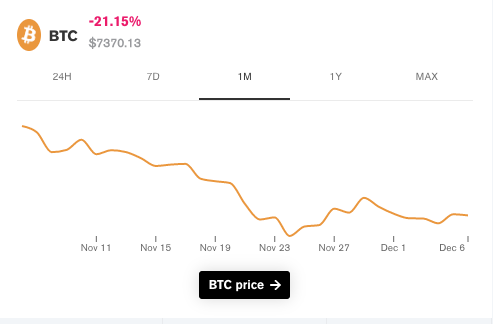

A sum of 1.3 million bitcoin (BTC) worth nearly $9 billion was proceeded onward chain in a solitary hour yesterday reported by Storify News. Notwithstanding this, the cost of bitcoin is presently holding consistent at around $7,300, after quickly spiking to more than $7,500 yesterday, which was great for investors trading with Bitcoin Loophole.

As per Rafael Schultze-Kraft, fellow benefactor of on-chain advertise knowledge firm Glassnode, this is the most noteworthy hourly USD exchange volume in bitcoin's history. In any case, who was moving such a great amount of bitcoin around? What's more, why?

Glassnode said that this ongoing spike was to a great extent brought about by crypto trade Bittrex, which moved around 1.18 million bitcoin ($8.7 billion) over a progression of 21 exchanges, each involved around 56,000 bitcoin. The move comes during Bittrex's planned upkeep, which will see the trade overhauled all through December 05, 2019.

Every one of these exchanges had an expense of around 0.00008 BTC, or around $0.60, this implies Bittrex had the option to move nearly $9 billion for under $12.50.

The way things are, it stays hazy why Bittrex moved nearly $9 billion in bitcoin, yet some have conjectured that the trade might be redesigning its cool stockpiling. Such noteworthy developments have been related with cold stockpiling moves before, with Binance moving around $1 billion in bitcoin into cold stockpiling back in July.

Typically such an enormous exchange to a trade would be viewed as a bearish sign, since this could prompt expanded sell pressure. On the other hand, enormous troves of bitcoin moving endlessly from trades is normally observed as bullish, since this demonstrates a diminished inventory. (The cost of a coin is generally affected by market interest). Be that as it may, since this is just an inner exchange, it is probably not going to essentially influence the bitcoin value activity.