If you can remember this story, it will give you a very powerful tool that will help you understand the limitations of certain crypto-currencies like Bitcoin, and will help you discern which will thrive and which will ultimately dry up and expire. I first read about it from Paul Krugman and just as he promised, it has dramatically shaped the way that I view the world. In fact, the way he put it was, that "it is a story that could save the world."

The authors belonged to a baby-sitting co-op, where a group of 150 young couples agreed to exchange baby-sitting services for each other. This way, they didn't need to pay for baby-sitting, they could just exchange their services.

In order to keep track of all the baby-sitting and who was owed who, the Capitol Hill co-op created a piece of paper, like an IOU, called a Scrip, equal to one hour of baby-sitting time. And over time, each couple would automatically do as much baby-sitting as it received in return. It sounded like a perfect system.

And it was a perfect little system, that is until opportunities to go out became a scarce. A typical parent would then start collecting Scrips and would build a reserve. They were at home watching their own-children anyway, so they might as well be rewarded for it. In an ideal world, that would be OK, because the couple could just collect coupons until opportunities opened up.

But what happens when there aren't enough Scrips in circulation? And what happens when a select few end up owning most of the Scrips in circulation? This is exactly what happened and it made a lot of couples anxious to spend their precious little Scrips, causing them to hoard more Scrips by seeking out baby-sitting opportunities. While this is a fine strategy for an individual, it is a terrible equilibrium if everyone is thinking the same thing - It makes it very difficult to earn Scrip coupons because no-one is willing to go out.

The fact that no one was willing to spend should sound an awful lot like a recession where the problem only feeds on itself with the potential to spiral out of control.

Interestingly, a lot of the co-op members were lawyers and so they tried to legislate recovery. They required couples to go out at least twice a month, but it didn't work and eventually they realized that they had to issue more coupons instead. In other words, the ultimate solution was monetary and removed the scarcity of Scrip coupons, allowing couples to feel less anxious about going out.

The story highlights the fact that monetary problems are often technical - there wasn't enough Scrip going around. It is a starting point, from which you can use your imagination to add the ability to borrow coupons, add central banks which can control the amount of Scrip currency, changing the total supply to stimulate a depressed baby-sitting economy. This is a powerful tool and incentive to help the co-op at times when it is cold and dark and people in general don't want to go out as much.

Understanding this central tenet is key to understanding Bitcoin and crypto-currencies where the supply is limited. Such currencies are especially prone to falling prey to there not being enouch "coupons", leading to hoarding, which in turn leads to more hoarding, and causes the number of Bitcoin transactions to plummet. Since Bitcoins are mined and since the monetary base has a pre-defined growth trajectory that has nothing to do with whether the economy is "hot" or "cold", there will be nothing anyone can do if the economy runs into trouble. The number of transactions and the health of he Bitcoin economy aren't taken into account. It is also problem that is compounded when people mistake a currency (a transaction facilitator) with an investment opportunity (a claim on future income) because it introduces investor sentiment and the whims of behavioral psychology as another factors influencing the monetary base.

I hope the story makes sense and that you'll use it to simplify the convoluted stories we are told in order to make better sense of the world. I also hope it is clear that not all crypto-currencies are created equally or that I'm in anyway being negative about them in general. But whatever the future of crypto-currencies, I hope that it has an elegant response to the instructive story of the Capitol-Hill Babysitting Co-op.

Wish You Success

@destinyworld

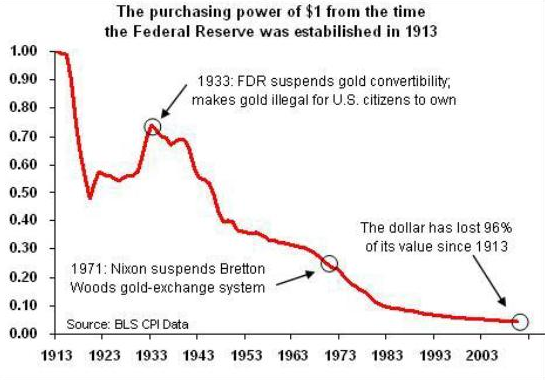

Well thats a very nice little story. Unfortunately it is based on flawed Keynsian logic. The government’s interference in the monetary supply has almost always had negative effects on the economy long term. Take a look at the purchasing power of a dollar since the federal reserve act of 1913.

And then even if your anicdote makes sense in theory, it still assumes that the federal government is made up of people competent enough to centrally operate what is bascially a global currency. Thats a big assumption, and likely an inaccurate one based on the track record of governments.

Sound Money>Stable Money