A couple of weeks ago, I wrote about 16,000 Bitcoins being moved from Mt Gox wallets. On May 10th, another 8,000 Bitcoin were moved from the same wallets.

And yesterday we had Bitcoin at $8,200, from almost $10,000 as it was two weeks ago.

A few people in the crypto spaces speculated that the price dip we experienced in the last few days was due to the "Tokyo whale", Nobuaki Kobayashi, the trustee of the now defunct Mt Gox exchange, dumping all that Bitcoin he has to get rid of.

It's difficult to state this with certainty, given the quasi-anonime nature of the crypto markets. But I tend to believe this theory. And here's why.

OTC versus Exchanges

The previous sales of BTC by the "Tokyo whale" were highly criticized by market analysts, which suggested to the trustee to go via OTC (Over The Counter) market, instead of exchanges. The reason: if the markets "don't see" the private price agreed in an OTC transaction, the price can't be manipulated. To a certain extent, this is true.

But in real life, this doesn't stand.

Suppose you agreed to a private transaction with Mr. Kobayashi, in which he sells you 8,000 Bitcoin at a very, very discounted price. That's the nature of OTC, by the way, it's all direct negotiation. And since Mr. Kobayashi just wants to liquidate his toxic asset, he will give discounted prices. Even discounted, these prices are incredibly higher than Bitcoin price in 2014.

So you wake up the next day with 8,000 Bitcoins which you bought, with, let's say $7,000 each. And nobody knows about this price, since the transaction was private and all. Now, there's this little thing in the market called "arbitrage". If you get an asset worth $9,500 for just $7,000, what would you immediately do?

Take profit, of course. And even a $600 / Bitcoin profit would be just enough at these numbers, resulting in an unbelievably easy $4,800,000 profit, made "just like that". That's an immediate ROI of almost 1%, which also opens the door to a re-entry, because the price will go down as a result of your own selling. So you get some profits, push market down, and then re-entry. Eat the cake and keep it. Please keep in mind these numbers are just illustrative, as a way to explain the mechanisms by which the floating Mt Gox Bitcoins are still a toxic asset.

So, even if Mr. Kobayashi doesn't dump directly on the exchanges, his clients are certainly free to do that. Because Mr. Kobayashi doesn't care if he sells to a Bitcoin maximalist, who is all HODL and stuff, or to some speculative actor, let's call it "institutional money", who just wants to:

- take as much profit as he can from his trades

- lower the entry point for more trades like this one

So, as long as the assets of the defunct Mt Gox exchange are still floating out there, and as long as highly speculative actors, loaded enough for the level of this game will be interested in playing the crypto markets, I think we're going to still see a lot of choppy trading.

I'm a serial entrepreneur, blogger and ultrarunner. You can find me mainly on my blog at Dragos Roua where I write about productivity, business, relationships and running. Here on Steemit you may stay updated by following me @dragosroua.

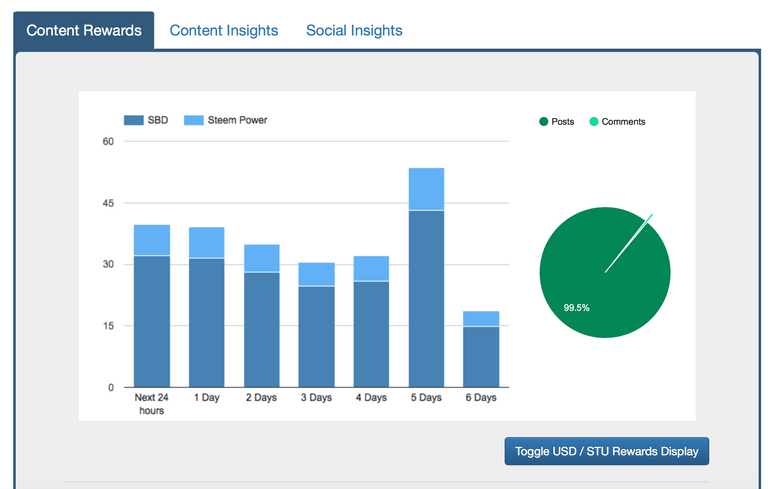

Wanna know when you're getting paid?

|

I know the feeling. That's why I created steem.supply, an easy to use and accurate tool for calculating your Steemit rewards |

all i could think about when reading this was the problem with the world is greed.. . expecting bitcoin to go up this week now and it's great to see steem hold in there! :)

its free to use!oh thanks

I definitely agree. Usually a sale doesn’t have no affect on the market, even with OTC

Owk this is cool as finally we now know the reason for the dip coz I have been trying to figure out what the cause night be. We are almost in the middle of the year and we still don't have a stable crypto chart. Should we be worried or do you think things will get better?

Stable charts makes trading uninteresting:)

You have a point, scarcity raises demands and demands drive price. So the dunping must have definitely affected the price of bitcoin thereby bringing it down

MtGox is one of the ghosts that continually crash the market. He who hold gold make the rules:)

To bad were not smart enough to break the chains and move away from Bitcoin. This will continue. Great post man....

The big whales are playing with the crypto.

Interesting article....I was wondering why BTC price fell the way it did.The silver lining is that BTC is very resilient and will bounce back with a vengeance.

Thank you for your fair opinion and post. I enjoyed it.

The biggest problem is that they recovered around half a million BTC. With how Japanese liquidation laws work, he is required to sell them all.

Most of which will then return to MtGox Founder Karpeles who doesn’t want the money tho

how long before he runs out?

Thanks for sharing. This pretty much make sense

its like a dark cloud in front of the bull run