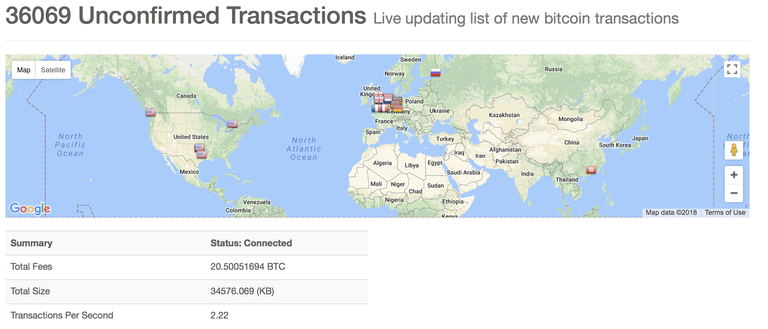

Bitcoin is now operating with just 35,000 transactions waiting to move at 2.2 transactions per second, significantly lower than the 300,000 or higher backlogs we have seen at around 20 tx/s.

Fees therefore have fallen from their high of around $70 per transaction, but still stand at $3, far higher than ethereum’s one cent current transaction fees.

Bitcoin’s current unconfirmed transactions levels.

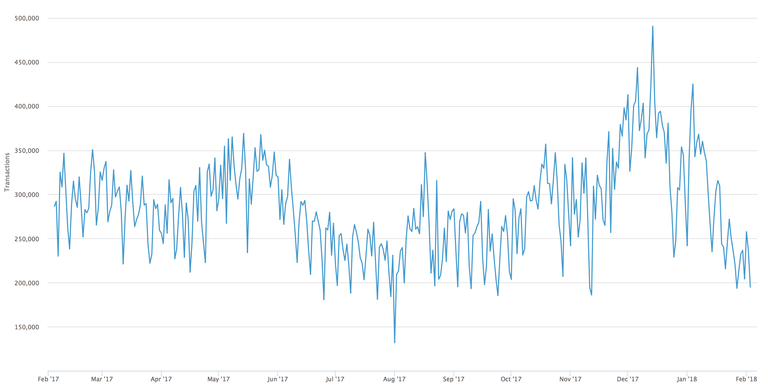

Bitcoin is now processing only around 170,000 transactions a day, more than half the almost 500,000 it processed on December the 14th.

The network is further running at below capacity with just 2.2 tx/s, less than the around 3-4 a second it can currently handle.

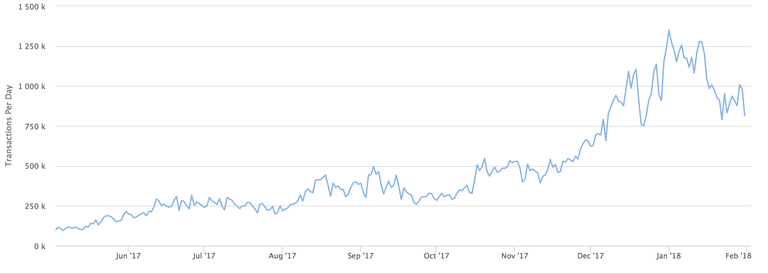

Bitcoin’s transaction levels.

Some are saying the reduced level might be due to some exchanges now bundling withdrawals, so that instead of instantly sending each withdrawal to each individual, they send one withdrawal transaction to many individuals at the same time.

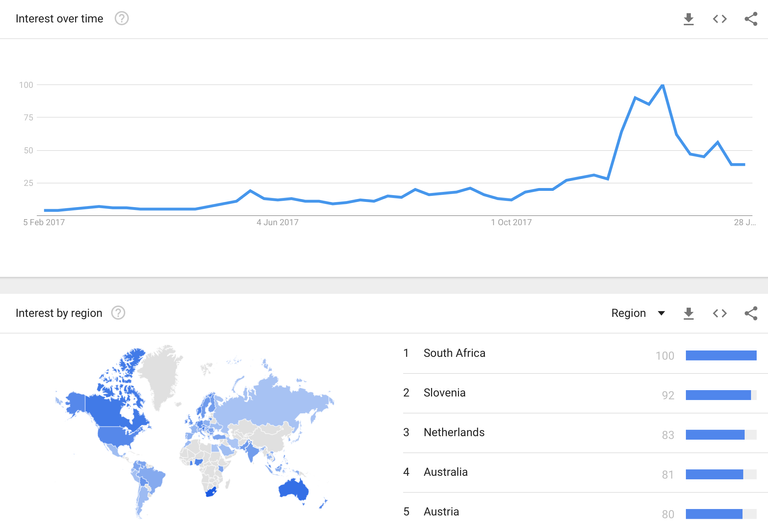

Exchanges, however, have been batching transactions since at least August, so it is unlikely that had such drastic effect. What might be more probable is a lower level of users in general, as show by google trends.

Bitcoin’s recent google trends.

Ethereum has also seen a drop recently from above 1.3 million transactions to now around 800,000, a level that nonetheless remains significantly higher than bitcoin.

The reason again ins’t very clear, but it does seem to coincide with a recent price decline from a high of around $1,400 to now around $900.

Ethereum’s current transaction levels.

There clearly appears to be a correlation between transaction numbers and price, but whether one is causing the other or whether a third factor is causing both, is unclear.

Nor is it clear whether transaction numbers are a lagging indicator as the two seem to be moving in a fairly concerted manner.

But this variance in transaction numbers might indicate that the settlement system in bitcoin, which requires high fees and a high backlog, might be cyclical rather than constant. Something which might affect this new and very unproven system design.

It's probably because Bitcoin and Ethereum service the altcoin investing market by being the largest pairings by volume and we're seeing less trading right now because of soft market conditions. This is going to change soon, probably in 2018 as we see cross chain capabilities and moving away from Tether as a pegged coin by allowing smooth Fiat conversions. When this happens the transaction volumes for both Bitcoin and Ethereum will likely fall dramatically exposing how little they're actually used in their intended use cases, more specifically Bitcoin.

I could'nt have said it better. With that being said though, what do you think happens with the market when/if Tether goes down?

I think it would be pretty big on a short to medium term because Tether is what all traders use to trade in and out of crypto. The whole markets volume would be crushed. Hopefully exchanges can onboard proper fiat trading before/if Tether crashes. Bittrex looks to have jumped through the regulatory hoops and plans to do just that very soon.

So you are saying, that Bitcoin is nearly working as it should? 😂

Maybe there is a correlation with its price? The more against 0 it is, the better it works?

So in a few days, it will work like a breeze! Looking forward to that!

Of course, this is just a theory.... 😉

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cryptonewsmonitor.com/2018/02/04/bitcoins-backlog-nearly-clears-transactions-reach-lowest-level-in-months/