For education purposes only.

Following from yesterday's review (here), the BTC price has recovered somewhat and is currently trading at $7,380 (Bitfinex).

BTC convincingly broke the most recent downtrend line (red, dashed), but now has some work to do to break the heavy overhead resistance (2 descending resistive trendlines and a horizontal resistance level at $7,800).

I suspect the BTC price will get through the first, relatively weak (only 2 price touches) resistive trendline but will retrace following a touch on the second stronger trendline.

That subsequent pull-back may be an opportunity to go long BTC, assuming the price doesn't then break down below the previous lows.

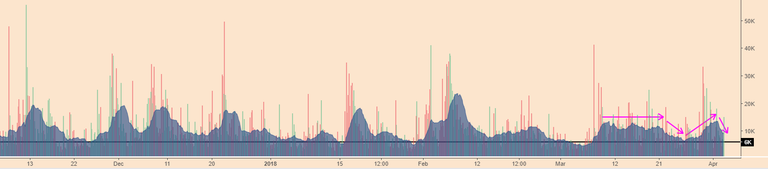

Volume

The trading volume has fallen off, however the averages remains above the 10k mark (Bitfinex).

The On-Balance-Volume (OBV) indicator has seen a steady decline over the past week or two (suggesting sellers are firmly in control), but today appears to be bottoming out. I would like to see a convincing break of the most recent descending trendling (red, thinline) and a hold above a previous high, to set us up for a potential trend reversal.

Bias

Last week I was a Neutral Bear, yesterday I was Neutral and today I'm a Neutral-Bull. The price needs to follow through, convincingly break above £7,800, test the descending trendline (approx. $8,200) - with some confirmation of the OBV, pull-back, make a higher low, I would then consider taking a long position on BTC.

Until tomorrow,

Bobby

Hi, davidwilsonuk1! I just resteemed your post!

I can also re-steem and upvote some of your other posts

Check out @resteemyou's' introduction post

PS: If your reputation is lower than 30 re-blogging with @resteemyou only costs 0.001 SBD