USD quoted crypto rates are infinitely easier on the eye than quotes against BTC. Before Tether transactions were commonplace, most altcoin buyers would swap Bitcoin unless the exchange accepted USD. At first, BTC was the main quote currency for altcoins, though the slower and more expensive transaction led to the rise of Ethereum cross rates. Ethereum cross rates were quickly joined by exchanges issuing their own cryptocurrency which exchange account holders could trade against such as BNB at the Binance exchange.

Quotes against USD are important because to take profit (and purchase that Lamborghini after mooning), conversion to USD is required to cash out. However, BTC quoted cross rates are also important as the altcoin market follows Bitcoin, and their sensitivity to Bitcoin movements change. This can work in an investor’s favor though in receding markets such as present can result in greater than expected losses. This is because the altcoin correlation to Bitcoin tends to be a positive relationship and can be greater than 1.

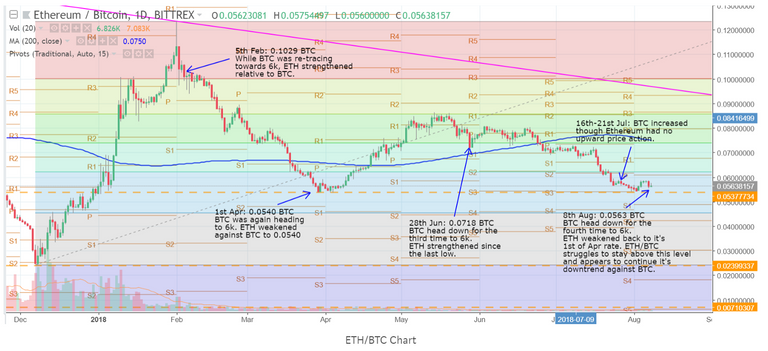

What this means is that in times of Bitcoin price appreciation, altcoins can increase at a higher rate than Bitcoin, but also visa versa. A popular exception to this was Bitcoin Cash which in the second half of 2017 exhibited negative correlation as traders swung from BTC and BCH (depended on what news was announced), though of late that correlation has turned positive in line with other major altcoins. Situations whereby a positive relationship suddenly decouples and Bitcoin rises leaving the altcoins behind also happens (and can be seen in the above below on the 16th July 2018).

To that end, the benefits of technical analysis of major altcoins are lessened due to the “Bitcoin price following” behavior, and traders would have to focus on both BTC/USD as well as the ALTCOIN/BTC charts when trading altcoins. Patterns present in Bitcoin’s price movements are sometimes easily recognizable in the altcoin charts.

This poses a problem for holders of altcoins this year as 2018 continues to be a price corrective year (though there have been some signs of strength as explained in my posting here). Investors buying into Ethereum earlier in the year with the view that it would hold greater value in the future over Bitcoin would now see their portfolio values lower as the ETH/BTC cross rates weaken in Bitcoin’s favor. This wasn’t a bad strategy at the time based on the understanding that Ethereum would be more future proof than Bitcoin, however the markets have shown the level of technology and use cases has not been the key driver in the pricing of cryptocurrencies. If anything, Bitcoin has taken a path more akin to Gold, and just like in Lord of The Rings, it has been one coin to rule them all.

Bitcoin evangelists may care less about the BTC/USD and remain trading on a BTC quote basis. Even now many holders of cryptos value their portfolios in both USD and BTC (or even ETH), particularly for ICO participants. BTC may also play the role as a “safe haven crypto” with the view that in the long run, BTC value will only increase.

The market continues its downward trend and as this article is written, Bitcoin is re-entering the re-test of the 6k levels. Support at this level may continue to prove Bitcoin’s strength, though altcoin holders may see their value at each Bitcoin re-test point decline. The saving grace would be a possible positive correlation to an upward trending Bitcoin with high enough sensitivity to make up for the shortfall.

Bitcoin today is trading closer to demand levels, though if bear traders have their way and the market repeats the 2014 price action following a surge, the price may decline back to 3k or lower. As always, trading should only be done with the amount of money you are willing to lose, and as they say, investing without a plan is planning to lose.

(This article is for educational purposes and is not trading or investment advice)

Coins mentioned in post:

Very curious as to the next BCH price action. Should it have negative correlation to Bitcoin again, the next surge upwards might be the end of it!