The price will fluctuate and short-term bubbles will eventually burst, but there is no stopping worldwide analysts from reassessing and re-imagining what the true definition of money is, or can be.If you thought 2017 has been crazy for Bitcoin and Cryptocurrency, 2018 is going to be absolutely wild. From states unveiling their own centralized cryptocurrency to more nations officially recognizing bitcoin as a medium of exchange. When tax season hits for many Americans, the Internal Revenue Service (IRS) will finally come out with more concrete guidelines on how to report the new asset class. The Securities and Exchange Commission (SEC) will continue striking against fraudulent ICOs and will classify a wide-range of crypto assets as securities. In the global political and economic arena, we have China inching closer to power-parity with the United States of America in a non-militaristic fashion. France & Germany have called for a Bitcoin Debate to be held at the next annual G20 Summit, a meeting between the European Union and 19 of the wealthiest nations. 2018 will be the year of Bitcoin diffusion, seeping into the markets and bureaucracies of countries whether they like it or not. We may even see the first event where the people of a sovereign nation decide to adopt Bitcoin as its reserve currency, likely hyper-inflationary candidates being Venezuela, Zimbabwe, and Argentina.

//SWIFT VS BITCOIN, BAN?

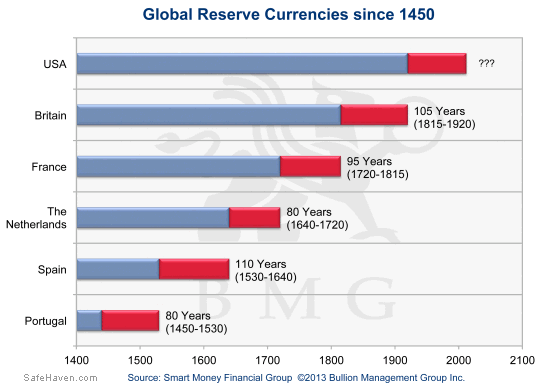

SWIFT is the Society for Worldwide Interbank Financial Telecommunications, also known as and was previously the only way to send and receive money internationally if you are a nation-state. In our digital age, SWIFT hilariously takes three days, on average, to send money globally and does not work on weekends. SWIFT is centrally controlled mostly by Western nations, particularly the United States of America which leverages SWIFT as a political tool. If you do not play nice with the U.S. or if you do something the U.S. does not like, you get cutoff from SWIFT, receive sanctions from the United Nations, and your economy cripples. Such nations include Iran, Russia, and North Korea, whom are fascinated by the Bitcoin protocol and are expeditiously testing it. Bitcoin is naturally attractive for countries that have no other means of moving money internationally when the U.S. embargoes said states. The Bitcoin protocol is a multitude times faster, more secure, and decentralized way of sending money versus SWIFT, and Bitcoin works weekends. The natural attraction then becomes a no-brainer answer because effectively-speaking, SWIFT is inferior to Bitcoin as a means of monetary exchange. I argue this: as more “enemies” of the Western Allies get prohibited from using SWIFT, the greater the proliferation of nation-states adopting Bitcoin as a method of transferring money and thus, the lesser the influence of the United States in geopolitics. The acceptance of Bitcoin by good or bad actors further legitimizes what was once an unknown socioeconomic experiment.Albeit individuals, small businesses, or multinational corporations, we have now reached a point where nation-states are starting to pay attention.The U.S. Dollar (USD) is the incumbent global reserve currency in our current economic system. The U.S. Dollar’s dominance is akin to the U.S. military’s strength, both of which play a crucial role in the uni-polar American hegemony since the end of World War II. Unless the representative leaders of the U.S. Republic concede to losing some economic influence & power, Bitcoin will eventually be perceived as a financial and/or national-security threat if it is not already. We can agree that governments do not like things they cannot control, and they cannot control Bitcoin. You cannot regulate a self-governing protocol. You cannot fully ban a peer-to-peer system of money. You cannot apply traditional rules and regulations to an entirely different type of technology altogether. When controlling the original blockchain protocol becomes out of question, we arrive at outlawing it. If the U.S. were to ban bitcoins, labeling it as a financial and/or national-security threat, the price will initially plunge in the short-term, but in the long-run, it will only become more sacred. Previous results of past bans we’ve witnessed include alcohol becoming more expensive during the Prohibition of 1920 and marijuana becoming cheaper as it is being legalized in the present. Admittedly, this is somewhat of a reach for argumentative purposes as I do not believe there is a better analogy. Perhaps the U.S. will attempt to criminalize bitcoins by painting a false portrait that it only funds terrorists organizations and/or is used by bad actors. I do not know, I am merely hypothesizing one of the last ways which Bitcoin can possibly be stopped and if it can be, it starts with the greatest Empire to have ever existed.

//PETRODOLLAR VS YUAN

At the moment, Bitcoin is not as worthy of an opponent as the Chinese Yuan to the USD supremacy. USD is strategically the most preferred method of exchange worldwide, be it oil, shipping ports in the Netherlands, taxis in Puerto Rico, or any international airport where it is always accepted. The Petrodollar as it is coined, has purposely been the sole medium of exchange for nations and companies to obtain oil, propping up the value of USD since most of us have been alive. For example, if you were a British oil company, you need to exchange for USD in order to buy oil and in fact, it is probably wisest to not sell out of USD if your business requires oil and you are going to need USD in the future.Iraq & Libya were the only two countries that have tried to use something other than the Petrodollar. Prior to the capture and assassination of Saddam Hussein & Muammar Gaddafi, both leaders of respective countries independently devised a monetary strategy to use another form of currency to exchange for oil: Hussein shifting to the Euro and Gaddafi’s gold-money plan.

