There is nothing hidden between heaven and earth, says the adage; and in the world of cryptocurrencies, where blockchain technology ensures that all aspects of its occurrence are revealed as in an open book, there is even more transparency: all its record is in plain sight, at least for a moderately trained eye.

However, when it set out to quantify investments in the Initial Coin Offering (ICO) over the past four years, the elementus team found a significant discrepancy in the estimates of various information providers. In fact, these were in a range ranging from $3.5 billion to $4.5 billion.

The reason for this inaccuracy, says Max Galca in the article "Four years of token sales in a single graph," is that the primary source of investment amounts comes from the reports of those who launch each ICO. That approach did not turn out to be entirely reliable, so to estimate the total investment since early 2014 it was necessary to go directly to the source, ICO by ICO, blockchain by blockchain, but limited to those over $100K in revenue.

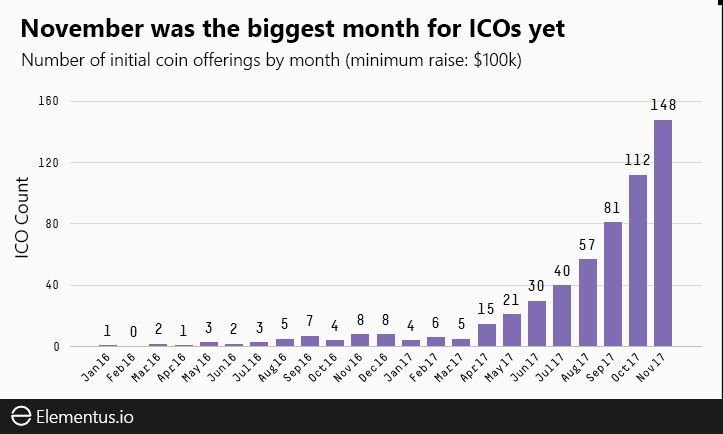

The following graph shows the increasing pace of ICOs since January 2016 and how the initial offers for the last 3 months exceed the total accumulated up to September of this year.

In October and November 2017 the ICOs move to the triple-digit zone. Source: elementus.io

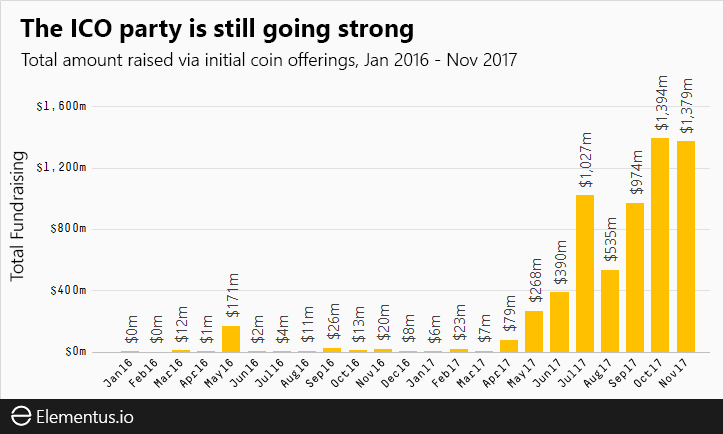

The graph of the amount collected per month in the same period is more dramatic, since except in May 2016 alone, the accumulated collection remained below $100 million dollars until April of this year, and then climbed three times over $1 billion dollars - July, October and November 2017. The ICO feast, despite some pessimistic opinions, is raging.

With little boom in the first quarter, ICOs start to operate from April onwards. Source: elementus.io

The final amount of capital that the ICOs attracted in four years was, according to the detailed study of elementus.io, 6.3 billion dollars and with growth prospects. November turned out to be the record month in initial currency offerings as 148 ICOs closed, although funds reached their all-time high in October - $1.39 billion versus $1.38 billion in November.

In the 4-year history of the ICOs, there is no doubt that 2017 was positioned as the year of the massive adoption of this collection tool. Not only did the cryptoecosystem actors finance their projects through this method of fundraising, but even companies linked to Disney used ICO to raise funds.

The evolution of ICOs over the last four years can be observed in an animated graph below:

LATEST NEWS

SPANISH IEBS BECOMES THE FIRST DIGITAL BUSINESS SCHOOL TO ACCEPT BITCOINS:

https://steemit.com/bitcoin/@emmanuel250998/spanish-iebs-becomes-the-first-digital-business-school-to-accept-bitcoins

13 SOUTH KOREAN CURRENCY EXCHANGE OFFICES OF CRYPTOCURRENCIES UNDER THE MAGNIFYING GLASS OF THE FAIR TRADE COMMISSION:

https://steemit.com/bitcoin/@emmanuel250998/13-south-korean-currency-exchange-offices-of-cryptocurrencies-under-the-magnifying-glass-of-the-fair-trade-commission

MITSUBISHI UFG WILL PROTECT BITCOINS OF ITS CUSTOMERS FROM EXCHANGE HOUSE FAILURES:

https://steemit.com/bitcoin/@emmanuel250998/mitsubishi-ufg-will-protect-bitcoins-of-its-customers-from-exchange-house-failures

LELIÈVRE WINES IS THE FIRST WINERY IN FRANCE TO ADOPT BITCOIN AS A PAYMENT METHOD:

https://steemit.com/bitcoin/@emmanuel250998/lelievre-wines-is-the-first-winery-in-france-to-adopt-bitcoin-as-a-payment-method

BITCOINERS ORGANIZE THEMSELVES TO PRESSURE CURRENCY EXCHANGES AND BITCOIN PORTFOLIOS TO IMPLEMENT SEGWIT: https://steemit.com/bitcoin/@emmanuel250998/bitcoiners-organize-themselves-to-pressure-currency-exchanges-and-bitcoin-portfolios-to-implement-segwit

I hope you found the information helpful! Please give me your vote and resteem my post to help me grow in the community. Also follow me so that you don't miss the latest news about the cryptocurrencies. Greetings from Venezuela ;)

Excellent work!

Thank you very much for take the time to stop by my blog friend @adamchase greetings :)

I Like this post interested

very very nice post..

Thanks friend @gaycharan789 greetings :)

Really good info ,, Glad I stopped by .. upvoted , pleasure to meet you ..

Thank you for taking the time to stop by my blog friend, a pleasure to meet you too. Thank you for your vote, greetings @jkenny

Great post my friend. I am involved in a company that launches ICO's

drivaconsulting.io napkin to success A-Z

Excellent colleague: D. Thank you for coming by my post and voting on it @driva greetings

Thanks for Reaching out, your post is very insightful... Thank you for being my "My first Padrino" in steemit replies @emmanuel250998 ! Lets continue to share, congrats, Saludos

Thank you for your comment, colleague, greetings :D

Thanks for the thoughtful post and advice - I think I will go ahead and regster for Binance after all. My buddy recommended it, but until your post, I lacked any compelling reason to proceed... and yeah, the Forks are getting out of hand for sure!

Thanks for your comment @ovyhossain

good post dear @emmanuel250998

Thank you @saifuk greetings :)

que ICOs me recomiendas invertir para este 2018?

GraciasHola @emmanuel250998...

Yo como tal no invierto en ICOs. Te recomiendo que inviertas en este portafolio de criptomonedas para este proximo año 2018: Bitcoin, Dash, Lisk, Bytecoin y PIVX... Tienen muy buen potencial y son proyectos fuertes que te darán beneficios de mediano a largo plazo. Un saludo @alejo :)