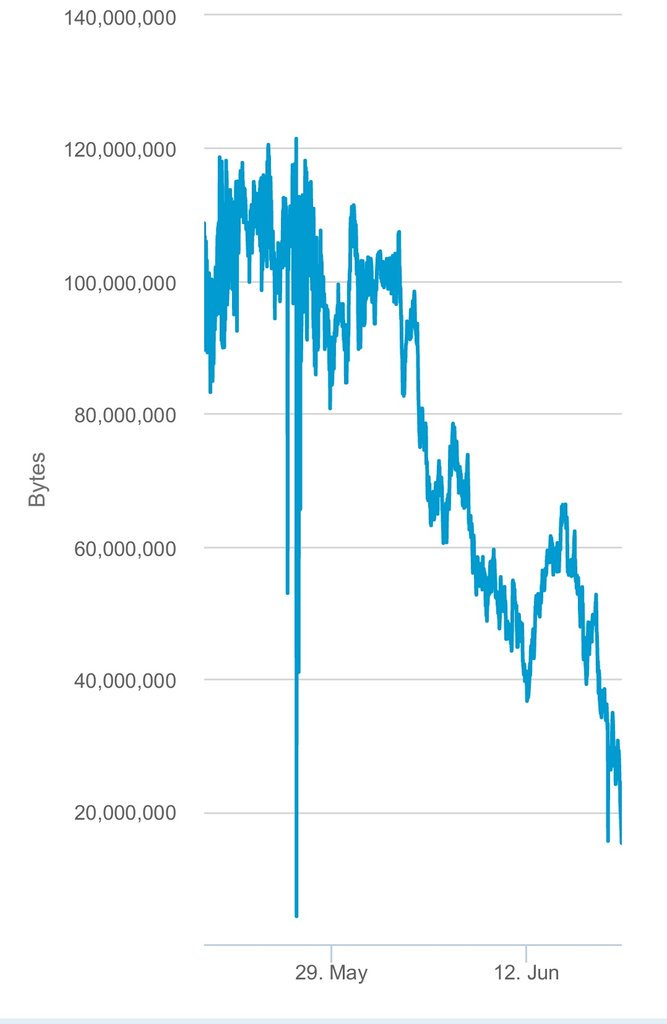

In late May, the size of the Bitcoin mempool reached an all-time high at around 120 GB. The large pool of unconfirmed transactions within the network led to the congestion of the entire Bitcoin Blockchain and the delay of transactions that had attached appropriate and proportional fees.

For over a month from May 1 to June 15, the Bitcoin mempool remained unreasonably large as the mempool failed to clear transactions during the weekend. Previously, the Bitcoin mempool had always cleared the majority of its unconfirmed transactions during the weekend when substantially fewer transactions were being settled on the Bitcoin Blockchain.

However, the failure to clear transactions during relatively inactive periods led the Bitcoin mempool to expand and store even more transactions.

Abruptly, the size of the mempool decreased within a matter of weeks and within 21 days starting early June, the size of the mempool declined from 120 GB to 20 GB.

On May 12, Cointelegraph reported that the activation of a viable scaling solution is urgently needed due to the abnormally large size of the Bitcoin mempool.

Several analysts including Bitcoin researcher Ben Verret suggested that the sudden decline in the size of the Bitcoin mempool is a direct result of the termination of network spam and that because the activation of segregated witness (SegWit) is getting closer, spam transactions have stopped targeting the Bitcoin Blockchain.

In my opinion bitcoin wont die never , the confirmation yeah its takes sometime very low but depends how much fee do you add into transaction . The principle is very simple , if you add a good fee into transaction then you have a high priority on transactions to be confirmed

If you put a low ammouny to transaction fee then you have to wait more days

I usually use blockchain wallet is one cloud wallet , they have automatically fees for transactions and they are confirmed fast

Bitcoin wont never die , the CEO from blockchain and many importants people told in an interview that bitcoin can reaches 500.000€ in 2030

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://bitcoinmagazine.com/articles/countdown-segwit-these-are-dates-keep-eye/

I don't feel Bitcoin will be hurt in the long run. This is just a time of change, and since all the altcoins look up to Bitcoin fork, it made anxiety and panic in the market.

However, Bitcoin fork is for solving some ongoing problems, they don't happen to create bigger problems, even though market fears it massively.

I think Bitcoin will hit around $4.000 mark just like Goldman Sachs is predicting in the late 2017.