The SEC temporally suspended the trading of two cryptocurrency ETN-s in Sweden. The “Bitcoin Tracker One” and the “Ether Tracker One” can’t be sold to US investors until the 20th of September, but the prohibition leaves open the case when US investors want to exit this assets.

Not in the US

The issuer, XBT Provider made a Clarification, explaining that the suspension of the trading “of the securities Bitcoin Tracker One and Ether Tracker One relates only to trading in the Unites States, does not apply to trading on the listing market - Nasdaq Stockholm, and does not relate to any action taken or failed to be taken by XBT Provider AB”.

XBT Provider has not sought registration or trading of these securities in the U.S., but “broker-dealer” could do it. (Bloomberg.com wrote about it in August.)

No importations, please

What is happening? I think nothing surprising. The SEC denied the permission to issue, if I’m counting it right, nine different cryptocurrency-ETF’s in the last weeks. It is comprehensible that the supervisory organization doesn’t want to allow similar products on US stock market coming from abroad, either.

The Swedish notes are coming from a regulated market, the Nasdaq Nordic, in Stockholm. But are representing an even higher level of risk than the ETF’s. ETF’s – “Exchange Traded Funds” – “represent a stake in an underlying commodity” (Investopedia). It means, this funds are really buying the stock, commodity, cryptocurrency or other product they are following.

One more risk

The ETN’s are “structured products that are issued as senior debt notes”, are more like unsecured bonds. By ETN’s, you have to risk the bankruptcy of the issuer (“underwriter”), which means at least one risk more than by ETF’s.

That doesn’t mean you can’t buy ETN’s, there are a lot of ETN’s on US markets. For example, following the crude oil, other commodities, the VIX S&P 500 volatility index, Indian stock markets etc. (See a list here.)

No panic today

What are doing this ETN’s today in Europe? You can track them on Investing.com – Bitcoin, Investing.com – Ether, or on Nasdaq NSCX – Bitcoin , Nasdaq NSCX – Ether. Also on Bloomberg.com, here, and here.)

Are investors in panic today? No. The fair value of the products can be seen here, and it isn’t very different as today’s stock exchange prices of the notes. (There are also some products issued in Swedish Crowns /SEK/, I linked only the Euro nominated ones.)

Small funds

The funds are relatively small, 150 Millions of Euros by the Bitcoin Tracker, and 37 Millions by the Ethereum Tracker. With a Bitcoin trading volume of 3,7 Billion USD in 24 hours, the market could afford the liquidation of this funds easily.

The worry

The one and only major worry is the negative attitude of the SEC. When and if it changes, I don’t know, but regulatory, supervisory and watchdog organisations, lawmakers are often late, running behind the new realities. Some European countries not even recognize the existence of cryptocurrencies.

Disclaimer:

I am not a financial advisor and this content in this article is not a financial or investment advice. It is for informative purposes only, or simply to make you think, entertain, increase testosterone and adrenaline level. Consult your advisers before making any decision.

Info:

You can message me in Discord.

(Photo: Pixabay.com)

I think the SEC will come around. If not in Q4 of this year, certainly by Q1 of next. Until then, I'll continue taking advantage of the low prices.Great post @deathcross. Even better username! Damn I wish I'd have thought of that...haha

Well the US FedGov (and Wall St) has been in all out war with Crypto since last year. First they ignored it. Now since late 2017 they are trying to destroy it. Just like their fraudulent actions back in the 2000s culminating in the 2008 GFC, these huge institutions are destroying people's lives just to keep their economic privilege. It is economic warfare, pure and simple.

First they ignore you, then they laugh at you, then they attack you... then you win.

They try to resist, but now they cant. Now what they can do is work around it to protect themselves getting obsolete.

They can be sold to US investors in 20th September, so this is gonna happen in few days ahead. I think this will be then a good piece of news that may push the prices more up after September20.

Anyway I persinally believe a lot of good stuff will happen with crypto in this Q4 of 2018.

They just need somebody to attack)

It's hard to get a read on the true intentions of the SEC. Things like this aren't so straight forward and there is usually a number of moving parts behind the scene.

Nice Blog buddy

This post has received a 14.43 % upvote from @boomerang.

Thank you for bring everything in detail

pls folow me

btc keep dumping every now and then

continue to succeed in steemit. Hopefully this article is useful for others to be an inspiration. and continue to create scientific works.

Posted using Partiko Android

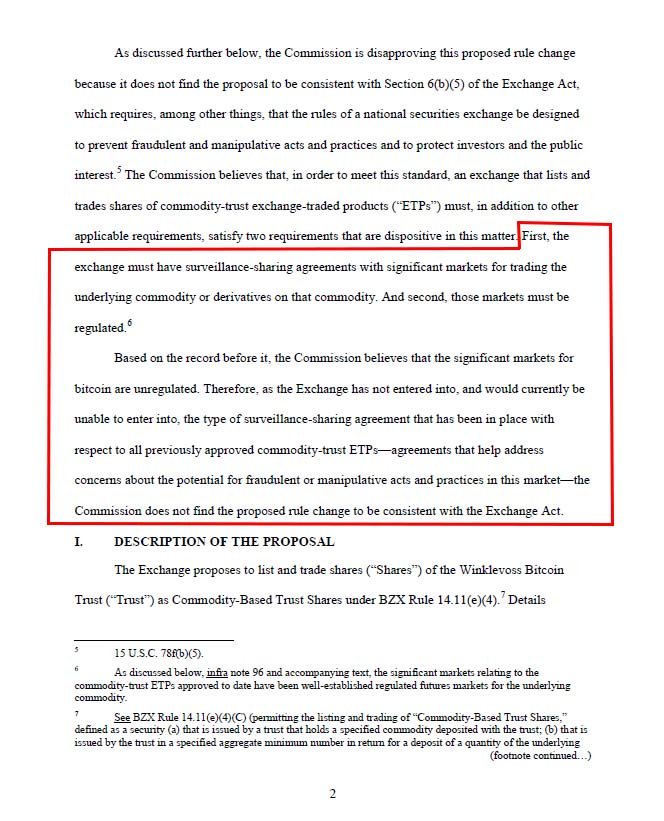

iirc, the reason the SEC hasn't authorized any ETF's and isn't likely to authorize any is stated in thier decision:

"First, the exchange must have surveillance-sharing agreements with significant markets for trading the underlying commodity or derivatives on that commodity. And second, those markets must be regulated"

"Based on the record before it, the Commission believes that the significant markets for bitcoin are unregulated. Therefore, as the Exchange has not entered into, and would currently be unable to enter into, the type of surveillance-sharing agreement that has been in place with respect to all previously approved commodity-trust ETPs—agreements that help address concerns about the potential for fraudulent or manipulative acts and practices in this market—the Commission does not find the proposed rule change to be consistent with the Exchange Act"

Allow me to translate that into english:

The existing market of cryptocurrency exchanges are too decentralized......and as such, surveillance-sharing agreements can't be obtained (or have not been obtained).

The SEC claims they want names, account numbers and trade data when they suspect manipulation. Whether that is their intent or not is another question.

If the market moves volume toward privacy oriented DEXs (decentralized exchanges) with no KYC/AML, a BTC ETF could never be approved by the SEC, imho.

Heres the comments from the March 2017 Winklevoss decision. Every ETF denial in 2018 has had similar language requiring surveillance-sharing agreements.