China becomes the third country attempting to compete with the dollar on the global oil exchange. North Korean shenanigans aside, China’s Shanghai Futures Exchange offering oil for Yuan backed by gold is the hottest topic in geopolitics and world economics today. Per Chinese Authorities, pricing oil in Yuan that is easily convertible to gold is one component to China’s ultimate plan to internationalize the Yuan and essentially challenge the United States Dollar on the global theater. Countries that have expressed deep interest are none other than U.S. sanctioned nation-states such as Iran, Russia, and Venezuela. Further, in the last several years and with Art of War style, China has positioned itself to triumph the United States hegemony. China is in control of their national debt-to-GDP ratio and is the United States’ biggest creditor to the enormous Federal Reserve debt. To launch the eventual Yuan-Oil Futures Exchange, China has been accumulating at least five-thousand tons of gold the past decade, equivalent to over $321 Billion. China also imports oil from at least ten other nations and will easily be able to fill the marketplace of the Shanghai Exchange. China’s infrastructure investment in Africa is unrivaled by any other country, including the United States. Finally, China’s One Belt One Road Initiative aims to claim economic influence throughout Eastern Europe, the Middle East, and South East Asia. Military strength is not nearly as important as it once was as economic power plays an ever-increasing role in the 21st century international arena, especially when comparing two nuclear states that both have mutually-assured destruction. We are seeing the very beginning of a worldwide shift from USD to the Yuan. The Petrodollar’s days seem to be unfortunately numbered.

//IMPLICATIONS OF BITCOIN

The incumbent in power is rightfully too complacent as the head honcho of the current global regime. Japan, Russia, Venezuela, Saudi Arabia, the United Arab Emirates, Sweden, Germany, Argentina, Thailand and China are all advancing towards the new paradigm shift that is Blockchain Technology and Cryptocurrency.Bitcoin serves as the inconvenient truth to China’s plan for international monetary and economic dominance. China’s struggle to thwart capital flight from leaving the country resulted in the complete ban of Chinese Cryptocurrency exchanges in September 2017. This is not to be mistaken for a ban of bitcoins or blockchain innovation, rather, a ban of the fiat to crypto on-ramps and off-ramps to restrict the Yuan from exiting China. Since the ban of centralized exchanges, Chinese citizens’ insatiable appetite for bitcoins is demonstrated by the explosion of over-the-counter & peer-to-peer trades via LocalBitcoins. Because no government can control the Bitcoin protocol, I am convinced that China has a master plan in the making. I believe that once China reopens their exchanges, they will reveal their cryptocurrency version of the Yuan, forcing Chinese citizens to first buy their centralized cryptocurrency before entering the market of the new asset class. Doing so, props up the value of the crypto-Yuan, drawing parallels to how USD’s value is propped up in traditional markets. Of course, this is sheer speculation on my part.In geopolitics and global economics, the Bitcoin protocol acts as a remarkable wildcard, fundamentally playing a role as a nation-less deflationary store of value against inflationary, flagged currencies. Few individuals have the luxury to speculate on bitcoins as an investment vehicle. Bitcoin has proven useful to Venezuelans that have experienced hyperinflation and have specifically fled to using bitcoins. Unseizable assets are necessary during moments of steep, 47.5% raids on Greek saving accounts at the hands of the government. Bitcoin changes the dynamics of geopolitics by serving as a form of value that does not rely on any central authority, but instead a public platform. Once Lightning Network gets activated for the protocol, Bitcoin will then test the waters as a world currency and will do it transparently 24/7, 365. Nation-states can no longer ignore the immutable blockchain, and countries that jump on the bandwagon first will get a head start on where our digital age is bringing us. Bitcoin knows no borders, is completely neutral and does not care whether you are Muslim, black, female, male, homosexual, Republican, fat, or have a weird fetish, as long as you can send or receive transactions, you are a part of the financial revolution of the century. The 100% decentralized and most computationally-secure network on Earth at the very least offers an option away from traditional forms of money, and is a self-governing new system of money that is becoming stronger every, single, day, it does not die. It is without a doubt that Bitcoin is in a short-term bubble, but one can make the argument that fiat money is the real bubble waiting to burst. 2018 and beyond will continue to prove that separating the control of money from state is as obvious as the separation of religion from government.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://epeak.in/2017/12/21/geopolitics-cryptoeconomics-2018-and-beyond/

Very intriguing post! Thank you for sharing and following me! It means the world to me! I love steemit and the steemit Family! Two thumbs up! :)

I thoroughly enjoyed this. Nice combination of perspectives!

Fantastic article, great perspective on what's taking place in geopolitics and markets today. This is really going to snow-ball going forward as the US looks to impose tariffs, triggering trade wars, While China on the other hand is welcoming with open arms those that refuse to bend the knee to financial slavery.

Simply, China is a better deal.