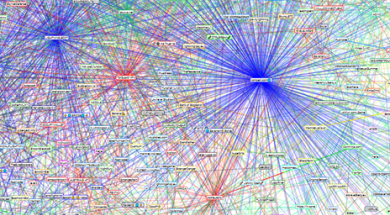

2013 was my first year in Bitcoin, and at that time I remember there were two big conversations about how Bitcoin would go ballistic and take its place as the new defacto world currency.The first was the conversation about which country would encounter a crisis severe enough or hit a mass adoption point steep enough that Bitcoin would become the national currency. Most people were placing their bets one of a variety of African nations.The second was the conversation on what the ‘killer app’ for Bitcoin would be.At that time I wrote an article claiming that Bitcoin was its own killer app. It is a transnational, censorship resistant, be-your-own-bank, no-need-for-government currency. And, given the depredations of Wall Street and the inability of the government to serve its basic function of reigning those in, I was sure that there would be another crash causing a mass shift into the only currency with true inherent value – value based on the fact that it was not controlled by central banks.Well, still waiting for that one too.I still think that Bitcoin is its own killer app. What’s more, Bitcoin has seen more adoptions, more development, and more hints of institutional investment than ever before. Unfortunately, in order to become its own killer app, Bitcoin needs to hold enough value that it can be can challenge national currencies like the yen and the dollar. We’ve seen advancements in this area; a recent reddit post points out that Bitcoin has been adding on average one 0 to it’s valuation every 2 years. The current valuation though needs to sustainably increase by 10 to 20 times before Bitcoin will become powerful enough that nations will have to learn to deal with it and not just try to ignore or regulate it away.What I did not foresee 4 years ago is that Bitcoin might need a booster to get it to those great heights. Transaction speeds were always a problem. I had at the time thought the blocksize limit would simply be raised to accommodate international interest. And though I still think that it could have been raised last summer to maintain good will and without damaging the system, there is no doubt now that it cannot be raised to the degree that would be needed for Bitcoin to operate on a level with Visa.And now it is increasingly looking like it won’t need to. The Lightning Network system built on top of Bitcoin that will allow for many more and much faster transactions. Basically, it is a system that uses smart contracts to ‘lock’ an amount of money into a payment channel you keep with someone you know you transact with a lot. As long as that channel is open and funded, then bitcoins can be shunted back and forth pretty freely without putting any load on the Bitcoin blockchain.What’s more, if I have a channel open with Bob and another open with Cheryl, I can pass bitcoins from Cheryl to Bob. And Cheryl wants to pay Microcraft for a new product, but doesn’t have a channel open with them, she can pass money to me, which I send to Bob, who then sends it to Microcraft. Cheryl doesn’t need to know me or Bob, and Microcraft will still know the money originated with Cheryl. And though not done yet, it seems like no one in the chain will know anything other than the people who were on either side of them in the transaction. I will know I got the money from Cheryl, but not that she started the chain. I’ll know the money is going to Bob, but not that it’s ending up at Microcraft.The way it looks now, putting money into a payment channel on Lightning will feel a lot like keeping a wallet for everyday spending money. You can get paid into the wallet and pay out of it. But, all of that will be a bit like ‘unrealized expenditures.’ In a real way the money will really have been transferred because the Lightning Network is tracking everything, but it won’t be seen on the Bitcoin blockchain until the channel is closed and a Bitcoin transaction registers the final balance.I’ll admit that I don’t fully understand all the details. I’m not sure anyone does at this point as it’s a work in progress, and the developers are doing their utmost to make sure that everything is working smoothly. When this hits, it will have to work flawlessly. Therefore, most of the wallets available are now in testnet. There are a few operating on the mainnet – which means using real money – but if you already know about those, you don’t need this article. And if you need this article, it is best to wait until fully vetted and tested software is made available.That being said, when looking at the number of nodes and channels operating on the mainnet, see the image above, it seems like the numbers are starting to increase at a faster pace. This suggests that progress is being made and that trust is growing.Lightning is not Bitcoin’s killer app. But it just might be the app that lets Bitcoin finally achieve its potential of being its own killer app.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://bitcoinwarrior.net/2018/07/is-the-lightning-network-bitcoins-killer-app/